Bitcoin futures data shows 'improving' mood' despite -31% GBTC premium

CME futures data combines with numbers from derivatives platforms to suggest that investors are getting less fearful. Bitcoin (BTC) traders may be nervous going into the Federal Reserve rate hike decision, but research suggests that the bulls are broadly gaining ground.In a fresh update on July 26, analytics firm Arcane Research flagged what it calls "improving" sentiment among institutional traders.Caution mixed with "improving sentiment"While attention has focused on the likelihood of a deeper macro low for BTC/USD to come, it appears that not every investor cohort is ready to run for....

Related News

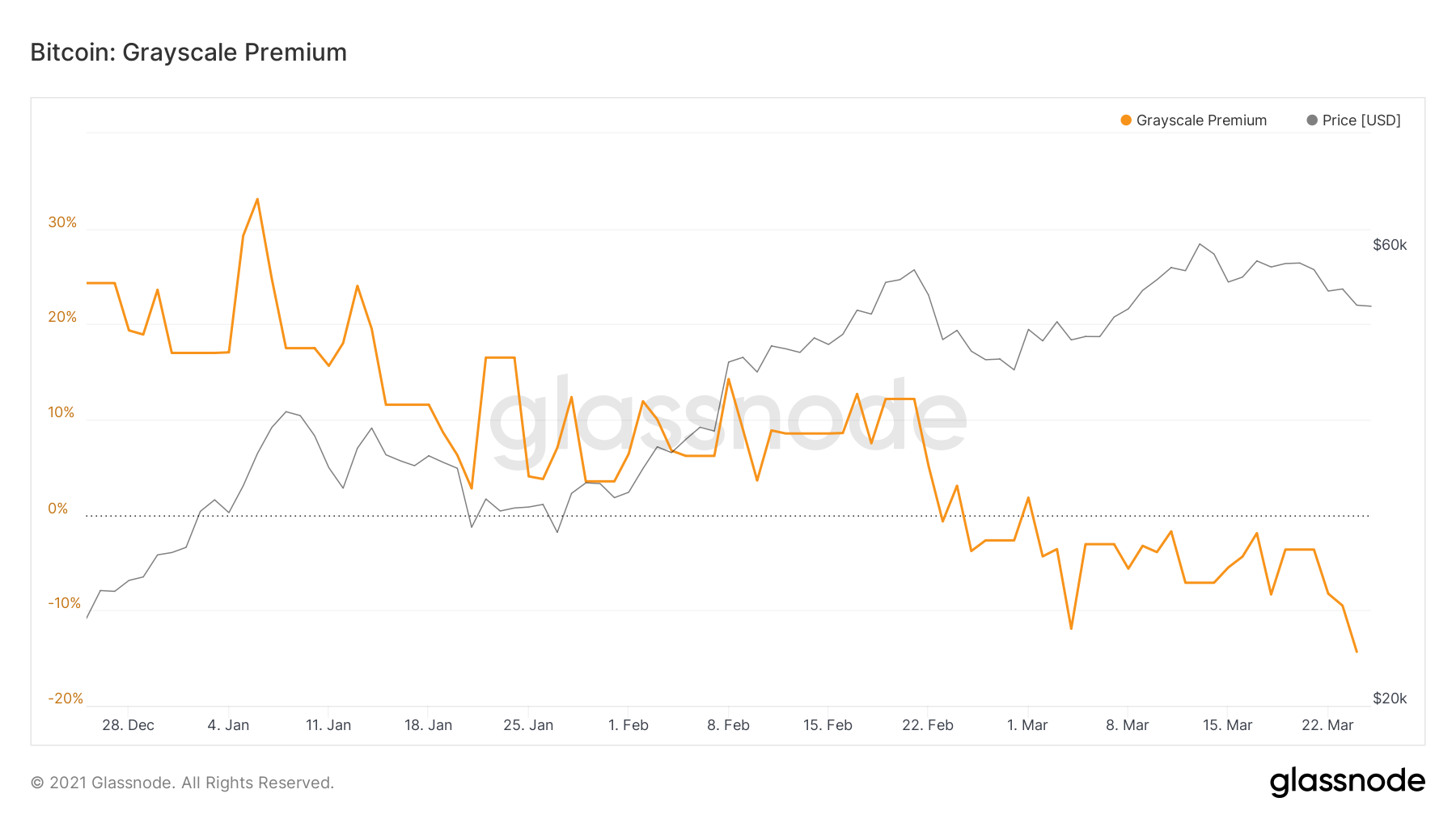

Following the recent bitcoin price pullback, the latest Skew data now indicates that the premium rate on Grayscale’s GBTC is under 10%. The lower rate comes just weeks after the premium peaked at 41% towards the end of December. The GBTC premium is a measure of the extent of differences in the value between the crypto asset on the open market and in the Grayscale fund. The same data also shows that between late October of 2020 and January 21 of the current year, this premium averaged 22%. However, in the seven days leading up to January 21, this rate dropped to 7.3%. According to....

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it. Analyzing Why Grayscale Bitcoin Trust Premium Continues to […]

For the past two months, Grayscale Bitcoin Trust (GBTC) has traded at a negative premium to the net asset value (NAV). GBTC historically traded at a high premium relative to the underlying, averaging a 15% premium since the fund’s inception. This was largely due to GBTC being the only investment vehicle easily accessible to institutional […]

The premium on Grayscale Investment’s GBTC, which turned negative for the first time on February 23, is continuing its downward slide. As the latest Glassnode data shows, the GBTC was trading at a record low discount of -11.92% on March 4, 2021. According to the same data, this new low is a significant reversal from the December 21 premium of nearly 40%. The Competition This growth in the discount on GBTC comes as Grayscale Investments gradually shifts focus to altcoins. As reported by news.Bitcoin.com, Grayscale added 174,000 litecoins or almost 80% of the newly minted LTC in....

Funds are flowing back into GBTC, data suggests, as CEO Sonnenshein reiterates plans to turn Grayscale crypto funds into ETFs. The Grayscale Bitcoin Trust (GBTC) is echoing bullish sentiment in Bitcoin (BTC) as its premium over spot price rises to its highest since May.Data from analytics resource Bybt shows that on Tuesday, the so-called Grayscale premium stood at -5.88%. The last time it was closer to zero was on May 25.GBTC premium slips above -6% That was a week after Bitcoin began a major price drawdown, which this week has finally shown signs of abating.GBTC has been the subject of....