Bitcoin Whales Make Alarming Deposits To Exchanges Amid Falling Prices

It would appear that Bitcoin whales are shifting their BTC into exchanges at an alarming rate, which is a warning that they may be getting ready to liquidate their holdings. Recent on-chain data shows that Bitcoin whale exchange deposits reached $275 million in a single day as the cryptocurrency continues to struggle to cross over $30,000. Bitcoin Whales Moving Funds to Exchanges Tweets from the whale transaction tracker @whale_alert indicate that a total of 9,406 Bitcoins, with an approximate worth of $275 million, have been moved into exchanges through separate transactions. Related....

Related News

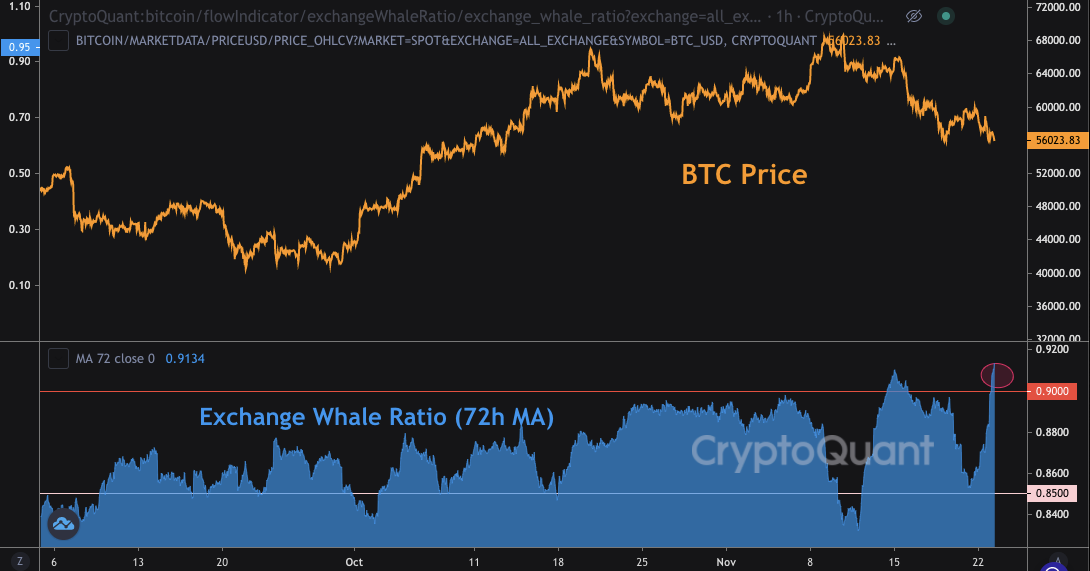

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]

The Ethereum whale investors have maintained an influence on ETH price. This is because they use their holdings to create their desired trend in the ETH market. But their impact is raising more brows as per the data from CryptoQuant. In the crypto space, the whales are persons or entities with higher investment holding of a particular asset. Holding a significant amount of cryptocurrency makes it easy for whales to manipulate and influence the crypto price. Over time, the perception has always been that the whales project negative influences on the market. This is because they always take....

Bitcoin price spikes continue as data reveals exchange activity is anything but flat this week. Bitcoin (BTC) whales are moving large amounts of coins to exchanges in tandem with large outflows, curious new data shows. According to the exchange whale ratio indicator from on-chain analytics firm CryptoQuant, large transactions have accounted for over 90% of recent exchange deposits.Top 10 deposits make up 90% of exchange inflowsIn a marked change from previous behavior, over the past week, whales have become much more active prospective sellers on exchanges.The exchange whale ratio, which....

There are four primary ways to track whale activities, which include monitoring known whale addresses, order books, sudden changes in market capitalization and trades on crypto exchanges. Whales are held responsible for sudden price fluctuations in the crypto and traditional markets every so often. Given their capability to manipulate market prices, it becomes paramount for the general Bitcoin (BTC) investors to understand the nuances that make one a whale and their overall impact on trading.Wallet addresses that contain large amounts of BTC are identified as Bitcoin whales. Dumping or....

Bitcoin whales are depositing large amounts of Bitcoin into South Korean exchanges as BTC continues to rally. Bitcoin (BTC) whales in South Korea have been selling heavily across major exchanges throughout the past week. Data shows that multiple $100 million deposits to Bithumb have been spotted in the last three days alone.By volume, South Korea has a much smaller cryptocurrency exchange market compared to the United States. Yet, South Korea’s cryptocurrency exchanges have seen massive inflows that are comparable with other major markets.Large inflows into exchanges typically indicate....