Federal Reserve, FDIC, OCC Discuss Allowing Banks to Hold Crypto on Balance S...

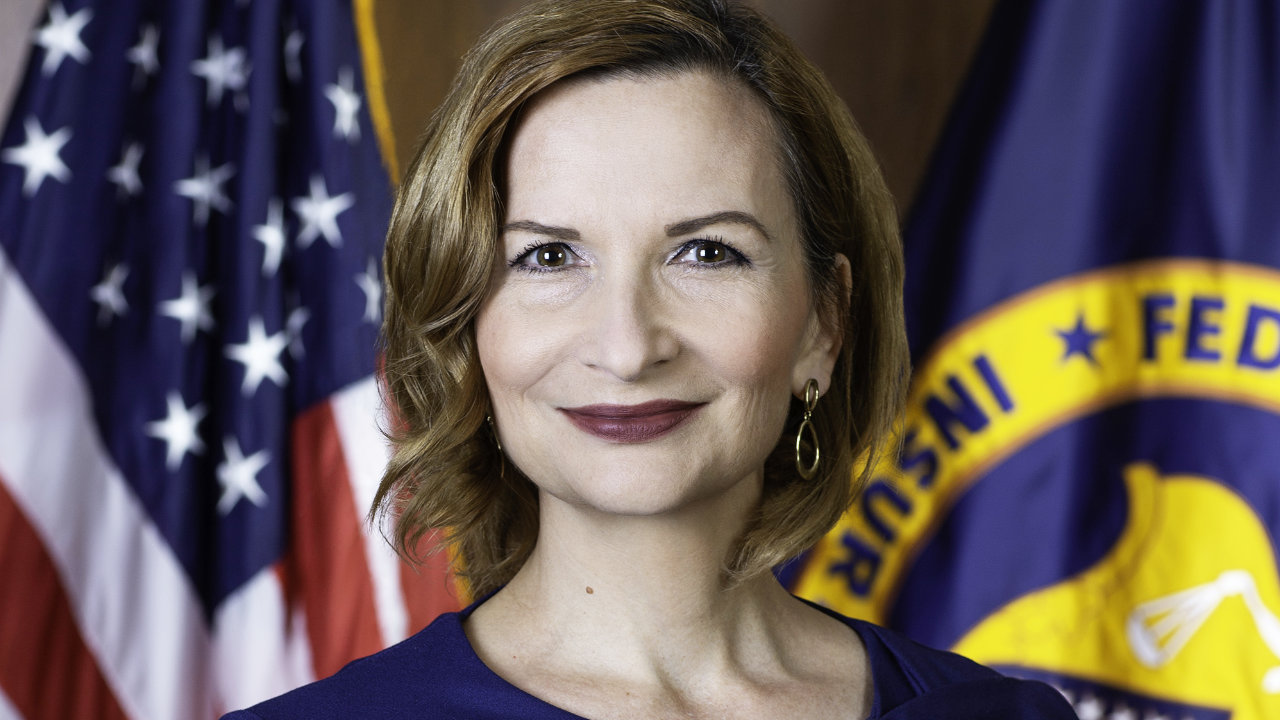

A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The federal regulators won’t be able to regulate it.” US Regulators to Set Clear Rules for Banks to Deal With Crypto Jelena McWilliams, the chairman of the Federal Deposit Insurance Corporation (FDIC), told Reuters in an interview at a fintech....

Related News

The U.S. Federal Deposit Insurance Corporation (FDIC) has asked thousands of banks and other financial institutions it supervises to declare existing crypto activities and any plans they have to engage in crypto activities in the future. Banks to Disclose Crypto Plans to FDIC The Federal Deposit Insurance Corporation (FDIC), an agency created by Congress to maintain stability and public confidence in the U.S. financial system, announced Thursday: The FDIC is requesting all FDIC-supervised institutions that are considering engaging in crypto-related activities to notify the FDIC of their....

Following Voyager Digital’s application for bankruptcy protection during the first week of July, Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Board today issued a joint letter to the company demanding a cease and desist against Voyager’s FDIC claims. The FDIC’s letter explains that Voyager’s FDIC claims are false and misleading, and the entity prohibits anyone from “representing or implying that an uninsured deposit is insured.”

FDIC Insists Voyager Digital Published Misleading and False Federal Deposit Claims

On....

Banks' BTC holdings could be used for client trading, as collateral for loans, or held as assets in their balance sheets.

The Federal Deposit Insurance Corp. is advising banks to contact it if they are currently engaged in or intend to engage in cryptocurrency-related activities. The FDIC notes that exposure to crypto assets may pose “safety and soundness hazards, as well as financial stability problems.” The FDIC, the country’s top banking regulator, said lenders considering dabbling […]

FDIC insurance is highly sought-after by crypto exchanges, lenders, and other service providers. Is it the key to mass adoption? Over the years, several cryptocurrency companies have claimed that deposits with them were insured by the United States Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) as if they were regular savings accounts. While so far, no crypto firm has been able to offer depositors this type of insurance, some speculate it could be the key to mass adoption.The most notable case is that of bankrupt lender Voyager Digital, which saw regulators instruct....