Grifter season in DeFi-land, and Uniswap v3 is here! Finance Redefined 4/28-5/05

Uniswap v3 starts off with a whimper, not a bang, and grifters galore in this week's Finance Redefined. Lots of cons, no artistryIt’s grifter season: scams and opportunists run amok, and it’s harder than ever to tell who to trust. Case and point: over the weekend, an influencer by the pseudonym “Crypto Spider” was found to have pumped-and-dumped a meme coin, $SELON — while publicly claiming that he had joined his followers in taking a loss. step 1: @linkpadvc make a Doge fork called Shibe-Elon step 2: give themselves a ton of it step 3: burn 1 of their top address to induce FOMO step 4:....

Related News

Fees are a DeFi user’s nightmare. How can you pay less? This is a repost of Finance Redefined's latest installment, where Cointelegraph unpacks the latest developments in DeFi. The newsletter is delivered to subscribers every Wednesday.DeFi was reasonably quiet in terms of major fundamental developments, instead letting prices do the talking. Many tokens rallied, both the popular and the almost forgotten. Save for a few hiccups due to Bitcoin’s shaky price action, we are still well into DeFi season.This price action, unfortunately, means that using DeFi is pretty much impossible. Ethereum....

An in-depth review of the most anticipated release in DeFi. Finance Redefined is Cointelegraph's weekly DeFi-centric newsletter, delivered to subscribers every Wednesday.Uniswap V3 was publicly announced yesterday and I didn’t really get a chance to write about it, so I wanted to dedicate this newsletter to a review of V3 and the AMM space in general.My initial reaction to Uniswap V3 in one, brutally honest word, was “meh.” But it got better when I read further into it, so let’s unpack what’s happening here.Uniswap V3 is a solid upgrade and it’s clear that a lot of work went into it. But....

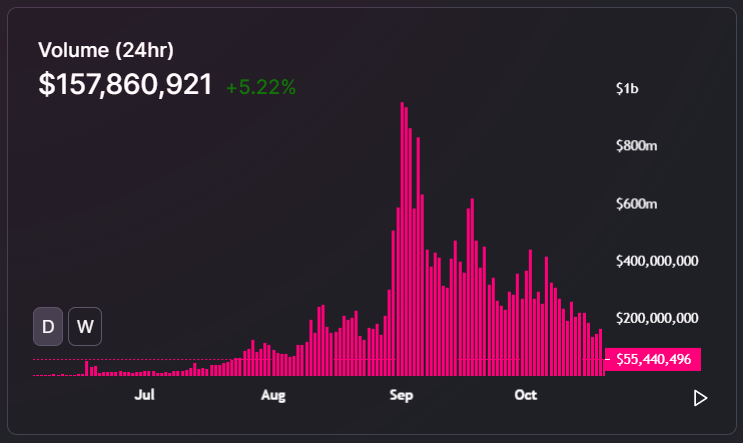

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

A DeFi dev’s vent highlights why traditional investment has its merits. Finance Redefined is Cointelegraph's newsletter focusing on the latest events and trends of DeFi, delivered to subscribers every Wednesday.This week I wanted to highlight Andre Cronje’s recent confession on Medium, which triggered a fair bit of discussion and quite a bit of salt from Uniswap team members. This particular spat occurred because he complained about developers just forking someone else’s code and launching it themselves. For those unaware of the irony, this is basically what SushiSwap, a Yearn ecosystem....

The Alpha Homora hack is still rippling through markets. Finance Redefined is Cointelegraph's DeFi-centric newsletter, delivered to subscribers every Wednesday.The Alpha Homora and Cream Finance hack has made a gigantic mark in the DeFi space this week.It is the largest single hack in DeFi history at $37 million in funds stolen. It is also one of the most complex, apparently leveraging several honest-to-God vulnerabilities in Alpha Homora. A few missing input checks in very specialized conditions allowed the hacker to abuse Alpha Homora’s privilege of borrowing an unlimited amount of funds....