Glassnode predicts BTC break-out as investors refuse to realize losses

Despite on-chain metrics indicating Bitcoin investors will soon face losses, Glassnode believes BTC is ready to bounce. A Jan. 25 report published by crypto data aggregator Glassnode has noted that Bitcoin’s adjusted Spent Output Profit Ratio, or aSOPR, suggests that a further decrease in prices will leave many investors in the red according to when their holdings last moved on-chain.Despite the metric suggesting few investors are sitting on paper-profits, Glassnode interprets the data as bullish, stating:“In order for SOPR to go lower, investors would have to be willing to sell at a loss,....

Related News

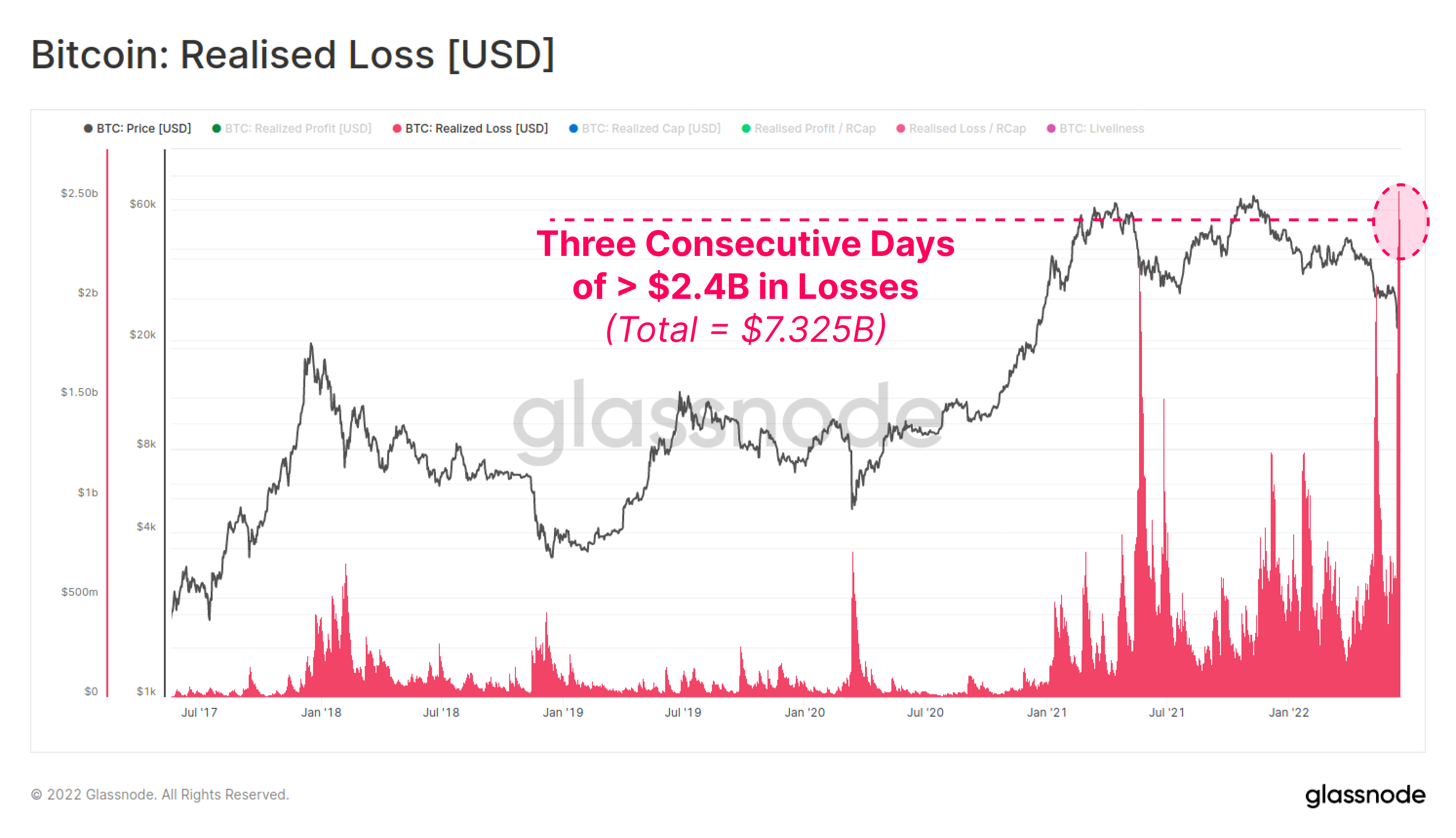

Data from Glassnode shows more than $7 billion in Bitcoin losses was realized within three consecutive days, the most in the history of the crypto. Highest Ever Bitcoin Loss Realization Took Place During The Last Few Days Latest on-chain data released by Glassnode shows BTC investors took a heavy amount of losses in the past […]

Bitcoin’s long-term holders are beginning to suffer losses matching those from previous bear markets, and Glassnode believes the pain may continue, and even get worse. Long-term Bitcoin holders are sitting on their largest losses since the March 2020 capitulation and the 2018-2019 bear market but may have to keep waiting for relief.Calculated by measuring the value of coins deposited to exchanges, aggregated realized losses from long-term holders (LTH) of Bitcoin (BTC) exceeded 0.006% of the market capitalization by May 29 according to Glassnode’s The Week Onchain report from June....

On-chain data shows that while miners are selling less BTC, old investors are realizing profits. On-chain analytics provider, Glassnode, has published data revealing that Bitcoin miners are accumulating while long-term investors are taking profits.Despite January seeing heavy selling from miners, Glassnode’s report shows that miner outflows have dried up during February so far.Chart - Glassnode.comThe report asserts that miners and longer-term investors are the two principal sellers of Bitcoin during bull markets. According to Glassnode, declining miner outflows can be inferred as bullish,....

While many indicators suggest that the market bottom may be close, time will be the ultimate determinant, according to a new report from Glassnode. Bitcoin wealth is being distributed from weak hands to strong hands due to ongoing capitulation from retail investors and miners, signaling that the bottom may be close.The latest ‘The Week On-Chain’ report from blockchain analysis firm Glassnode on July 11 explains that market capitulations have been ongoing for about a month and that several other signals suggest bottom formations in Bitcoin prices. However, Glassnode analysts wrote that the....

A report from on-chain analytics firm Glassnode has highlighted how transitions into strong upside phases have historically required liquidity to hold above a key threshold. Bitcoin Rally Could Require Realized Profit/Loss Ratio To Rise Above 5 In its latest weekly report, Glassnode has talked about liquidity conditions present on the Bitcoin network as the asset’s price has gone through a drawdown following its failed recovery attempt earlier in the month. Related Reading: Bitcoin Death Cross That Last Preceded A 66% Drop Is Back “Any meaningful transition back toward a....