US banking regulator authorizes federal banks to hold reserves for stablecoins

Federal banks in the U.S. see new capacity to provide services to crypto firms, specifically stablecoin operators. Per an interpretive letter from the U.S. Office of the Comptroller of the Currency released on Monday, national banks will be free to hold reserve currencies for stablecoins.The new guidance reads, "We conclude that a national bank may hold such stablecoin 'reserves' as a service to bank customers."Alongside the announcement, Acting Comptroller of the Currency Brian Brooks noted that stablecoin services are already a part of many banks' activities: “National banks and federal....

Related News

The U.S. Office of the Comptroller of the Currency (OCC) on Monday published a letter clarifying that national banks and federal savings associations can now hold reserves for stablecoin issuers in the country. According to the OCC’s interpretive letter, reserve accounts can either be funded through deposits from stablecoin issuers or deposits from individual stablecoin holders. It stressed that banks can hold such reserves provided that ”the issuer has sufficient assets backing the stablecoin in situations where there is a hosted wallet.” The letter responds to questions....

The top banking regulator in the U.S. has announced that national banks and savings associations in the country can use public blockchains and stablecoins for payment activities. Experts say this is good for bitcoin and its importance should not be understated. Banks Can Use Public Blockchains and Stablecoins The Office of the Comptroller of the Currency (OCC) published an interpretive letter on Monday “clarifying national banks’ and federal savings associations’ authority to participate in independent node verification networks (INVN) and use stablecoins to conduct....

Japanese firm GMO will now be able to offer Yen and dollar-pegged stablecoins to the public in New York. New York has given the first authorization to a stablecoin backed by the Japanese Yen to operate in the U.S.Per a Dec. 29 announcement, the New York Department of Financial Services has granted Japanese firm GMO-Z.com a charter to handle U.S.D. and Yen-backed stablecoins in New York. Given New York's status as a global center, the NYDFS is the most prominent state financial regulator in the U.S. It is also one of the most aggressive. A pass to operate in New York often opens up the rest....

Banks can act as nodes on a blockchain or conduct payments using stablecoins, the OCC said Monday.

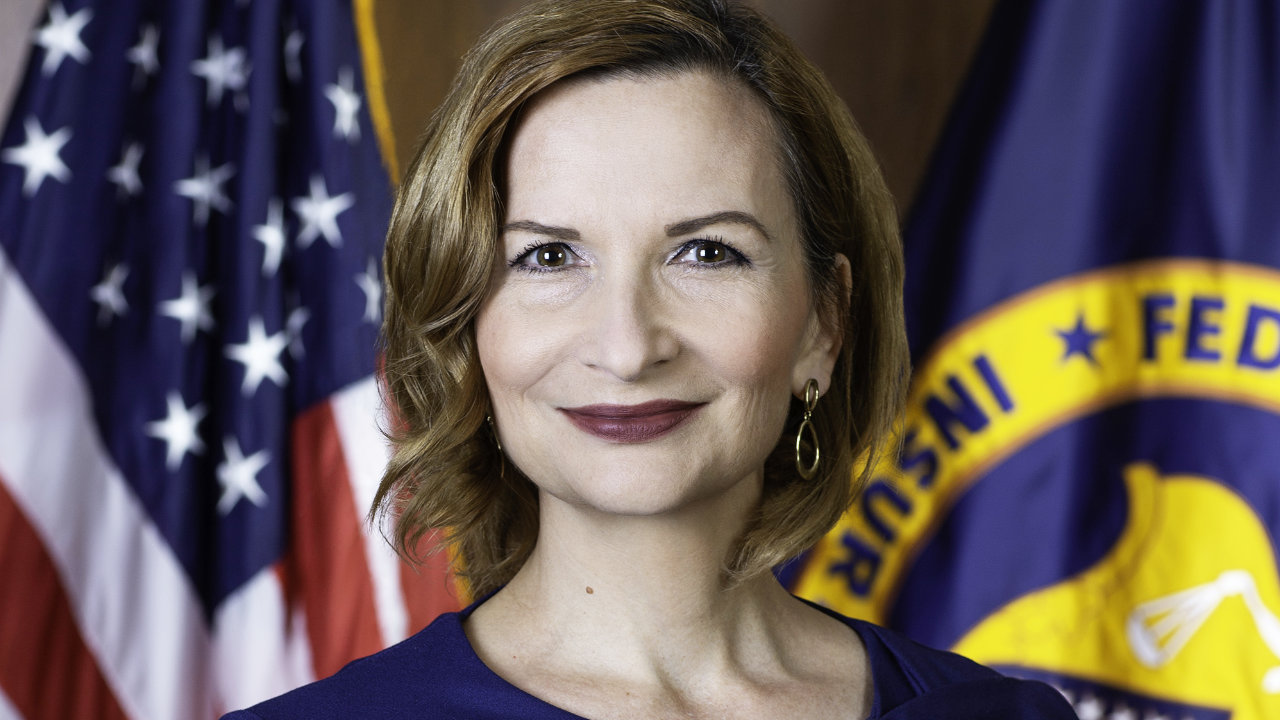

A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The federal regulators won’t be able to regulate it.” US Regulators to Set Clear Rules for Banks to Deal With Crypto Jelena McWilliams, the chairman of the Federal Deposit Insurance Corporation (FDIC), told Reuters in an interview at a fintech....