Central Bank of Jordan Exploring the Possibility of Launching a CBDC

The governor of the Central Bank of Jordan recently said his institution is studying the possibility of launching a legal digital currency, one that will be linked with its national currency. He also suggested that cryptocurrency trading might eventually be allowed in Jordan once the necessary legislation has been put in place. Protecting Investors Jordan is currently studying and exploring the possibility of launching a central bank digital currency (CBDC) linked to its currency the Jordanian dinar, the country’s central bank governor has said. In addition, the governor, Adel Al....

Related News

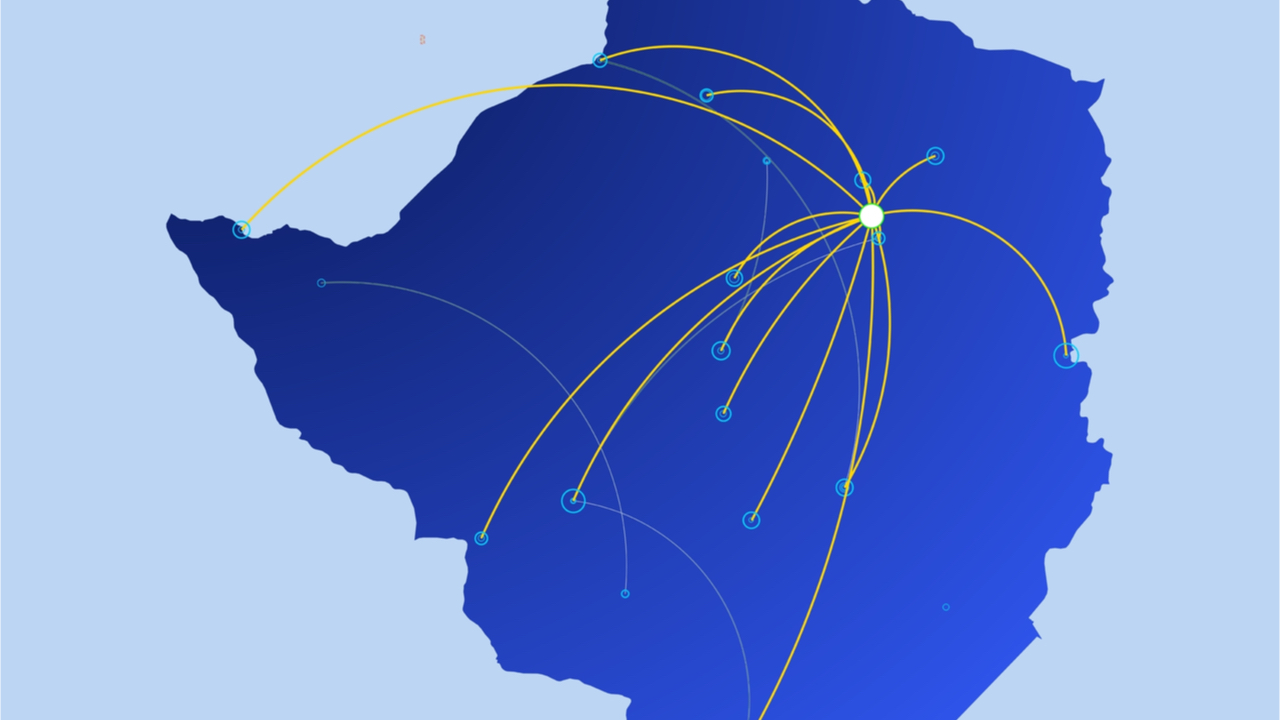

Zimbabwe’s central bank, which has expressed its opposition to cryptocurrencies in the past, announced yesterday it is presently exploring the feasibility of rolling out its own central bank digital currency (CBDC). The bank also said its regulatory sandbox continues to garner interest.

CBDC Roadmap

The Zimbabwean central bank, the Reserve Bank of Zimbabwe (RBZ), has reiterated that it prefers a central bank digital currency (CBDC) to cryptocurrencies, in its latest monetary policy statement. It adds it is now “actively exploring the feasibility of adopting a....

CBJ governor also predicted that cryptocurrency trading might eventually be permitted in Jordan once the appropriate legislation is in place. Central Bank of Jordan (CBJ) has revealed that it is researching issuing a digital currency. The central bank digital currency (CBDC) would be linked to the Jordanian dinar and have legal standing.Adel Al Sharkas, the governor of CBJ, has reportedly stated that his institution is researching the option of creating a legal digital currency. He also predicted that cryptocurrency trading might eventually be permitted in Jordan once the appropriate....

The Republic of Georgia's central bank has invited fintech firms and others to participate in the CBDC project. The National Bank of Georgia said that it is considering launching a central bank digital currency.In an announcement today, the central bank hinted at the issuance of a central bank digital currency, or CBDC, in an effort “to enhance efficiencies of the domestic payment system and financial inclusion.” The National Bank of Georgia, or NBG, said it would be inviting fintech firms and other financial institutions to participate in the project, named Digital Gel after the symbol....

There are at least four countries that have either scrapped or halted CBDC plans so far, and each central bank has its own reasoning for not launching one. As countries around the world race to launch a central bank digital currency (CBDC), some jurisdictions have slowed down or dropped out of the race altogether.While many observers were pushing a narrative of urgency around CBDCs, some countries have decided that launching a CBDC isn’t currently necessary, while others have tested CBDCs only to dismiss them.Each country had its own reasons, with global central banks providing very....

The bank is exploring technological solutions and platforms for its own digital currency. The 2.8-million nation of Qatar is going to join a growing range of countries, experimenting with the central bank digital currency (CBDC) concept. The Qatar Central Bank (QCB) is currently “in the foundation stage” of issuing its digital currency. On June 21, during the “Inflation Test” session at the Qatar Economic Forum, QCB Governor Sheikh Bandar bin Mohammed bin Saoud Al Thani revealed that the bank is working to find technological solutions for its CBDC. Right now the project is in its early....