UMA, Maker, Uniswap Surge Up to 22%: What’s Causing the DeFi Recovery?

Major DeFi tokens, including UMA, Maker, and Uniswap have surged up to 22% in the past 24 hours. The decentralized finance (DeFi) market has generally rebounded following a sustained pullback. There are two main reasons behind the short-term recovery of major DeFi tokens. First, most DeFi tokens were heavily sold since September, causing most to […]

Related News

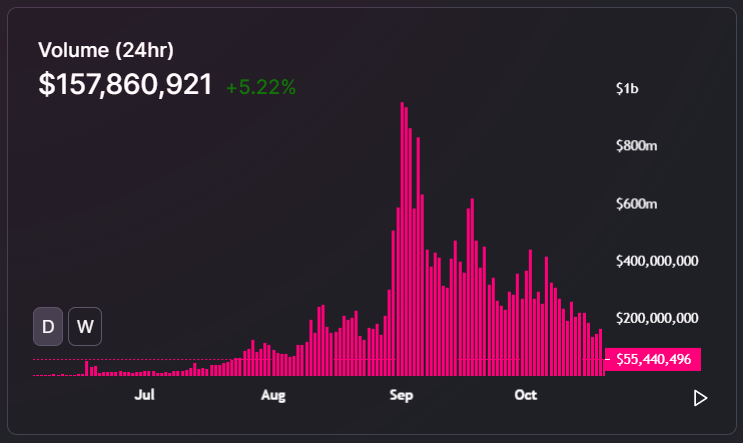

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

The DeFi market has corrected hard as Bitcoin dropped below $40,000, but analysts say a recovery is likely. The decentralized finance or DeFi market saw a steep correction over the last 12 hours as Bitcoin (BTC) was unable to break the $41,000 level.Meanwhile, analysts say that the profits from major DeFi tokens are flowing back into Bitcoin, even though the DeFi market is still lagging behind despite BTC’s recovery over the past week.1-hour candle DeFi index (Binance). Source: TradingView.comSo what’s next for the DeFi market?Both major bluechip DeFi tokens and small market cap....

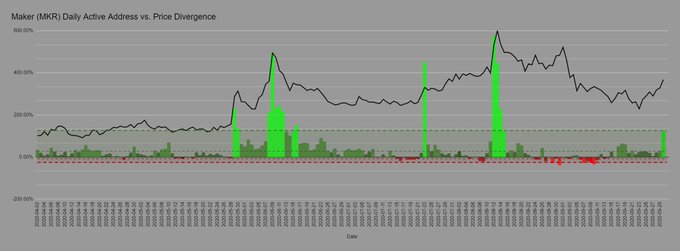

MKR, the native token of the Maker Protocol, has recorded substantial gains despite the most recent market downturn. After news of FTX’s liquidity crisis rocked the crypto market, several coins have struggled to bag daily gains to no avail. However, MakerDAO’s governance token has experienced an impressive surge today. Specifically, MKR trades at $873 press time, gaining over 26% on the day. Despite the huge jump in the day, Maker still hasn’t recovered its weekly losses. However, if its bullish trend continues, it might fully recover in a short time. Related Reading: Bitcoin Eyes $18K....

While decentralized finance (DeFi) has seen a strong surge in 2020, Maker (MKR), a token strongly tied to DeFi, has underperformed. The cryptocurrency, relative to its competitors, is underperforming; where Aave’s LEND and Synthetix’s Synthetix Network Token surged hundreds of percent in this year alone, MKR only saw a 20-30% move higher. The market may […]

Ethereum is the home of decentralized finance (DeFi), looking at the over $100 billion in total value locked (TVL). Even though the figure fluctuates, mainly depending on the performance of ETH, it is clear that DeFi has proven revolutionary, opening up new use cases spanning multiple sectors, including finance and insurance. Are Ethereum DeFi Protocols […]