Breaking: U.S. Regulators Exploring How To Allow Banks To Hold Bitcoin

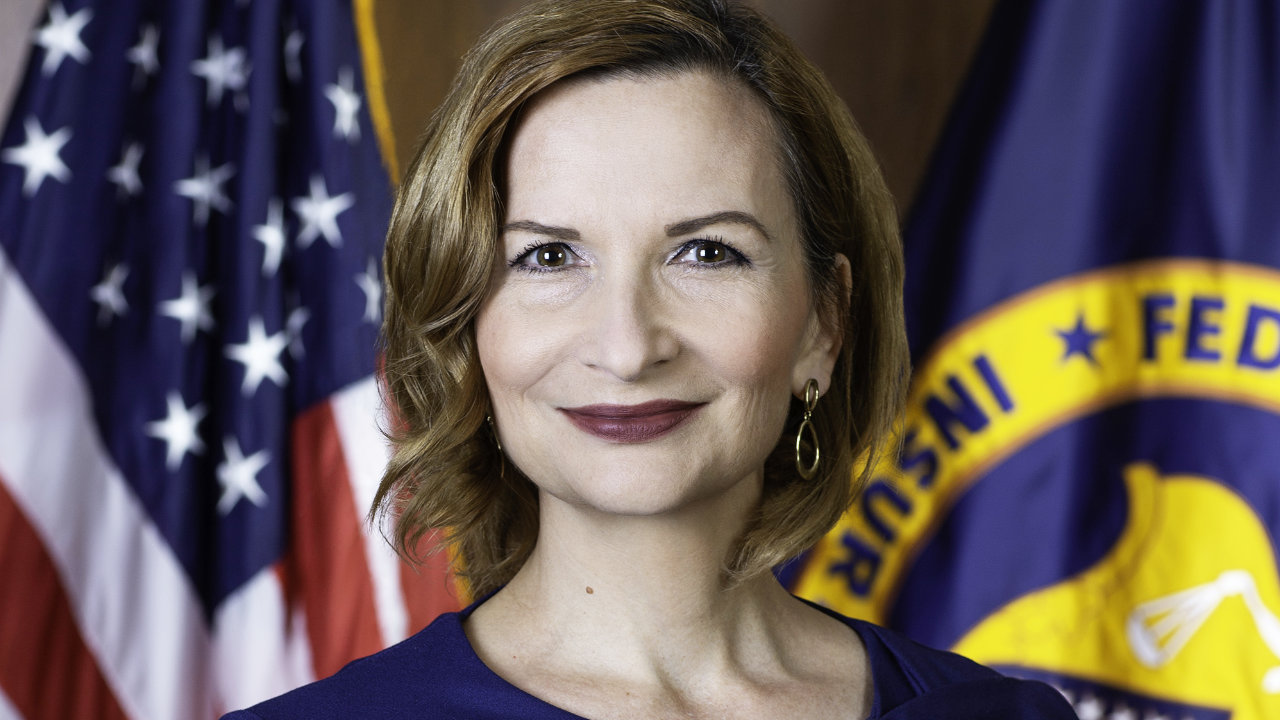

Per a Reuters report, the Federal Deposit Insurance Corporation (FDIC) Chair Jelena McWilliams claims regulators in that country are exploring a “clear path” to allow banks and clients to hold Bitcoin and other cryptocurrencies. Related Reading | CFTC Commissioner Stresses: Ethereum Is Under Our Jurisdiction In doing so, the U.S. officials are looking to incentivize […]

Related News

Banks' BTC holdings could be used for client trading, as collateral for loans, or held as assets in their balance sheets.

U.S. banking regulators are exploring how traditional banks can hold bitcoin for various purposes.

A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The federal regulators won’t be able to regulate it.” US Regulators to Set Clear Rules for Banks to Deal With Crypto Jelena McWilliams, the chairman of the Federal Deposit Insurance Corporation (FDIC), told Reuters in an interview at a fintech....

US Regulators are scrutinizing the Swift payment network in light of the recent heists which have taken place. That is not a complete surprise, as there is plenty of cause for concern. Things have gotten so dire; the US regulators have warned banks about more imminent threats to their cyber security. Ever since the various Swift breaches became public knowledge, there has been a lot of concern among financial regulators. Albeit the hackers used smaller banks to gain access to the Swift network, regulators feel the interbank protocol is no longer safe. Swift Is Not Adequately Protecting Its....

The Office of the Comptroller of the Currency (OCC) — the bureau responsible for regulating and supervising all national banks — has announced that US financial institutions may hold crypto assets to cover blockchain network fees. National Banks Allowed To Manage Crypto In a letter released on Tuesday, the OCC stated that banks are permitted […]