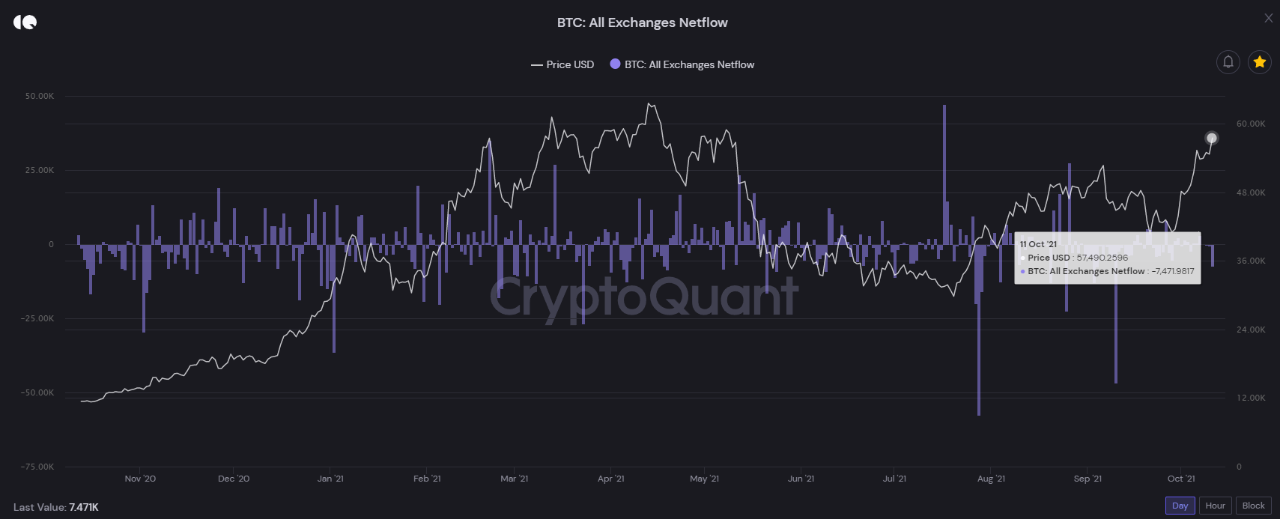

Despite Dip To $44K, On-chain Data Suggests Bitcoin Still Bullish

On-chain data shows Bitcoin netflows are still deeply negative, a sign that means BTC remains bullish. This is despite the dip to $44k. Exchanges Observe Deeply Negative Bitcoin Netflow As per a CryptoQuant post, the Bitcoin netflow indicator has been deeply negative recently, suggesting that signs are still overall bullish for the market. Related to the netflow are two other indicators, the outflow and the inflow. The first one is defined as the total amount of BTC flowing out of exchanges towards personal wallets. Related Reading | Hot Bitcoin Summer. But Why Altcoins Are On The....

Related News

Bitcoin could soon see a bullish trend reversal as an on-chain indicator suggests it will do so. The on-chain indicator has predicted a number of notable price trends over the past few years. For one, during 2017’s bull market, the indicator formed a number of bounces off the 1.0 reading. Other fundamental trends also suggest that the prevailing Bitcoin trend is bullish. Bitcoin Could See a Bullish Trend Reversal Very Shortly: Key On-Chain Analysis Bitcoin […]

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

On-chain data suggests the Toncoin whales have participated in significant accumulation over the past week, which could be bullish for TON. Toncoin Whales Have Bought Large During The Last Seven Days As explained by analyst Ali Martinez in a new post on X, Toncoin whales have been active with net buying recently. The on-chain indicator […]

Despite on-chain metrics indicating Bitcoin investors will soon face losses, Glassnode believes BTC is ready to bounce. A Jan. 25 report published by crypto data aggregator Glassnode has noted that Bitcoin’s adjusted Spent Output Profit Ratio, or aSOPR, suggests that a further decrease in prices will leave many investors in the red according to when their holdings last moved on-chain.Despite the metric suggesting few investors are sitting on paper-profits, Glassnode interprets the data as bullish, stating:“In order for SOPR to go lower, investors would have to be willing to sell at a loss,....

On-chain data shows the Chainlink exchange supply has observed a plummet, something that could turn out to be bullish for the asset’s price. Chainlink Supply On Exchanges Has Registered A Drawdown Recently According to data from the on-chain analytics firm Santiment, the LINK supply on exchanges could be forming a bullish divergence right now. The […]