Bitcoin Bearish Signal: Exchanges Observe Huge Inflow From Long-Term Holders

On-chain data shows exchanges have received a huge Bitcoin inflow spike from long-term holders, a sign that could be bearish for the price of the crypto. Investors Holding Bitcoin Since 12 Months To 18 Months Ago Transfer A Huge Amount To Exchanges As pointed out by an analyst in a CryptoQuant post, some long-term investors holding on to their coins since between a year to a year and a half recently sent big inflows to exchanges. The relevant indicator here is the “exchange inflow,” which measures the total amount of Bitcoin moving to centralized exchange wallets. When the....

Related News

On-chain data shows that $44.2 million in Bitcoin was dumped in just one minute, following which the price of BTC declined to $46k. Exchanges Observe Huge Bitcoin Inflow Of 1923 BTC As pointed out by an analyst in a CryptoQuant post, on-chain data shows that around1923 BTC entered exchange wallets today. The relevant indicator here is the “inflow” metric, which measures the total amount of Bitcoin being transferred to exchanges. Since investors usually transfer their coins to exchanges for withdrawing to fiat or for purchasing altcoins with them, big inflow values can be....

On-chain data shows some old Bitcoin supply has recently been moved into exchanges, something that could be bearish for the crypto’s price. Bitcoin Exchange Inflow CDD Has Spiked Up Over The Past Day As pointed out by an analyst in a CryptoQuant post, the long-term holders have deposited some coins to exchanges over the last […]

On-chain data shows that Bitcoin long-term holders are making deposits to exchanges currently, something that could be bearish for the price. Bitcoin Exchange Inflow CDD Has Spiked Recently As explained by an analyst in a CryptoQuant Quicktake post, investors have been making deposits to spot exchanges recently. There are two relevant indicators here: the “exchange inflow” and the “exchange reserve.” The former of these keeps track of the total amount of Bitcoin that the holders are transferring to centralized exchanges, while the latter one measures the total....

On-chain data suggests Bitcoin long-term holders have started to capitulate recently as the sharp price drop causes panic in the market. Bitcoin CDD Inflow Indicator Jumps Up, Showing Long-Term Holders Have Been Selling As pointed out by a CryptoQuant post, the recent price drop has pushed long-term holders towards selling their BTC. “Coin days” are the number of days a Bitcoin has remained dormant for. An example: if 1 BTC doesn’t move for 5 days, it accumulates 5 coin days. When such a coin would be transferred or moved, its coin days would be “destroyed” as....

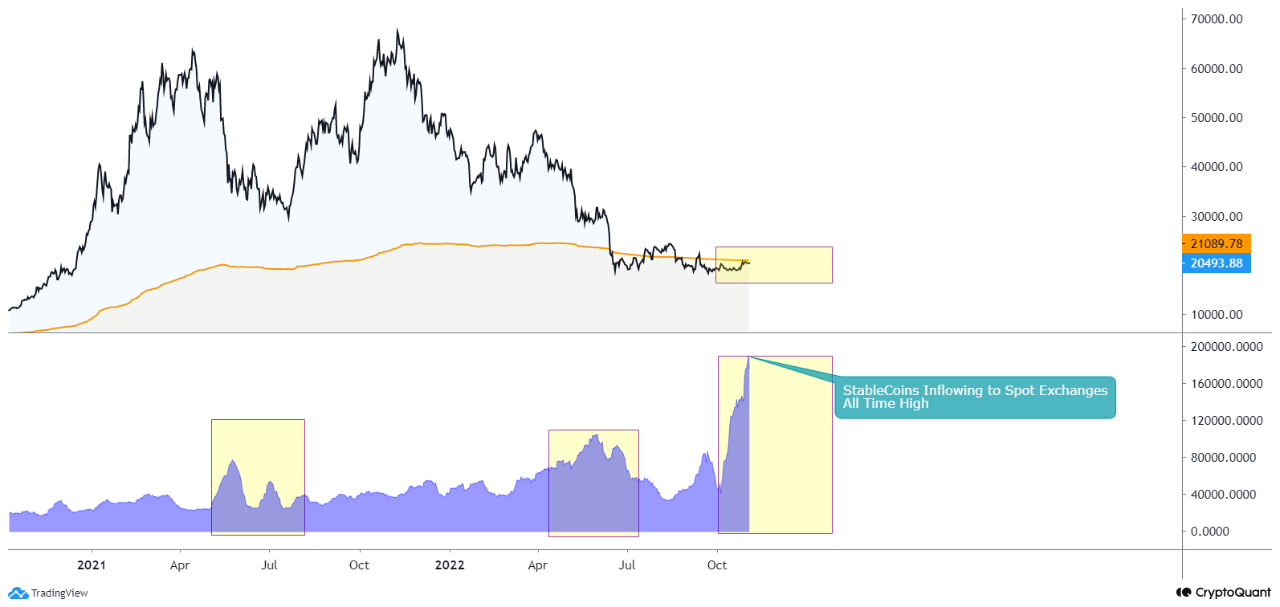

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....