Crypto Taxes 2022: Here’s What You Need to Know According to CoinTracking

PRESS RELEASE. Crypto changes quickly, with new tax laws and regulations coming to several countries in 2022, impacting how people need to report their crypto gains on taxes. New regulations in the US are a hot discussion topic among crypto investors, with a bill coming to fruition severely increasing the reporting needs for crypto brokers and traders. Beyond the increased regulation, new investment vehicles in crypto also spark doubts on traders on how to incorporate them into their local tax regimes. CoinTracking is here to cover the top 5 crypto tax changes to be aware of in 2022 and....

Related News

If you’ve gone deep in the current crypto craze, you might need to prepare your heart once you do your crypto taxes. Crypto may have started out as a humble money gig, but with its total value at nearly $2 trillion, many are betting it’s “the future of money.” However, its growing popularity has come […]

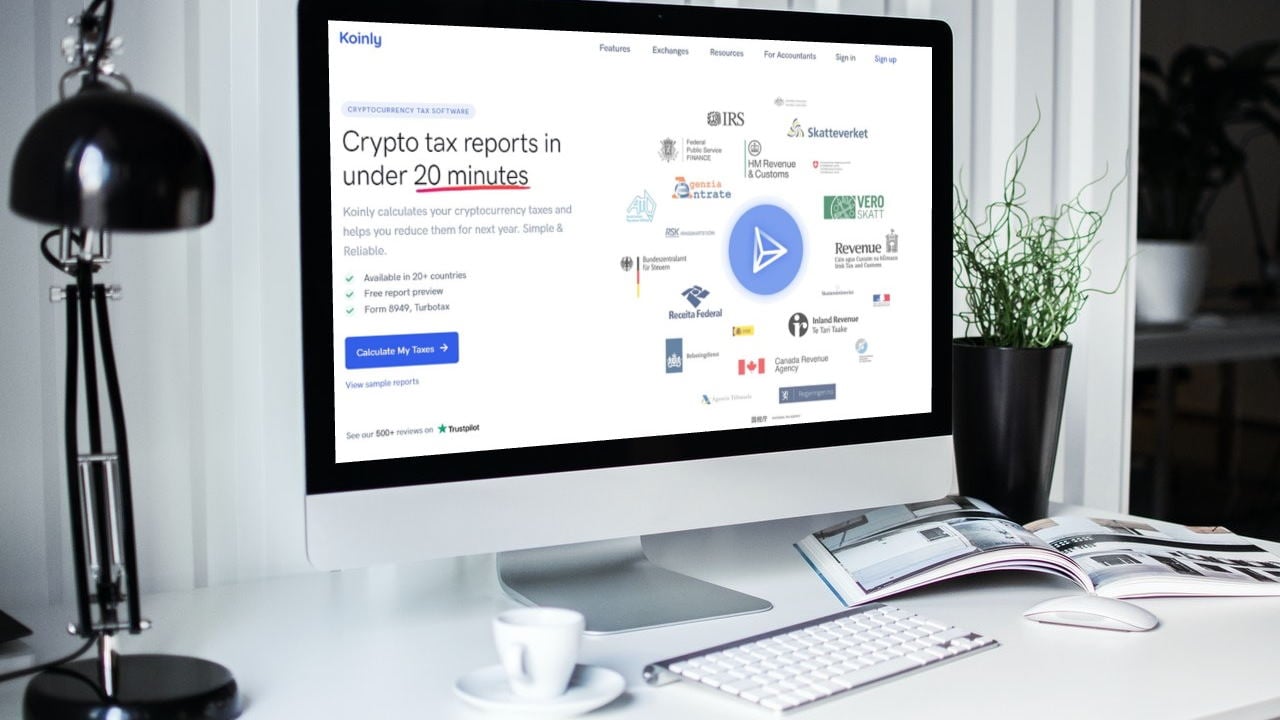

Cryptocurrency users can face a lot of challenges finding the right information needed for reporting taxes. Koinly, a leading cryptocurrency tax calculator and portfolio tracker for traders, has created the ultimate guide to help. Koinly Presents The Ultimate Bitcoin Tax Guide for 2022 Crypto tax regulations and laws can be confusing, leaving investors with many questions about what crypto taxation looks like – how much tax to pay on Bitcoin and the tax rate? But do not worry. Koinly brings an ultimate crypto tax guide to help answer all the questions related to crypto taxes and....

The key to properly filing taxes on cryptocurrency comes down to excellent record-keeping, the correct IRS tax forms, and knowledge about what qualifies as income versus capital gains. Handle Tax Filings With Care to Avoid Any Audits Although the traditional April 15th deadline for filing US taxes has been pushed to May 17th, there is no time like the present for organizing cryptocurrency transaction records. At this point, all cryptocurrency transactions are taxable in some constellation, so it’s vital to familiarize yourself with the nuances to ensure you fill in the accompanying....

Most transfers of cryptocurrency are taxable, unless the transfer is qualified as a gift or a charitable contribution. Way back in 2014, the United States Internal Revenue Service (IRS) ruled that cryptocurrency is property in Notice 2014-21. That classification as property has some big tax consequences accentuated by wild price swings. Buying and selling crypto can trigger gain or loss and be taxable. Yes, buying something using crypto — a house, a car, a new suit — can trigger taxes. Even paying taxes in crypto can trigger taxes.If you owe $5,000 in taxes, you could pay the $5,000 in....

In Argentina, a provincial legislature has voted in favor of a bill to impose new taxes on gross incomes from crypto transactions. Cordoba’s central province is now the first one to impose crypto taxes in the country, which involves crypto exchange platforms and retail traders. Approved Tax Bill Grants a Definition of Cryptocurrencies According to CBA4N, the “Tax Law 2021” approved by the legislature seeks to tax people 4% to 6.5% on gross incomes from crypto-related transactions. Also, individuals or businesses who receive payments in cryptocurrencies “in exchange....