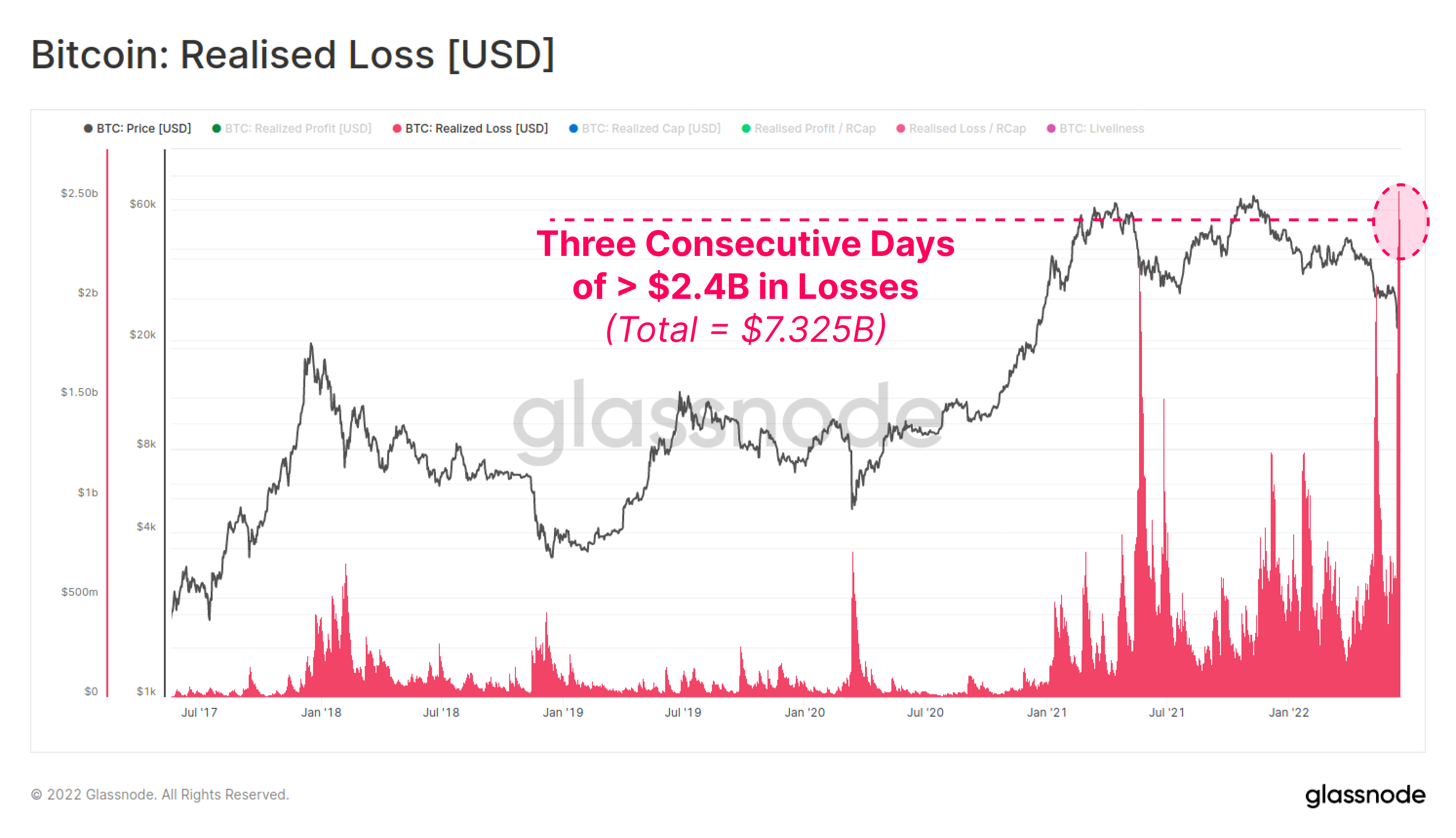

Glassnode: $7B In Bitcoin Losses Realized In Just Three Days, Highest In BTC ...

Data from Glassnode shows more than $7 billion in Bitcoin losses was realized within three consecutive days, the most in the history of the crypto. Highest Ever Bitcoin Loss Realization Took Place During The Last Few Days Latest on-chain data released by Glassnode shows BTC investors took a heavy amount of losses in the past […]

Related News

Data shows the net amount of losses being realized in the Bitcoin market is going down, but nonetheless remains at a high value. Bitcoin Net Realized Profit/Loss Still Has A Pretty Negative Value As per the latest weekly report from Glassnode, the net loss realization has reduced a bit recently, but the market is not near a neutral level of selling yet. The “net realized profit/loss” is an indicator that measures the net magnitude of profits or losses being realized by all investors in the Bitcoin market. The metric works by looking at the on-chain history of each coin being....

The inventor of Ethereum Vitalik Buterin and his father Dmitry “Dima” Buterin talked about the crypto market, volatility, and speculators. In an interview with Fortune Magazine Buterin claimed he is unbothered by ETH’s price downside action. Related Reading | Glassnode: $7B In Bitcoin Losses Realized In Just Three Days, Highest In BTC History Buterin and his […]

The classic bottom zone reappears on the back of serious sell pressure stoked by mayhem on stablecoin markets. Bitcoin (BTC) bounced past $28,000 during May 12 after repeating a chart structure not seen since March 2020.BTC/USD 1-hour candle chart (Bitstamp). Source: TradingViewBTC seller losses spiralData from Cointelegraph Markets Pro and TradingView continued to track BTC/USD as it briefly fell to just under $24,000 on Bitstamp.A strong reversal then sent the pair several thousand dollars higher in minutes, with consolidation then taking hold to see it trade at around $27,000.The bounce....

Bitcoin’s long-term holders are beginning to suffer losses matching those from previous bear markets, and Glassnode believes the pain may continue, and even get worse. Long-term Bitcoin holders are sitting on their largest losses since the March 2020 capitulation and the 2018-2019 bear market but may have to keep waiting for relief.Calculated by measuring the value of coins deposited to exchanges, aggregated realized losses from long-term holders (LTH) of Bitcoin (BTC) exceeded 0.006% of the market capitalization by May 29 according to Glassnode’s The Week Onchain report from June....

Bitcoin’s price action in the past two weeks has opened a new phase of stress among traders, with on-chain data showing realized losses climbing to heights last observed in 2022. Glassnode’s latest Week-On-Chain report shows Bitcoin is trading above an important cost-basis level but is also visibly straining under intensified loss realization, fading demand and weakening liquidity, which has placed short-term investors in a difficult position. Realized Losses Return To Deep Territory According to Glassnode, realized losses among Bitcoin entities have risen massively, and is now almost at....