Major Crypto Mining Company Core Scientific Going Public on Nasdaq With $4.3 ...

Core Scientific, a major blockchain hosting and digital asset mining company, is going public through a merger with Power & Digital Infrastructure Acquisition Corp. The deal values the combined company at approximately $4.3 billion. Core Scientific to List on Nasdaq Core Scientific Holding Co., one of the largest blockchain hosting and digital asset mining companies in North America, announced Wednesday its plan to go public on Nasdaq via a special purpose acquisition company (SPAC). The crypto firm has entered into “a definitive merger agreement” with Power & Digital....

Related News

The Bitcoin miner will merge with Power & Digital Infrastructure Acquisition Corp in the latest crypto SPAC deal. Core Scientific, one of the largest Bitcoin (BTC) mining operations in North America is set for a public listing on Nasdaq.According to CNBC on Wednesday, Core has inked a $4.3 billion merger with Power & Digital Infrastructure Acquisition Corp — a special purpose acquisition company (SPAC). Apart from the planned valuation, other listing details like trading ticker and the start of actual public trading are yet to be revealed as of the time of writing.The SPAC merger and....

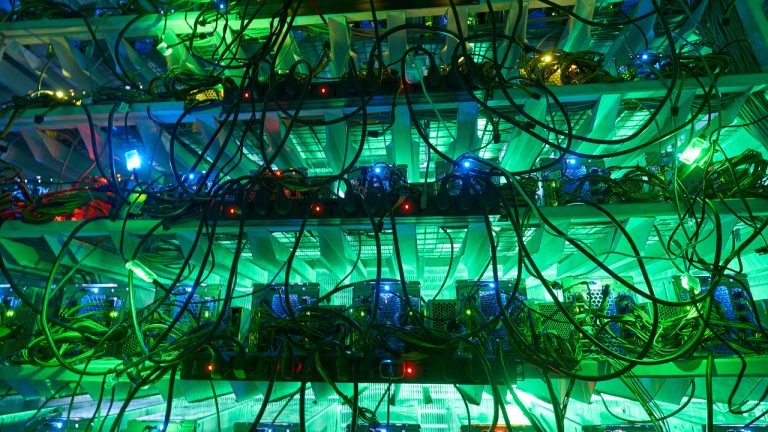

A major North American blockchain hosting provider announced its expansion by ordering over 58,000 additional S19 Series Antminers, as part of an agreement arranged with the Chinese mining hardware manufacturer. US Contract Miner Core Scientific Arranges Purchase of Over 58,000 Bitmain S19 Antminers According to the announcement, Bitmain’s deal expects to facilitate Core Scientific customers’ purchases through September 2021. The purchase agreement will bring total purchases to 76,024 next-generation bitcoin (BTC) miners, the S19 and S19 Pro Antminers for the past 16 months,....

While the current quarter in the crypto market has been bad for many companies as Bitcoin dropped, it has been successful for some. Core Scientific has proven that market lows can be beneficial if the right opportunity is identified. The U.S-based crypto mining company produced 1,334 BTC in August and sold over 1,125 Bitcoin for $25.9 million in approximate. According to Core Scientific’s August Production and Operational updates, it operated 25,451 ASIC servers for colocation and self-mining. Also, data shows that the hash rate produced was about 21.54EH/s (hash rate per second). Related....

The mining firm has cited the low price of Bitcoin, electricity costs, an increase in the BTC hash rate, and litigation with Celsius playing a role in its financial difficulties. Bitcoin mining firm Core Scientific is reportedly considering a potential bankruptcy amid a group of its convertible bondholders consulting restructuring lawyers.According to a Nov. 1 report from Bloomberg Law, the Core Scientific bondholders worked with legal firm Paul Hastings following a United States Securities and Exchange Commission filing suggesting financial distress. The Oct. 26 filing indicated that the....

One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due for Oct. and early Nov. 2022. SEC Filing Shakes Core Scientific Investors, CORZ Slides 97% in 12 Months Bitcoin miners are having issues after the price of bitcoin (BTC) has slid roughly 70% against the U.S. dollar since Nov. 10, 2021. Moreover, the network’s mining....