Bitcoin Whales Load Their Bags: $1.7 Billion In BTC Flow Out Of Exchanges

The price of Bitcoin — and the general market — started the week with one of the largest declines they have seen in 2024. While this broad market downturn resulted in widespread fear and panic amongst crypto enthusiasts, it appears that many investors took the opportunity to amass more digital assets at low prices. According […]

Related News

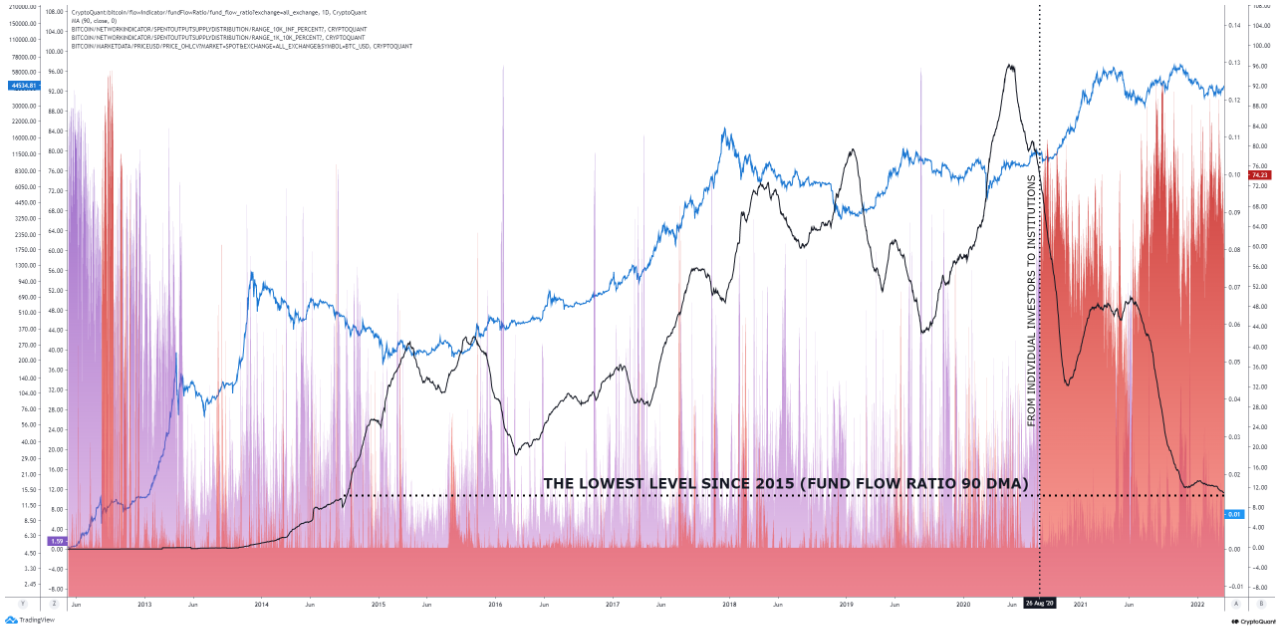

Data shows the Bitcoin fund flow ratio has been going down in the last couple of years, suggesting that whales have started to prefer selling through OTC deals over centralized exchanges. Bitcoin Fund Flow Ratio Reaches Lowest Level Since 2015 As explained by an analyst in a CryptoQuant post, BTC whales seem to have increasingly […]

On-chain data shows that large Chainlink holders have been buying during the past two weeks, a sign that’s positive for the coin’s rally. Chainlink Sharks & Whales Have Added Another $53 Million In LINK As pointed out by analyst Ali in a post on X, the large LINK investors have been buying recently. The indicator […]

On-chain data shows whales are sending their Bitcoin from spot exchanges to derivatives, indicating that they are building up their positions. Bitcoin Whales Build Up Their Positions On Derivative Exchanges As pointed out by a CryptoQuant post, Bitcoin whales seem to be moving their crypto from spot exchanges to derivative exchanges. The relevant indicator here is the “all exchanges to derivative exchanges flow mean,” which shows the total amount of coins being transferred from spot exchanges to derivative exchanges. When the value of this metric shows continuous high values,....

Crypto whales have taken advantage of the recent market downturns, loading up their bags as the price of several tokens slipped to lower levels. During the last few retraces, a whale bought over 400 billion PEPE, already registering unrealized profits from its purchase. Some market watchers believe the token is poised to lead the “memeseason” after its recent performance. Related Reading: USTC Preps For Explosive 360% Run, Crypto Analyst Reveals When Whale Goes On Buying Spree A week ago, the crypto market saw a significant slump, with most cryptocurrency prices nosediving by over 20%.....

On-chain data shows Bitcoin whales are transferring large amounts to derivatives exchanges right now, a signal that more volatility could be ahead for the crypto. Bitcoin All Exchanges To Derivatives Flow Continues To Show High Value As explained by an analyst in a CryptoQuant post, BTC whale activity on derivatives exchanges still seems to be high. The relevant indicator here is the “all exchanges to derivatives exchanges flow,” which measures the total amount of Bitcoin moving from spot exchange wallets to derivatives. When the value of this metric spikes up, it means whales....