Are Ethereum DeFi Titans Like Uniswap, Maker, And Lido Are Grossly Undervalued?

Ethereum is the home of decentralized finance (DeFi), looking at the over $100 billion in total value locked (TVL). Even though the figure fluctuates, mainly depending on the performance of ETH, it is clear that DeFi has proven revolutionary, opening up new use cases spanning multiple sectors, including finance and insurance. Are Ethereum DeFi Protocols […]

Related News

Major DeFi tokens, including UMA, Maker, and Uniswap have surged up to 22% in the past 24 hours. The decentralized finance (DeFi) market has generally rebounded following a sustained pullback. There are two main reasons behind the short-term recovery of major DeFi tokens. First, most DeFi tokens were heavily sold since September, causing most to […]

Singapore — August 17th – Lido Finance, a giant in the Ethereum staking world, will be enhancing liquidity on Polygon with KyberSwap Elastic. Lido Finance is the largest platform for liquid staking services on Ethereum. Powering DeFi and CeFi applications alike with their technology, Lido Finance empowers stakers to put their staked assets to use on their supported networks: Ethereum, Solana, Polygon and Polkadot. This first phase of this joint initiative is set to bring liquidity providers over $120,000 in liquidity mining rewards, with more incentives to come in the near....

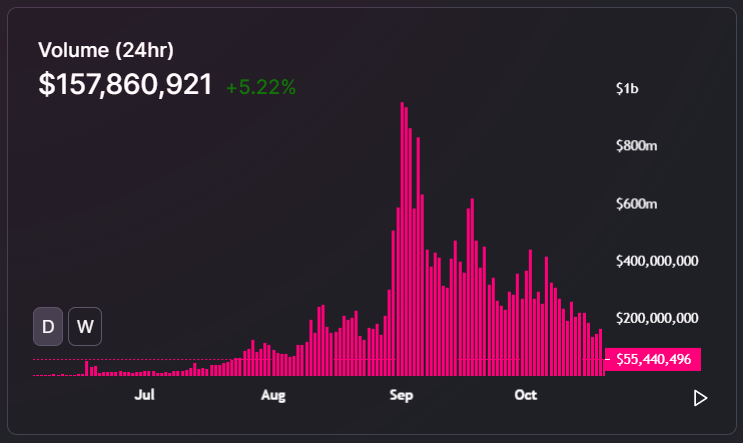

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

The price of SUSHI, the governance token of SushiSwap, has increased by 73% in the last four days, as fundamentals strengthen. SUSHI, the native token of SushiSwap, rallied by 73% in the past four days. However, some investors believe the DeFi token may still have a lot more room to run.SushiSwap is an automated market maker (AMM) that allows users to trade cryptocurrencies in a decentralized manner on the Ethereum blockchain.SUSHI/USDT 15-minute price chart (Binance). Source: TradingView.comWhy is SUSHI undervalued at $2 billion?The market cap of SUSHI achieved $2 billion as its price....

The Bitcoin versus Ethereum debate has been going on for years and waxes stronger as the market grows. Pitting the two top cryptocurrencies against each other has been one of the greatest pastimes for the market. However, not everyone subscribes to the school of thought that they are in competition. ARK Invest CEO Cathie Wood is known in the crypto space for giving her outlook on Bitcoin but Ethereum has been largely left out of the conversation. Wood is mostly known in the space for her bitcoin at $500,000 prediction, which she has stood by at various points. Related Reading | Why....