Quant Explains Similarities Between Current And Summer 2020 Bitcoin Markets

A quant has pointed out some similarities between the current and summer 2020 Bitcoin markets through on-chain data. Bitcoin Exchange Supply Shock Ratio Has Rapidly Risen Recently As explained by an analyst in a CryptoQuant post, there seem to be some similarities between the current market trend and that during the summer of 2020. The “exchange supply” is an indicator that measures the total amount of Bitcoin present on wallets of all exchanges. This supply is usually assumed to be the selling supply of the crypto as investors generally transfer their coins to exchanges for....

Related News

On-chain data shows while the price of Bitcoin has continued to struggle recently, miners have shown diamond hands. Bitcoin Miner Reserve Holds Still Amid The Recent Price Consolidation As pointed out by an analyst in a CrypoQuant post, BTC miners have been accumulating for some time now, and the dwindling price hasn’t scared them. The “Bitcoin miner reserve” is an indicator that measures the total amount of coins present in wallets of all miners. When the value of this indicator observes a decrease, it means the supply held by miners is going down. Such a trend may be a....

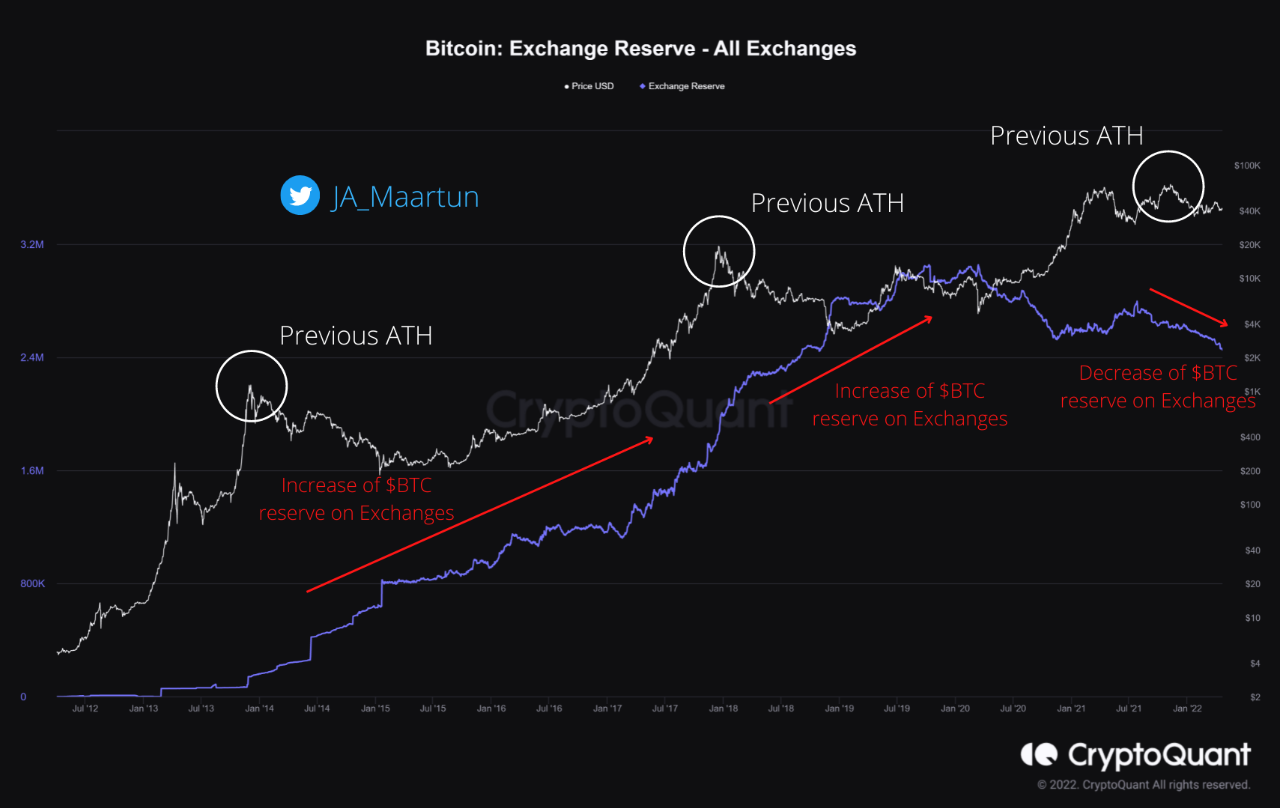

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

A quant has explained how the Bitcoin exchange reserve on-chain indicator differs between the current crash and that of May’s. After Spiking Ahead Of The Crash, Bitcoin Exchange Reserves Have Resumed Downtrend As explained by an analyst in a CryptoQuant post, the current trend in BTC exchange reserves is quite different from when the crypto […]

Analysts across crypto and traditional stocks have taken notice of the similarities between what happened in March 2020 and market moves so far this month. Analysts in both crypto and traditional markets have noted some startling similarities between the recent downturn and the one caused by a pandemic panic in March, 2020.The real question is whether it’s the start of a larger downturn or if there will be a significant bounce-back as in 2020 that led to an extended bull run in both crypto and stocks markets.Podcaster and author of The Pomp Letter, Anthony “Pomp” Pompliano is on the....

Quant rose to its highest point since the start of the year on Saturday, as prices climbed for a third straight session. In addition to this, tron was also higher, as the token attempted to break out of a key resistance point. Overall, cryptocurrency markets were down 1.95% as of writing. Quant (QNT) Quant (QNT) was one of the notable movers to start the weekend, as the token surged to a ten-month high. Following a low of $162.00 on Friday, QNT/USD surged to an intraday peak of $184.98 earlier in today’s session. This move saw the token climb to its highest point since January 8,....