Bitcoin bulls respond with a $150M short squeeze above $53K — Can BTC go hig...

Bitcoin saw $150 million worth of short contracts obliterated within hours. Roughly $150 million worth of shorts were liquidated within a span of hours as the price of Bitcoin (BTC) rose from around $47,000 to over $53,000 on April 26.The cryptocurrency market as a whole saw a strong short squeeze, as Ether (ETH), Binance Coin (BNB), and other major cryptocurrencies also rose by around 15% in the same period.Following Bitcoin's 12% recovery within a single day, the futures market has completely reset, with funding rates hovering at neutral levels.Why today's Bitcoin short squeeze is....

Related News

As a result of the recent pullback in the cryptocurrency market over the weekend, Ethereum (ETH) has created two Chicago Mercantile Exchange (CME) gaps at $3,000 and $2,600. Crypto analyst Ted suggests that a short squeeze could soon push the price beyond $3,000, potentially filling these two CME gaps. Is An Ethereum Short Squeeze Imminent? […]

Quick Facts: ➡️ Ethereum lost 13% in recent weeks, falling as low as $3,055, creating the perfect conditions for a projected $7B short squeeze. ➡️ Ethereum’s short squeeze could drive major price recovery, boosting overall market sentiment and drive $ETH’s price even higher. ➡️ PEPENODE introduces a gamified, virtual mining system, allowing users to mine […]

After beating Wall Street with its short squeeze of GameStop stock, the members of r/wallstreetbets should level up with Bitcoin. The post After GameStop Short Squeeze, r/Wallstreetbets Is Ready For Bitcoin appeared first on Bitcoin Magazine.

Data shows that on Monday crowded Bitcoin shorts have lead to the largest recorded squeeze in the history of the cryptocurrency. Bitcoin Records Largest Short Squeeze Ever As per an Arcane Research report, BTC has recorded the largest squeeze in its history where $750 million worth of shorts have been liquidated. Here is a chart that shows the data for Bitcoin short liquidations over the past one year: BTC short squeeze spikes | Source: Arcane Research As is clear from the above graph, the short squeeze seen on Monday, 26 July, hasn’t been observed in the past year. In fact,....

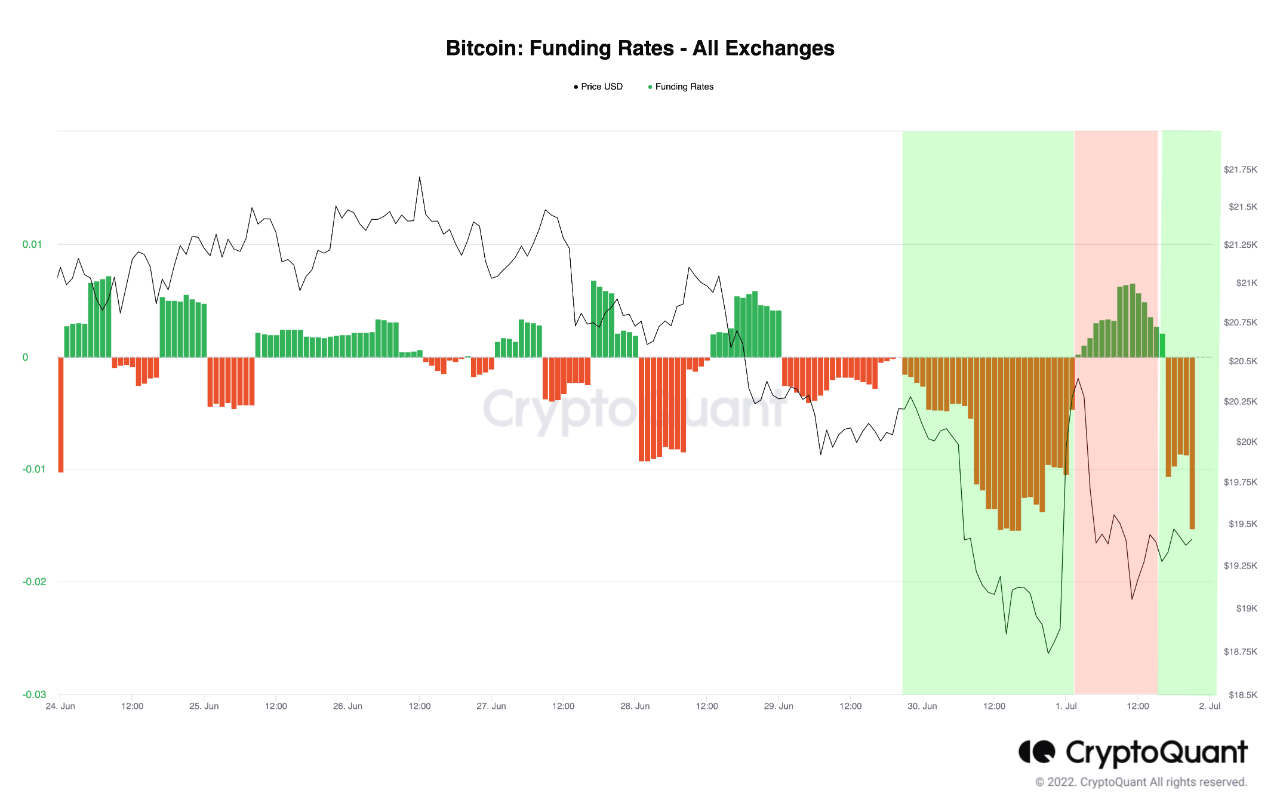

On-chain data shows Bitcoin funding rates have sunk into deep negative values, something that could pave way for a short squeeze in the market. Bitcoin All Exchanges Funding Rate Has A Red Value Right Now As pointed out by an analyst in a CryptoQuant post, BTC may see a slight uplift in the short term […]