FDIC Asks Thousands of Banks to Disclose Crypto Plans

The U.S. Federal Deposit Insurance Corporation (FDIC) has asked thousands of banks and other financial institutions it supervises to declare existing crypto activities and any plans they have to engage in crypto activities in the future. Banks to Disclose Crypto Plans to FDIC The Federal Deposit Insurance Corporation (FDIC), an agency created by Congress to maintain stability and public confidence in the U.S. financial system, announced Thursday: The FDIC is requesting all FDIC-supervised institutions that are considering engaging in crypto-related activities to notify the FDIC of their....

Related News

Sen. Pat Toomey says he has information from whistleblowers that the FDIC, without a legal basis, is discouraging banks from dealing with companies that have crypto links. Pennsylvania Senator Pat Toomey, ranking member of the United States Senate Banking Committee, has sent a letter to Federal Deposit Insurance Corporation (FDIC) director and acting chairman Martin Gruenberg informing him of allegations made by a whistleblower concerning FDIC activities. The senator suspects the FDIC “may be improperly taking action to deter banks from doing business with lawful cryptocurrency-related....

The Federal Deposit Insurance Corp. is advising banks to contact it if they are currently engaged in or intend to engage in cryptocurrency-related activities. The FDIC notes that exposure to crypto assets may pose “safety and soundness hazards, as well as financial stability problems.” The FDIC, the country’s top banking regulator, said lenders considering dabbling […]

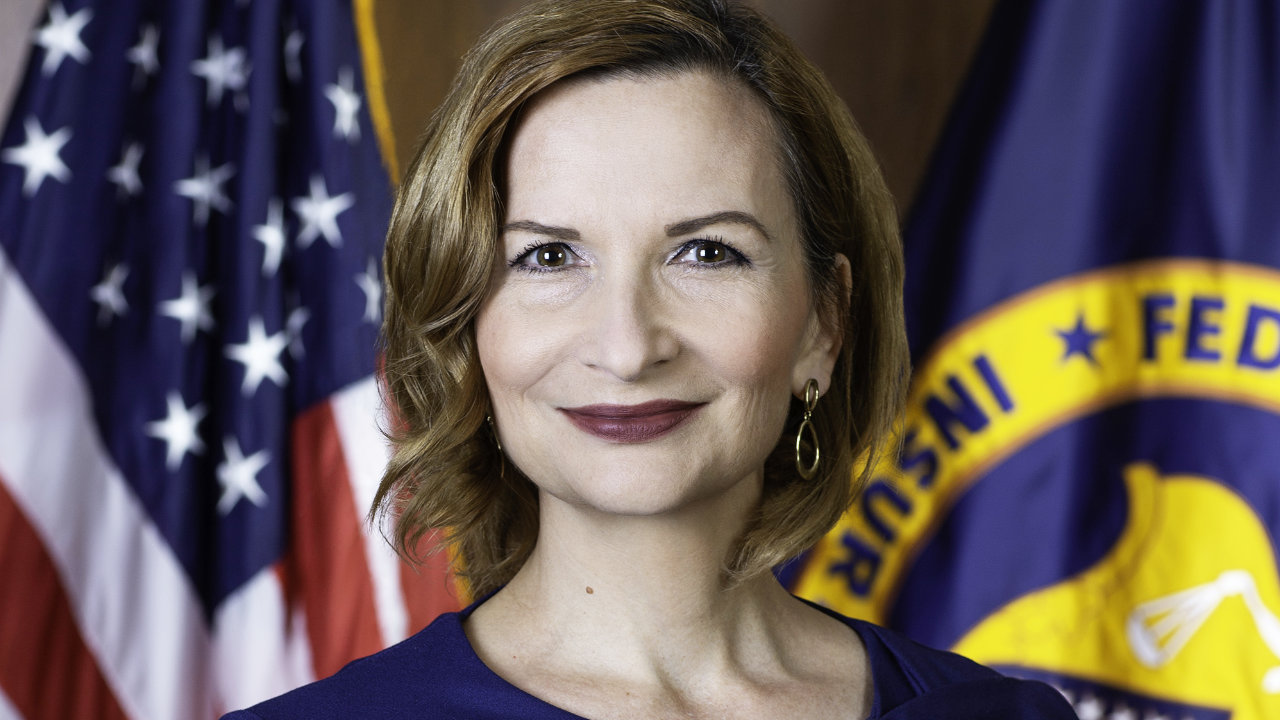

A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The federal regulators won’t be able to regulate it.” US Regulators to Set Clear Rules for Banks to Deal With Crypto Jelena McWilliams, the chairman of the Federal Deposit Insurance Corporation (FDIC), told Reuters in an interview at a fintech....

The Federal Deposit Insurance Corporation (FDIC) has announced a new framework that outlines how banks can apply to issue payment stablecoins through subsidiaries as part of the implementation of the country’s stablecoin bill, the GENIUS Act. FDIC’s First Move On GENIUS Act In a statement, Acting Chair Travis Hill emphasized that the proposed process is […]

The Federal Deposit Insurance Corporation (FDIC) has sent a cease and desist letter to five companies, including crypto exchange FTX US. CEO Sam Bankman-Fried explained that FTX does not have FDIC insurance, stating: “We never meant otherwise, and apologize if anyone misinterpreted it … to be clear FTX US isn’t FDIC insured.”

FDIC Orders 5 Firms to Cease and Desist

The Federal Deposit Insurance Corporation (FDIC) issued crypto-related cease and desist orders to five companies Friday. The agency regulates and insures the deposits of FDIC-insured....