Bitcoin Miners Net Position Turn Positive: A Crypto Bull Case?

Bitcoin in Downtrend After another week of turbulent market volatility, the cryptocurrency market saw severe drops with Bitcoin (BTC) and its peers plummeting nearly 25% from recent highs. This selloff caught many speculators and traders off-guard, causing a panic reaction across the market. The Crypto Fear and Greed Index shifted from a weekly high of 94 back down to a more modest 55. However, analysts have reiterated that minor corrections are both necessary and organic, […]

Related News

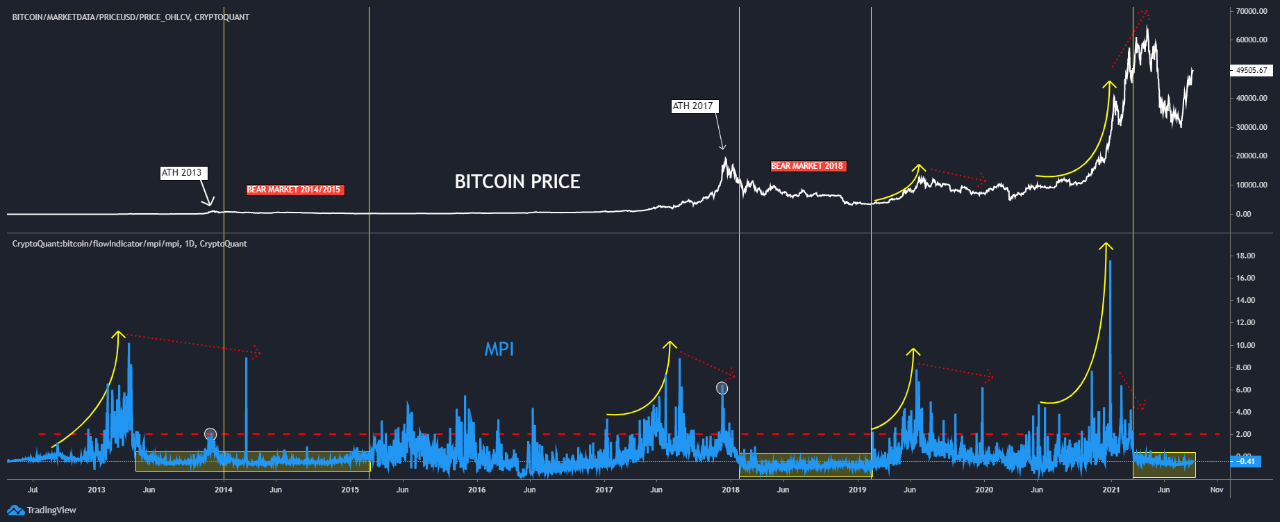

A look at the history of the Miner’s Position Index (MPI) would suggest Bitcoin miners usually sell before the bull run cycle top. The Bitcoin Miner’s Position Index Vs The Price For Various Cycles As pointed out by a crypto analyst on CryptoQuant, the BTC Miner’s Position Index may suggest that miners aren’t good at […]

On-chain analysis shows Bitcoin miner reserves seem to be closing in on the ATH seen in May, as the BTC bull rally continues. Bitcoin Miner Reserves Reach Close To May ATH Levels As pointed out by a CryptoQuant post, the BTC miner reserves seem to be on the rise, and look to be close to the levels seen during the 9 May all-time-high (ATH). The BTC miner reserves is an indicator that shows how many coins miners are holding in their wallets. More the value of this metric, less the selling pressure for miners in the market. Related Reading | S2F Creator Beckons Beginning Of Second Leg Of....

Given its early emphasis on distributed ledgers in what was then widely described as the digital currency ecosystem, Ripple has long held a unique market position in the industry. In the age of "blockchain", the startup remains one of the few holdouts to describe its offerings as "distributed financial technology". Since it was founded in 2012, Ripple has garnered a track record of success with major banks, which have viewed bitcoin and its largely anonymous transaction validators (miners), as a potential liability. Ripple and its permissioned network, in turn, emerged as a 'safe'....

The Federal Reserve has committed to keeping the fund rate at zero or near zero, maintaining the bull case for bitcoin.

Bitcoin miners have borne the brunt of the bear trend since it began. They watched cash flow plummet on their machines, forcing them to look to other ways to finance their operations. The natural response to this was for public miners to dip into their bitcoin reserves and begin selling off BTC to keep their operations going. For a time, it seemed miners would stop selling due to the recovery in price, but this is proving not to be the case. Miners Offload More BTC Bitcoin miners had sold off more bitcoin than they had mined for the first time in May. The same trend then continued into....