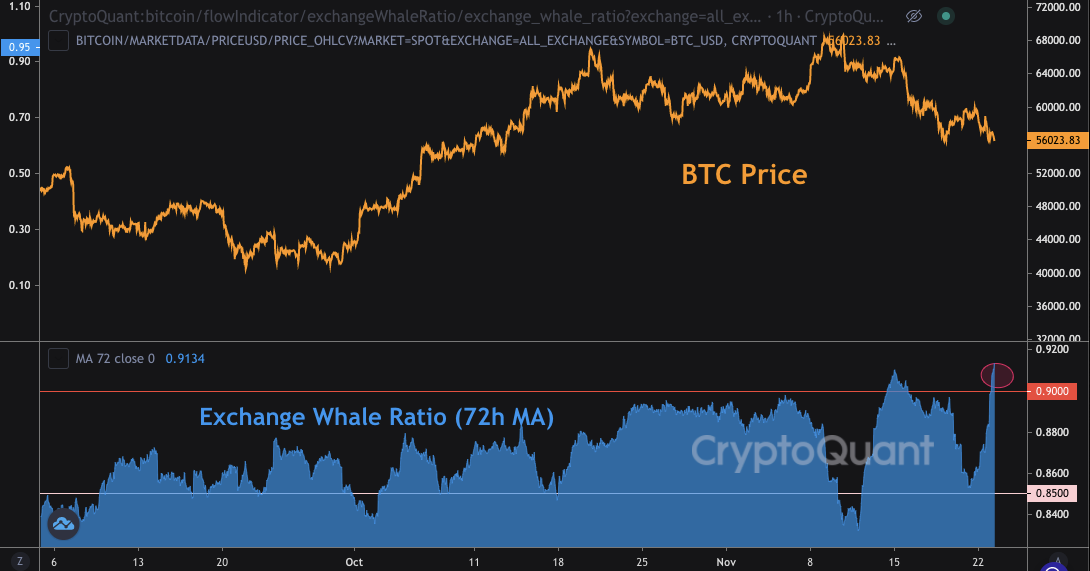

Bitcoin Bearish Signal: Whales Now Make Up For 91% Of Exchange Deposits

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]

Related News

It would appear that Bitcoin whales are shifting their BTC into exchanges at an alarming rate, which is a warning that they may be getting ready to liquidate their holdings. Recent on-chain data shows that Bitcoin whale exchange deposits reached $275 million in a single day as the cryptocurrency continues to struggle to cross over $30,000. Bitcoin Whales Moving Funds to Exchanges Tweets from the whale transaction tracker @whale_alert indicate that a total of 9,406 Bitcoins, with an approximate worth of $275 million, have been moved into exchanges through separate transactions. Related....

On-chain data shows the Bitcoin exchange whale ratio has started to sharply rise, a sign that these humongous holders may be beginning to dump. Whales Are Behind Almost 90% Of Bitcoin Exchange Inflows Right Now As pointed out by an analyst in a CryptoQuant post, whales may be ramping up dumping, a sign that could be bearish for the price of BTC. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top ten Bitcoin transactions to exchanges and the total exchange inflows. Since the 10 biggest transactions to exchanges usually belong to the....

On-chain data shows the Bitcoin exchange whale ratio has spiked up recently, a signal that shows dumping may be going on in the market. Bitcoin Exchange Whale Ratio Surges Up As Price Declines As pointed out by an analyst in a CryptoQuant post, the BTC exchange whale ratio has risen to very high values recently. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top 10 transactions to exchanges and the total amount of Bitcoin moving into exchanges. In simpler terms, this metric tells us what part of the total exchange inflows the ten....

The Ethereum netflow chart shows that the spike in exchange flows has often come at a time when the price of ETH was trading at a short-term/long-term low. The exchange netflow of Ether (ETH) over the past couple of years highlights a behavioral pattern among Ether whales that market analysts believe is done to pump the price of the second-largest cryptocurrency.The “exchange netflow” is an indicator that measures the net amount of crypto entering or exiting wallets of all centralized exchanges. The metric's value is simply calculated by taking the difference between the exchange inflows....

On-chain data shows whale ratio has exceeded the 0.50 mark, historically a sign that whales are dumping in the short term. Bitcoin Whales Have Started Selling Their Coins As pointed out by a CryptoQuant post, the Bitcoin whale ratio has started going up above the 0.50 level. This signal has usually meant a bearish outlook for the crypto in the short term. The BTC all exchanges whale ratio is an indicator that gives an estimation of how many whales are sending their coins to exchanges. The metric does so by taking the sum of the top 10 transactions to each exchange and dividing it with the....