This Metric Suggests Bitcoin Miners Rarely Catch The Cycle Top

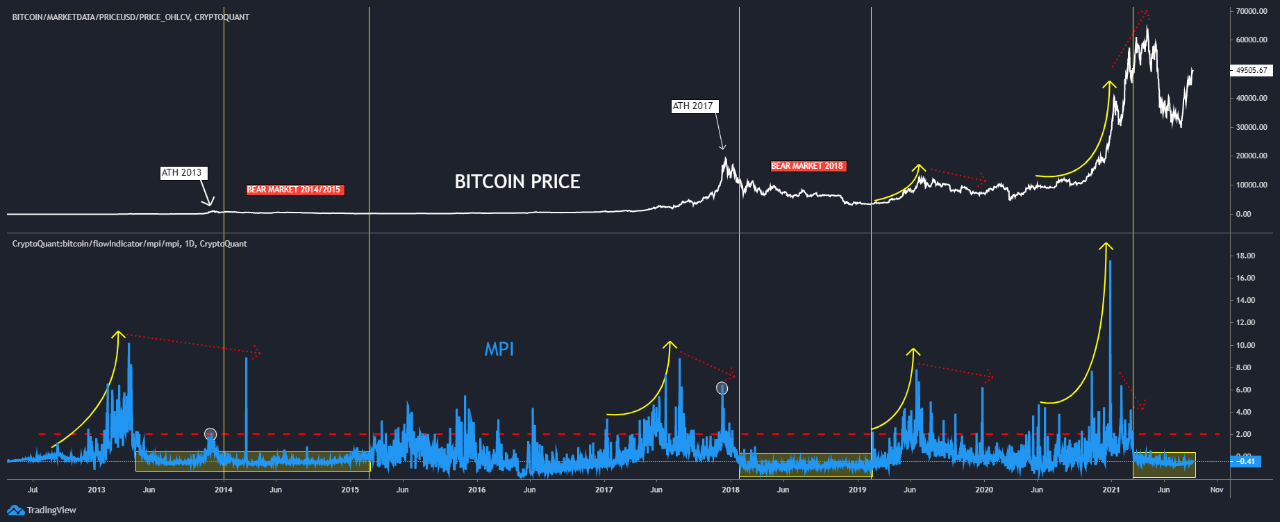

A look at the history of the Miner’s Position Index (MPI) would suggest Bitcoin miners usually sell before the bull run cycle top. The Bitcoin Miner’s Position Index Vs The Price For Various Cycles As pointed out by a crypto analyst on CryptoQuant, the BTC Miner’s Position Index may suggest that miners aren’t good at […]

Related News

Cold hard numbers are showing why Bitcoin moons and dumps — and the reasons are more straightforward than you might imagine. Bitcoin (BTC) is still at the “low end” of a 2021 bubble, new data tracking miner and investor behavior suggests. In the latest signal that BTC price action still has major growth potential, researcher Geert Jan Cap showed bullish signs coming from Bitcoin’s thermocap. Thermocap suggests Bitcoin just getting startedThermocap is a metric which aims to track Bitcoin price cycles based on actions taken by miners and investors with regards to buying and selling BTC.It....

Bitcoin may be demonstrating a slight rebound from its recent downward trend, which began after it hit a new all-time high, but discussions about a possible cycle top are intensifying within the community. While this discussion is accompanied by speculations about this bull cycle nearing its end, an analyst has highlighted a key metric that […]

Bitcoin miners caught a small break late Sunday evening (ET) after the network’s mining difficulty dropped 0.20% lower than the difficulty rating two weeks prior. The drop is the first mining difficulty decrease in four weeks, as the metric changed from 36.84 trillion to 36.76 trillion.

Bitcoin Miners Catch a Miniscule Break as the Network’s Difficulty Shrinks by 0.20%

Bitcoin’s mining difficulty is still extremely high in comparison to the height it was in mid-August 2022. For instance, on Aug. 17, 2022, just before the year’s third largest....

Bitcoin on-chain data shows that miners have transferred a huge amount of coins to cryptocurrency exchanges. On-chain Data Suggests Miners Transferred 11,816 BTC To Exchanges As pointed out by a CryptoQuant post, 20 July saw a huge outflow from Bitcoin miners. The total outflow from that day is around 12k. Here is a chart that illustrates the trend in all miners BTC outflow over the last one year: BTC miner outflow seems to have spiked There are a few interesting features in the chart. This sudden rise of almost 12k BTC observed on Wednesday is the most since May, when the price of the....

Bitcoin (BTC) has declined more than 10% from its latest all-time high (ATH) of $124,128, recorded on Binance in August 2025. However, fresh on-chain data suggests that the cryptocurrency may be preparing for its next bullish wave, as miners are starting to show a structural shift in behavior. Bitcoin Miners Shift Strategy – New High Ahead? According to a CryptoQuant Quicktake post by contributor Avocado_onchain, recent on-chain data hints at a structural shift in Bitcoin miner behavior. At the same time, various other metrics point toward increasing resilience in the Bitcoin....