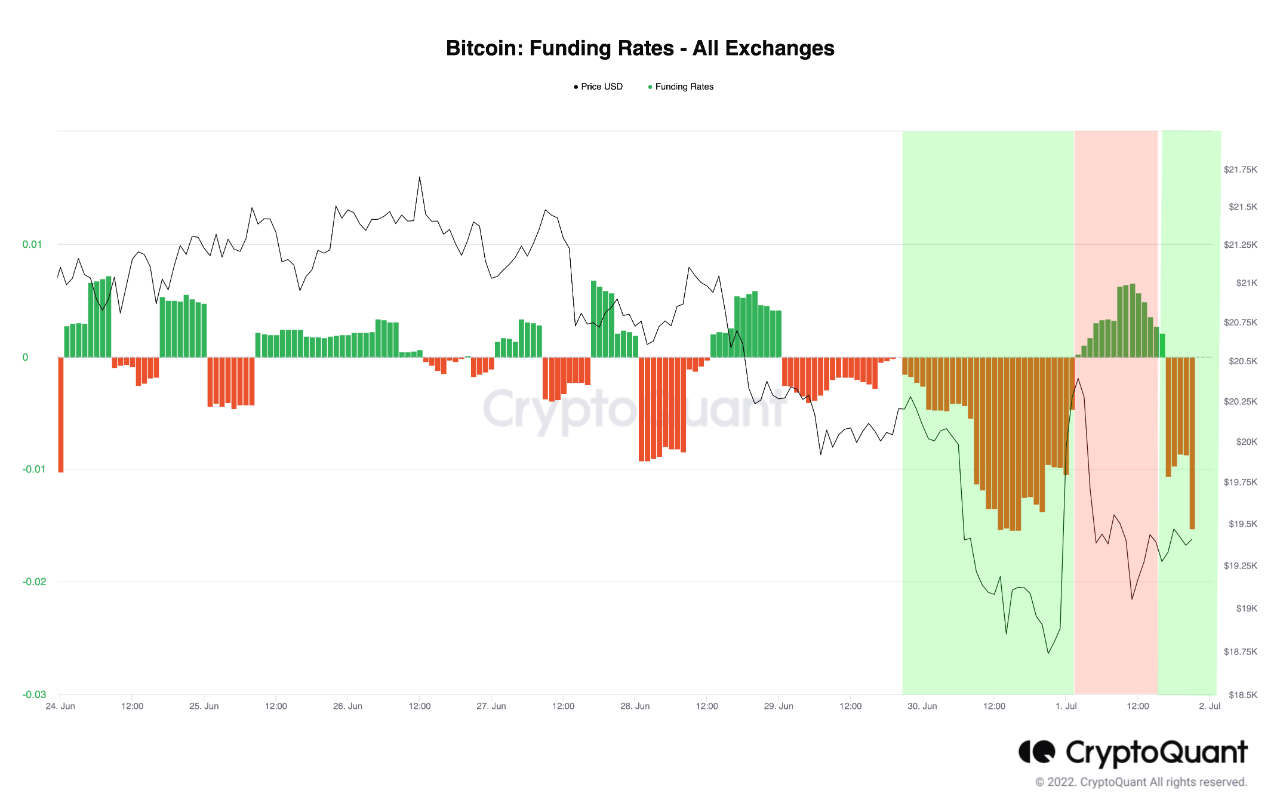

Bitcoin Funding Rate Turns Deep Red, Short Squeeze Soon?

On-chain data shows Bitcoin funding rates have sunk into deep negative values, something that could pave way for a short squeeze in the market. Bitcoin All Exchanges Funding Rate Has A Red Value Right Now As pointed out by an analyst in a CryptoQuant post, BTC may see a slight uplift in the short term […]

Related News

Data shows the Ethereum Funding Rate has declined into the negative zone. Here’s what has usually followed this trend in the last two months. Ethereum Funding Rate Suggests Traders Are Now Bearish As explained by analytics firm Santiment in a new post on X, shorts are dominating the Ethereum derivatives market now. The indicator of […]

The price of Bitcoin surpassed its all-time high and surged above $24,600 as traders analyze what will come next. The price of Bitcoin surpassed its all-time high on Christmas, reaching $24,681 on Binance. Following BTC’s strong rally, traders and analysts are exploring short-term bear and bull cases. The market sentiment around Bitcoin remains overwhelmingly positive, but there are some concerns put forth by analysts in the foreseeable future and as a result, the next move is not a clear-cut one.The funding rate of Bitcoin futuresBitcoin (BTC) has rallied above $24,600 with a relatively....

Bitcoin saw $150 million worth of short contracts obliterated within hours. Roughly $150 million worth of shorts were liquidated within a span of hours as the price of Bitcoin (BTC) rose from around $47,000 to over $53,000 on April 26.The cryptocurrency market as a whole saw a strong short squeeze, as Ether (ETH), Binance Coin (BNB), and other major cryptocurrencies also rose by around 15% in the same period.Following Bitcoin's 12% recovery within a single day, the futures market has completely reset, with funding rates hovering at neutral levels.Why today's Bitcoin short squeeze is....

The funding rate of the Bitcoin (BTC) futures market is turning negative as the price of BTC surges. The trend indicates that short contracts are getting squeezed as the dominant cryptocurrency rises. The term short squeeze refers to a scenario where traders are increasingly betting against Bitcoin but BTC goes up. As BTC increases, short […]

The price of Bitcoin was somewhat slow in the last days of April before bursting to life again to begin the new month of May. The premier cryptocurrency has since made a return near $98,000, flirting with the highly coveted $100,000 level to kick off the weekend. Since losing the $100,000 price mark in early […]