Bitcoin's Derivative Market Bulls Have Vanished

Recently, funding for bitcoin futures contracts has flipped negative and perpetual futures are trading below spot.The bitcoin perpetual swap, the most liquid and traded futures instrument, is a contract that allows traders to speculate on the bitcoin price with leverage. While there is always an equal amount of long and shorts, the positioning of those contracts relative to the spot bitcoin price shows the bullish/bearish bias in the derivatives market. When the contract price of a perpetual futures contract (a futures contract that never expires) is above the spot market bitcoin price,....

Related News

Bloomberg reported on Monday that Goldman Sachs has begun trading a sort of derivative linked to Ethereum. Goldman Sachs Launches Derivative Product As a torrent of institutional money entered the market in 2021, the investment bank relaunched its crypto activities, with the core of its services focusing around derivatives tied to cryptocurrencies like bitcoin. Goldman […]

For years, the cryptocurrency industry has had a complicated relationship with regulators. An example of regulatory pushback within the crypto space was when Facebook-backed Diem tried to launch its stablecoin. Regulatory limitations have undoubtedly had an impact on derivative brokers and exchanges. Just recently, Binance, one of the biggest exchanges, was forced to shut down crypto derivatives in several countries, including Germany, Italy, and Hong Kong. Since this announcement, derivatives traders have been on edge about what this means for the derivatives market and, most importantly,....

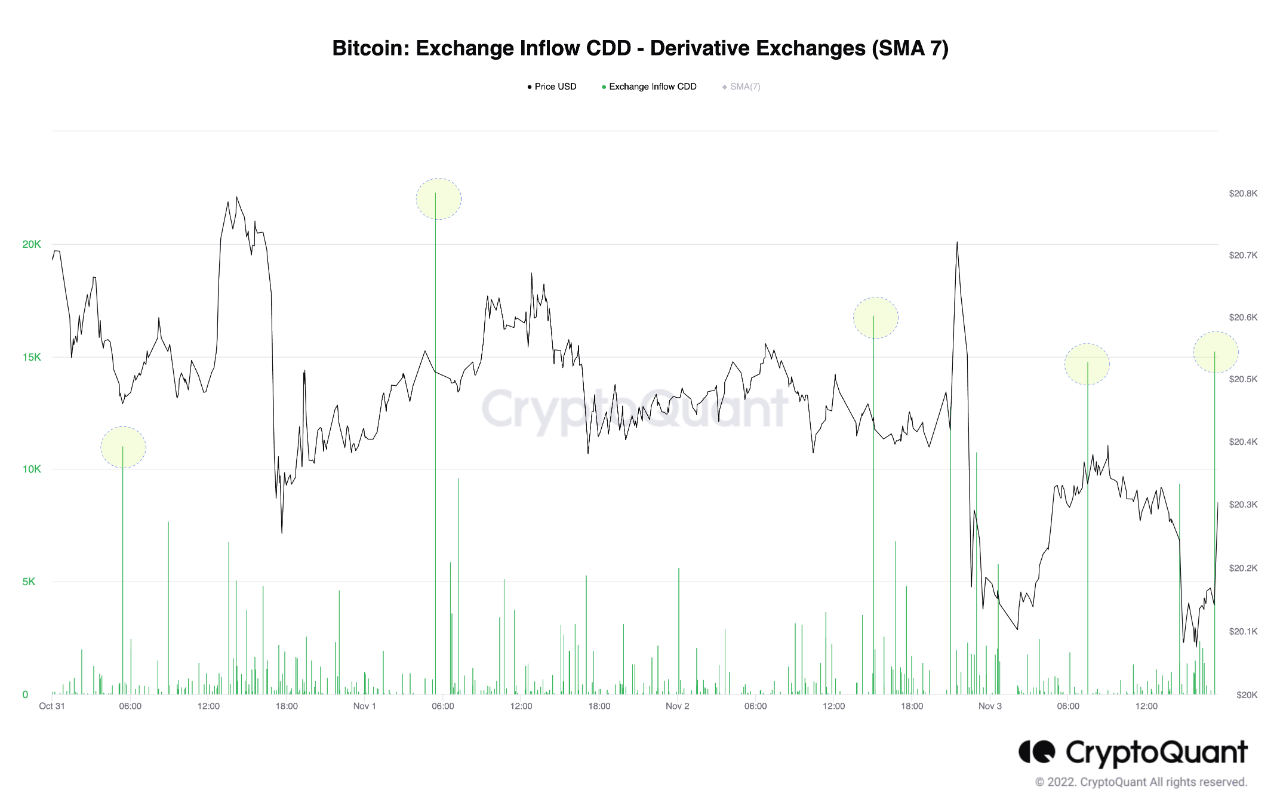

On-chain data shows Bitcoin funding rates have turned positive, suggesting there have been some fresh long openings on derivative exchanges. Bitcoin Funding Rate Turns Green After Derivative Exchange Inflows Spike Up As pointed out by an analyst in a CryptoQuant post, the new long positions can drive the price up in the short term. There are mainly two Bitcoin indicators of relevance here, the derivative exchange inflow CDD, and the funding rates. First, the “derivative exchange inflow CDD” is a metric that tells us whether old BTC supply is moving into derivative exchange....

Australian FX and CFD provider Eightcap has recently announced that it has partnered with TradingView, allowing crypto derivative traders to trade directly from TradingView’s charts into their Eightcap trading accounts. Crypto derivative traders will access Eightcap’s full suite of crypto derivatives, including altcoins, crypto-indices and crypto-crosses. Eightcap’s integration with TradingView is the next step for the award-winning broker as it continues to build a home for crypto traders. TradingView is a charting platform and social network that attracts over 30....

Daraprim has become a popular pharmaceutical medication in recent weeks thanks to Martin Shkreli's decision to increase the price of the drug from $13.50 to $750. The medicine is on the World Health Organization's List of Essential Medicines. The drug was originally developed to combat malaria and has been available since 1953. The market for the medicine is so small that no generic manufacturer has started making it. Shkreli, an American hedge fund manager, and entrepreneur, is the founder of Turing Pharmaceuticals AG. He ultimately announced the price of the drug his firm bought the....