FDIC Chairman: US Regulators Exploring How Banks Could Hold Bitcoin

Banks' BTC holdings could be used for client trading, as collateral for loans, or held as assets in their balance sheets.U.S. regulators are exploring ways for traditional banks to hold bitcoin.Banks' BTC holdings could be used for client trading, as collateral for loans, or held as assets in their balance sheets."I think that we need to allow banks in this space," the FDIC chairman said.A team of U.S. bank regulators is trying to provide a more straightforward path for banks to engage with and hold bitcoin, the Federal Deposit Insurance Corporation (FDIC) chairman said.FDIC chair Jelena....

Related News

Per a Reuters report, the Federal Deposit Insurance Corporation (FDIC) Chair Jelena McWilliams claims regulators in that country are exploring a “clear path” to allow banks and clients to hold Bitcoin and other cryptocurrencies. Related Reading | CFTC Commissioner Stresses: Ethereum Is Under Our Jurisdiction In doing so, the U.S. officials are looking to incentivize […]

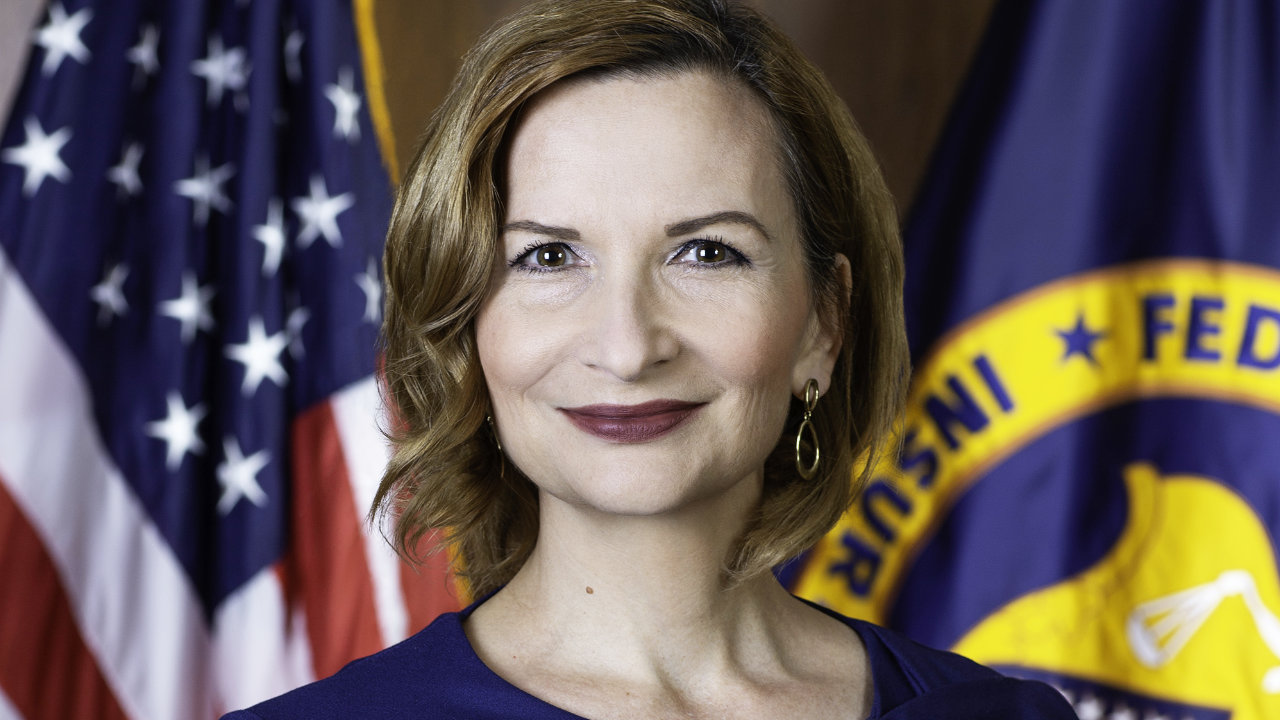

A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The federal regulators won’t be able to regulate it.” US Regulators to Set Clear Rules for Banks to Deal With Crypto Jelena McWilliams, the chairman of the Federal Deposit Insurance Corporation (FDIC), told Reuters in an interview at a fintech....

“Establishing clear regulatory expectations will be paramount to give this market an opportunity to grow and mature in a responsible manner,” said Jelena McWilliams. Jelena McWilliams, the chairperson of the Federal Deposit Insurance Corporation, or FDIC, has said the agency is working with other regulators in the United States to explore “under what circumstances banks can engage in activities involving crypto assets.”In a speech at the Money20/20 fintech conference on Oct. 25, McWilliams said the FDIC, in coordination with the Federal Reserve and the Office of the Comptroller of the....

The FDIC issued a request for public input to get more information on the industry and consumers’ interests in the market. The United States Federal Deposit Insurance Corporation is looking for information and public comments on banks' cryptocurrency-related activities.The FDIC is the major provider of deposit insurance to U.S. commercial and savings banks, originally created to address bank runs during the Great Depression. On Monday, the FDIC officially announced a request for public input to get more information on the industry and consumers’ interests in the market as well as the role....

Acting Federal Deposit Insurance Corporation chairman Martin Gruenberg said the agency needs more information about crypto, and the crypto industry needs to understand the FDIC better. Acting United States Federal Deposit Insurance Corporation chairman Martin Gruenberg spoke on Oct. 20 about possible applications of stablecoins and the FDIC’s approach to banks considering engaging in crypto-asset-related activities. Although he saw no evidence of their value, Gruenberg conceded that payment stablecoins merit further consideration.Gruenberg began his talk at the Brookings Institute with an....