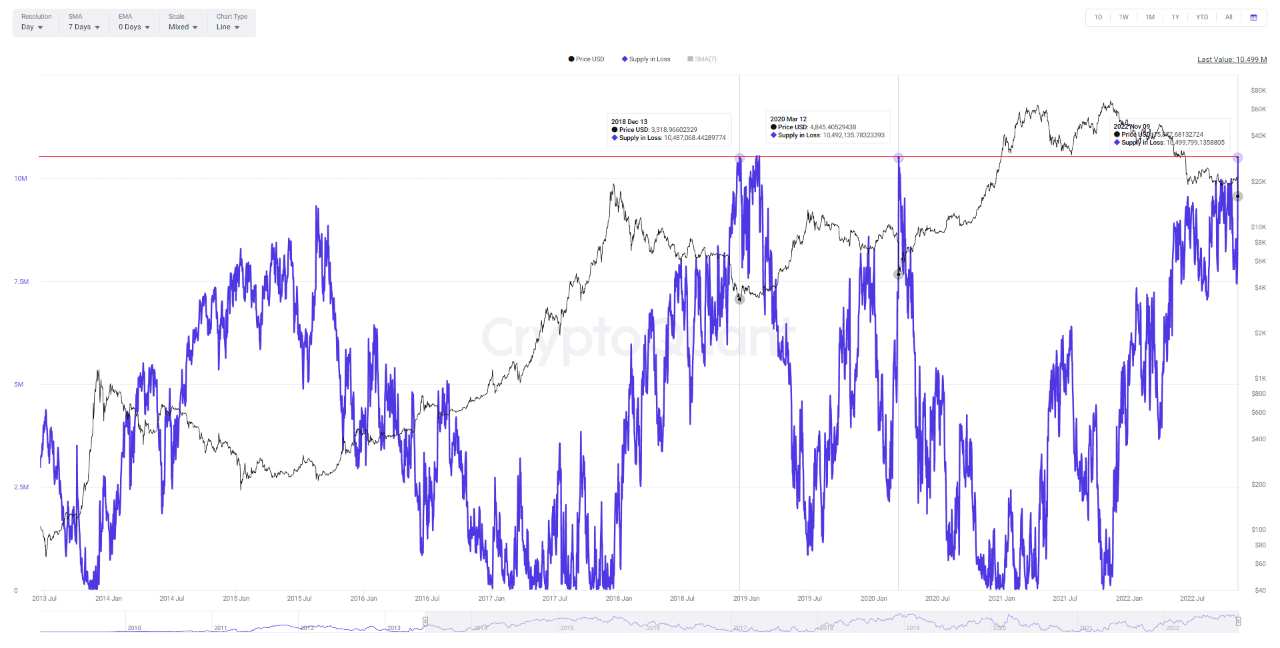

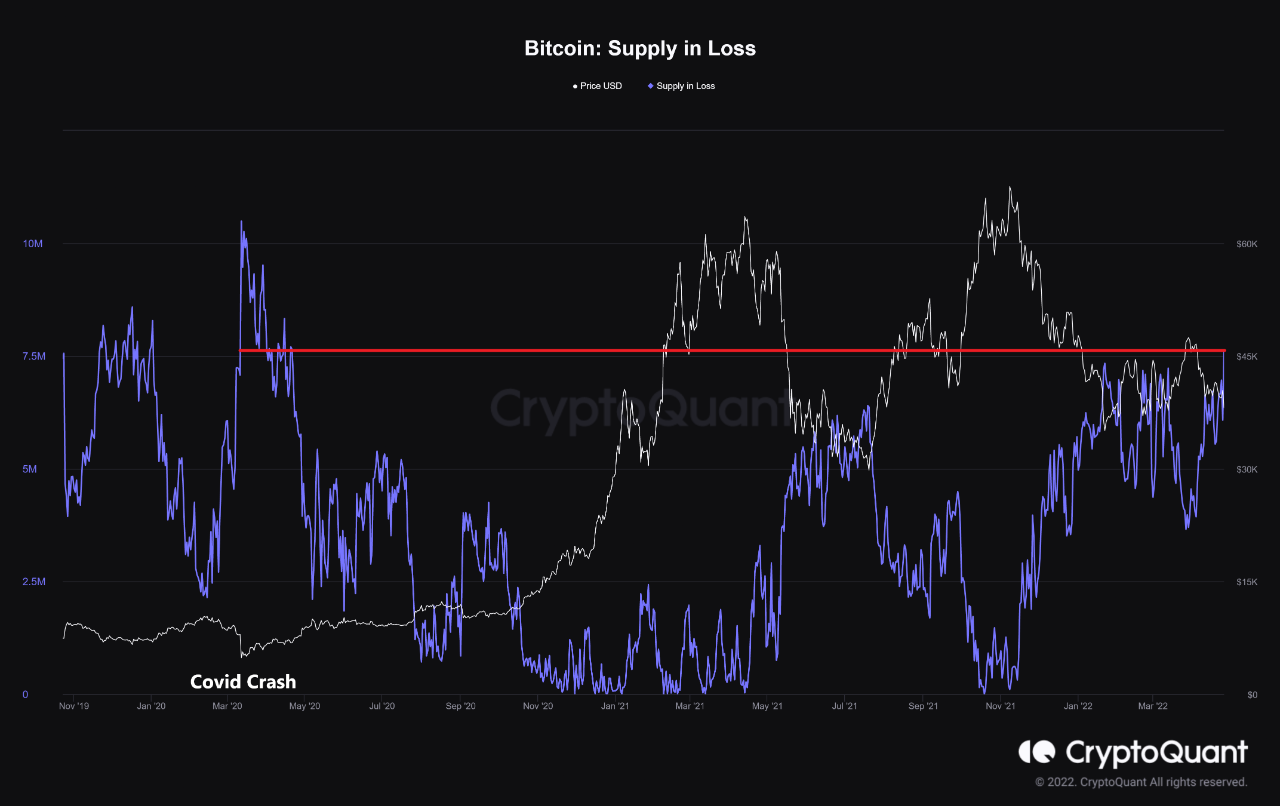

Bitcoin Supply In Loss Reaches Highest Value Since COVID Crash

On-chain data shows the amount of Bitcoin supply in loss has now risen to the highest value since the COVID-19 crash. Bitcoin Supply In Loss Now Measures Around 7.6M BTC As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss hasn’t shown such high values since the first half of […]

Related News

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

On-chain data shows the percentage of the Bitcoin supply in loss has surged to almost 50% now as the crypto’s price tumbles below $20k. 49.94% Of The Total Bitcoin Supply Is Now Holding Some Loss As pointed out by an analyst in a CryptoQuant post, the drop below $20k has now put almost 50% of the supply underwater. The “percent supply in loss” is an indicator that measures what part of the total Bitcoin supply is currently in the red. The metric works by checking the transfer history of each coin on the chain to see what price it was last moved at. If the previous selling....

On-chain analytics platform Glassnode has revealed the number of Bitcoin supply that is currently sitting at a loss. This comes as the BTC price continues to trade below the psychological $90,000 level following its crash, which began last month. Here’s The Amount Of Bitcoin Supply At A Loss In a report, Glassnode revealed that the Bitcoin supply in loss has risen to 6.7 million BTC, marking the highest level of loss-bearing supply observed in this cycle. The analytics platform further noted that this represents 23.7% of the circulating supply, which is currently underwater. 10.2% of this....

On-chain data shows around 82% of the Bitcoin short-term holder supply is currently in loss, suggesting that capitulation may occur soon. 82% Of Bitcoin Short-Term Holder Supply Now In Loss, While Total STH Supply Declines According to the latest weekly report from Glassnode, the BTC STH supply is nearing all-time lows at the moment. However, 82% of it is being held at a loss. The “BTC short-term holder supply” is that part of the total Bitcoin supply that has been held for less than 155 days. The investors holding this supply are usually the likeliest to sell their coins off....

Unrealized losses are hitting both long-term and short-term holders this week, with half of the supply underwater in wallets. Bitcoin (BTC) is setting unenviable records this week as hodlers big and small battle some major pain.Data from on-chain analytics firm Glassnode shows over one-third of the BTC supply being held at a loss by long-term hodlers (LTHs) — a new all-time high.Long-term holders shoulder record unrealized lossesProfitability has taken a serious hit in recent days, and on-chain data confirms that even the most seasoned investors are suffering.As BTC/USD crashed to two-year....