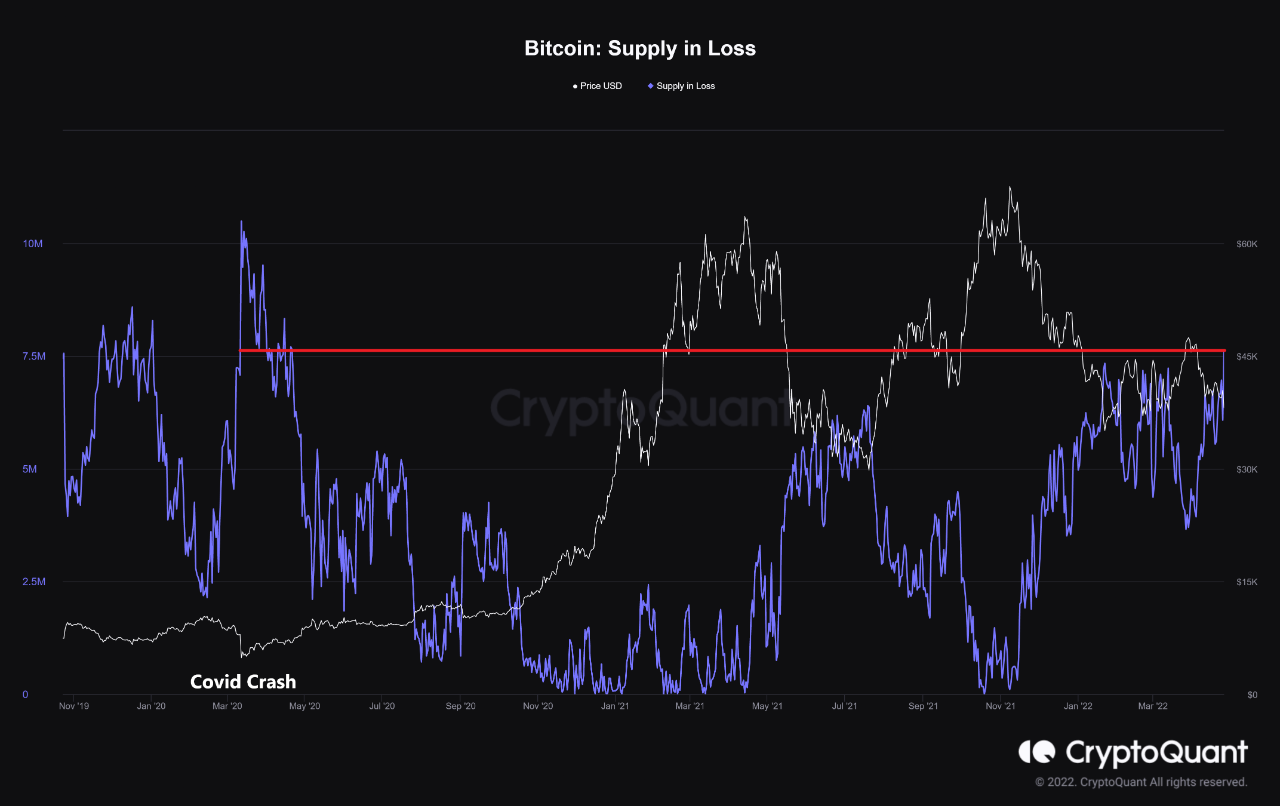

Bitcoin Supply In Loss Now At Similar Levels To COVID Crash And 2018 Bottom

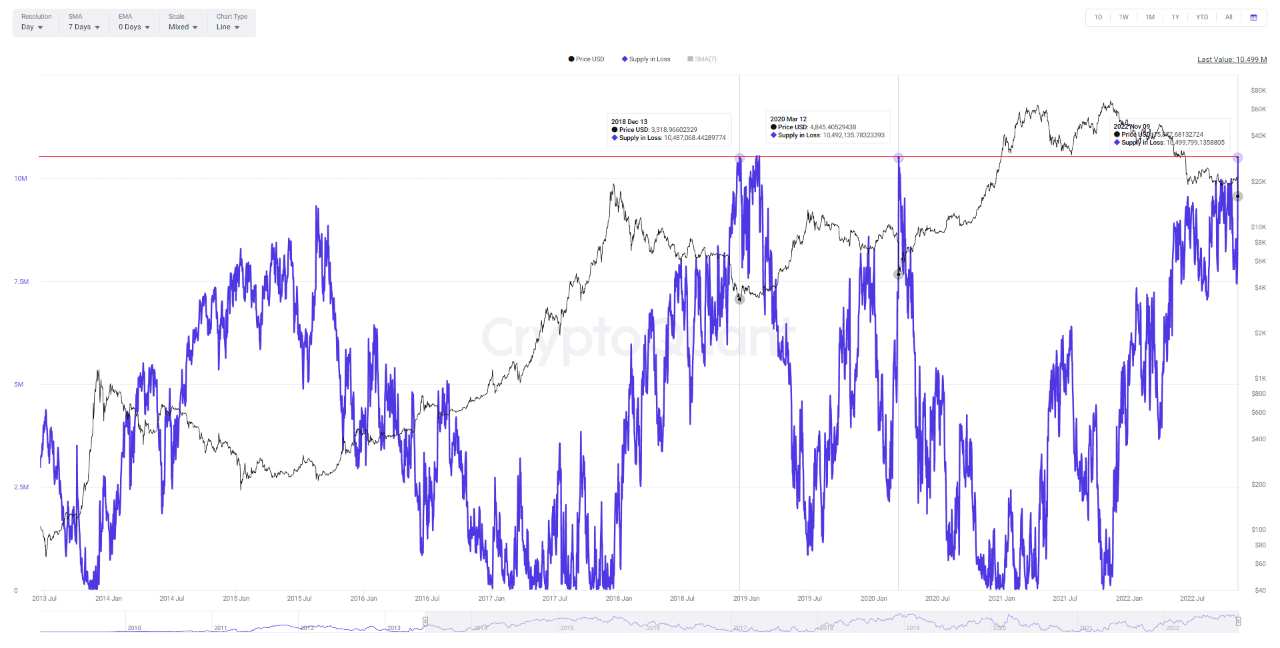

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

Related News

On-chain data shows the amount of Bitcoin supply in loss has now risen to the highest value since the COVID-19 crash. Bitcoin Supply In Loss Now Measures Around 7.6M BTC As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss hasn’t shown such high values since the first half of […]

Bitcoin accumulation is in full swing during the downtrend despite BTC price having more room to drop. A Bitcoin (BTC) on-chain indicator, which tracks the amount of coin supply held by long-term holders (LTHs) in losses, is signaling that a market bottom could be close.Eerily accurate Bitcoin bottom punditAs of Sept. 22, approximately 30% of Bitcoin's LTHs were facing losses due to BTC's decline from $69,000 in November 2021 to around $19,000 now. That is about 3%–5% below the level that previously coincided with Bitcoin's market bottoms.For instance, in March 2020, Bitcoin price declined....

The cryptocurrency market has weathered a challenging period, testing the resolve of the most seasoned investors. After a prolonged period of downward pressure, the Bitcoin Supply-Loss Chart is flashing a possible bottom signal. A Deeper Look At Bitcoin Supply In Loss Chart Bitcoin on-chain data on the loss chart is currently flashing a possible bottom. In an X post, CryptosRus has revealed that the supply in the Loss metric chart tracks the total amount of BTC held by addresses where the current market price is below the average cost basis of those holdings. Essentially, the portion of....

Bitcoin has been moving sideways around its current levels with no clear direction on lower timeframes. The cryptocurrency has experienced its worst-selling pressure in years but has held firmly around its 2017 all-time high. Related Reading | Crypto Trading Volumes In India Sink Due To Heavy Taxation, What’s Ahead? At the time of writing, Bitcoin trades at $20,140 with a 4% profit in the last 24 hours. The general sentiment in the market has been turning more positive, as NewsBTC reported yesterday, as the Crypto Fear and Greed Index climbs back from Extreme Fear levels. According to....

Unrealized losses are hitting both long-term and short-term holders this week, with half of the supply underwater in wallets. Bitcoin (BTC) is setting unenviable records this week as hodlers big and small battle some major pain.Data from on-chain analytics firm Glassnode shows over one-third of the BTC supply being held at a loss by long-term hodlers (LTHs) — a new all-time high.Long-term holders shoulder record unrealized lossesProfitability has taken a serious hit in recent days, and on-chain data confirms that even the most seasoned investors are suffering.As BTC/USD crashed to two-year....