Ethereum Mid-Sized Whales See Peak Unrealized Gains: Profit-Taking Risk Rises

Ethereum is showing resilience in the current market, holding above the $4,500 level after weeks of steady momentum. The second-largest cryptocurrency has maintained a bullish structure, but buyers are now struggling to break past the $4,750 resistance zone, a level that has become a critical short-term test. While fundamentals remain solid, the hesitation at this […]

Related News

On-chain data shows the Bitcoin short-term holder whales are sitting on their highest unrealized gain of the cycle after the latest rally. Bitcoin Short-Term Holder Whales Are Carrying $10.1 Billion In Profits As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Bitcoin short-term holder whales have seen their profits hit the highest point of the cycle. The short-term holders (STHs) broadly refer to the BTC investors who purchased the cryptocurrency within the past 155 days. These holders are considered to include the “weak hands” of the market, who....

On-chain data shows the XRP investors with more than 300% in profits took part in a significant amount of selling earlier in the month. XRP Whales With Over 300% Gains Are Calm For Now In a new post on X, the on-chain analytics firm Glassnode has talked about the trend in the Realized Profit for […]

Total value locked across decentralized finance-enabled smart contracts has dipped 35% from its peak. The drop in the price of Ether (ETH) is failing to shake out the long-term holders, while the decentralized finance (DeFi) sector is also providing opportunities for investors. So suggests a new Glassnode report that noted many long-term Ether holders (>155 days) are sitting atop profits despite ETH/USD’s 55% decline from its peak level above $4,300. In comparison, the short-term Ether holders (“After almost hitting 46% of the market cap in unrealized gain, short-term holders are now....

On-chain data shows the recent bearish Bitcoin price action has put the network’s short-term holder whales into a significant unrealized loss. New Bitcoin Whales Have Dived Underwater In a new post on X, on-chain analytics firm CryptoQuant has discussed about the latest trend in the profit-loss situation of the short-term holder Bitcoin whales. The “short-term holders” (STHs) broadly refer to the BTC investors who purchased their coins within the past 155 days. Related Reading: Chainlink To $100? Analyst Says This Breakout Could Be The Trigger The STH whales (or....

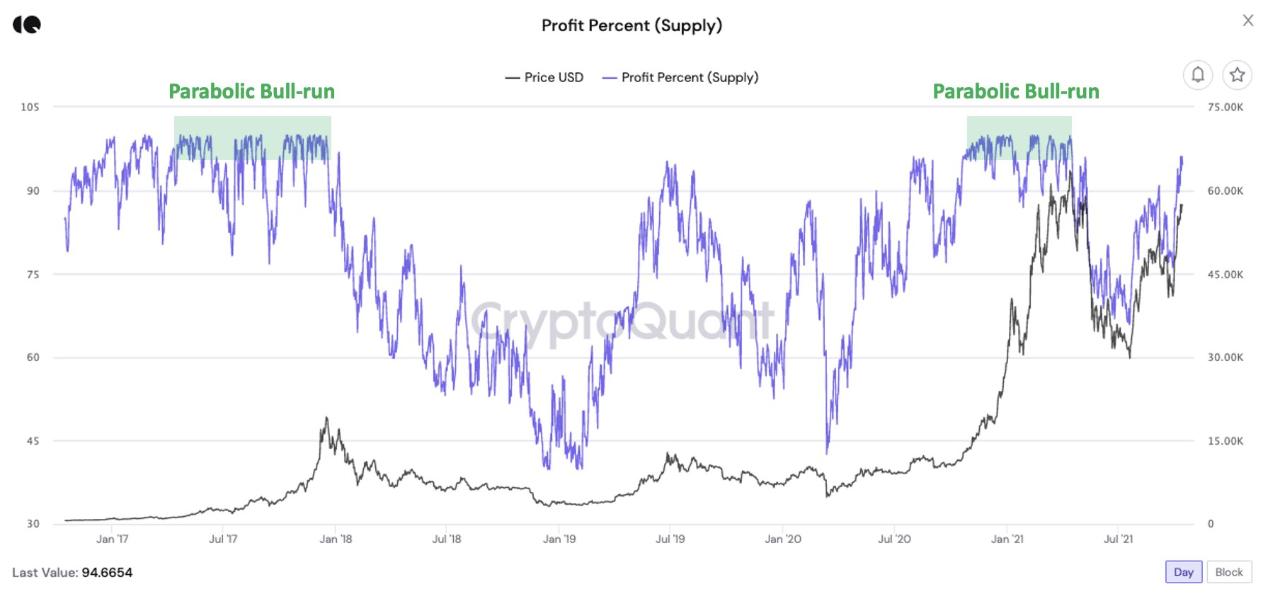

On-chain data shows 99% of the circulating Bitcoin supply has unrealized profits again. History may have the hint for where the market could head next. 99% Of The Circulating Bitcoin Supply Has Unrealized Gains As pointed out by a CryptoQuant post, the profit percent of the circulating BTC supply has reached 99% once again as […]