Bitcoin Bearish Signal: Whales With 1k-10k BTC Depositing To Exchanges

On-chain data shows Bitcoin exchange inflows from whales holding between 1k to 10k BTC have spiked up recently, a sign that can be bearish for the price of the crypto. Bitcoin Exchange Inflows Spike Up Following Rally Above $24k As pointed out by a CryptoQuant post, the BTC whales with between 1k to 10k BTC seem to have sent a large stack to exchanges recently. The “exchange inflow” is an indicator that measures the total amount of Bitcoin being transferred to wallets of all centralized exchanges (both spot and derivatives). When the value of this metric spikes up, it means a....

Related News

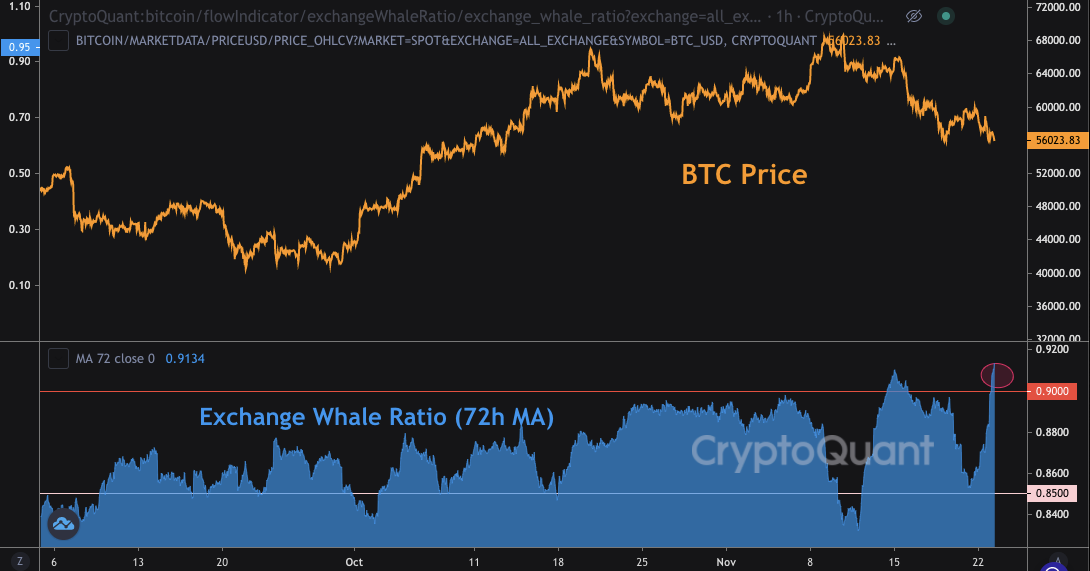

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]

On-chain data shows Bitcoin whale inflows to exchanges have remained at highest ever levels recently, suggesting that the latest recovery above $22k may not last too long. Bitcoin Top 10 Exchange Inflows Have Been Elevated In Recent Days As pointed out by an analyst in a CryptoQuant post, the current whale deposits to exchanges are at their highest value in the history of the crypto. The “all exchanges inflow” is an indicator that measures the total amount of Bitcoin currently entering into wallets of all centralized exchanges. The sum of the top ten inflows, specifically,....

On-chain data shows Bitcoin inflows are trending up, a sign that whales might be increasing their dumping. This could prove to be bearish for the coin. Bitcoin Inflows Move Up As Whales Continue To Sell As pointed out by a CryptoQuant post, on-chain data highlights that BTC inflows to exchanges have been going up. The “all exchanges inflow” is an indicator that shows the amount of Bitcoin that holders are depositing to exchanges on a given day. When the value of this metric moves up, it means more investors are sending their coins to exchanges. Holders usually deposit their BTC....

On-chain data shows whale ratio has exceeded the 0.50 mark, historically a sign that whales are dumping in the short term. Bitcoin Whales Have Started Selling Their Coins As pointed out by a CryptoQuant post, the Bitcoin whale ratio has started going up above the 0.50 level. This signal has usually meant a bearish outlook for the crypto in the short term. The BTC all exchanges whale ratio is an indicator that gives an estimation of how many whales are sending their coins to exchanges. The metric does so by taking the sum of the top 10 transactions to each exchange and dividing it with the....

On-chain data shows the Bitcoin exchange whale ratio has started to sharply rise, a sign that these humongous holders may be beginning to dump. Whales Are Behind Almost 90% Of Bitcoin Exchange Inflows Right Now As pointed out by an analyst in a CryptoQuant post, whales may be ramping up dumping, a sign that could be bearish for the price of BTC. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top ten Bitcoin transactions to exchanges and the total exchange inflows. Since the 10 biggest transactions to exchanges usually belong to the....