GrayScale Bitcoin Trust (GBTC) Premium Sinks To All-Time Lows

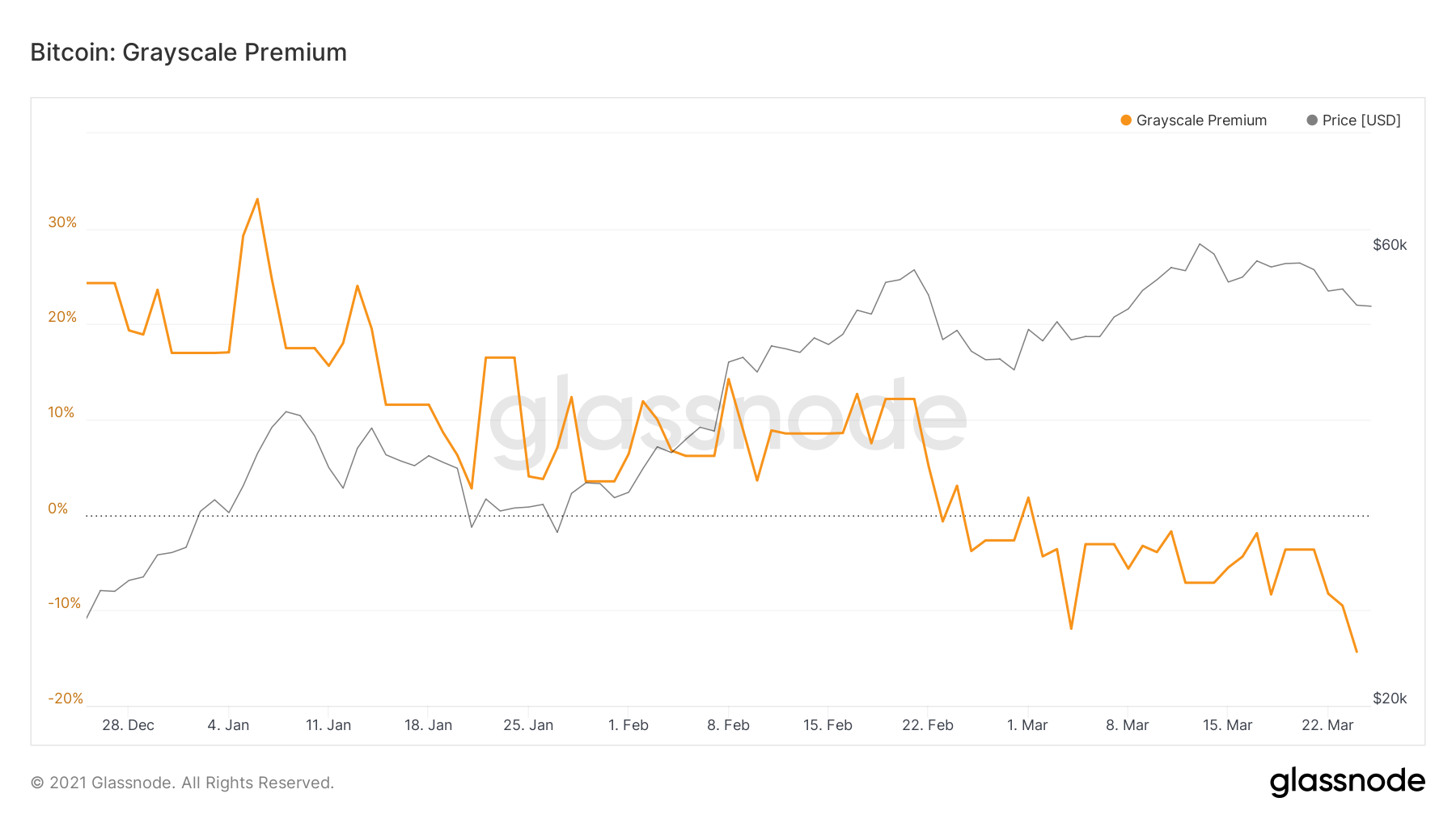

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it. Analyzing Why Grayscale Bitcoin Trust Premium Continues to […]

Related News

For the past two months, Grayscale Bitcoin Trust (GBTC) has traded at a negative premium to the net asset value (NAV). GBTC historically traded at a high premium relative to the underlying, averaging a 15% premium since the fund’s inception. This was largely due to GBTC being the only investment vehicle easily accessible to institutional […]

Grayscale Bitcoin Trust's premium is now above 30% as institutional demand for BTC continues to increase. The demand for the Grayscale Bitcoin Trust (GBTC) continues to rise with its premium surpassing 30% on Dec. 3. This indicates that Bitcoin (BTC) is seeing increasing institutional demand as its price consolidates above $19,000.The Grayscale Bitcoin Trust is an institutional vehicle that is tradable in the United States through OTC markets. Accredited and institutional investors typically use the trust to obtain exposure to BTC with their brokerage accounts.Why is the Grayscale Bitcoin....

Grayscale Investments’ GBTC might be the absolute market leader but it is currently trading below fair value as the TSX Purpose Bitcoin ETF is seeing record inflows. Grayscale Bitcoin Trust ($GBTC) is currently the largest listed cryptocurrency asset with $30.17 billion in assets under management. The firm currently holds more than 655,730 BTC and the security is tradable in the United States through over-the-counter markets.How is GBTC different from a Bitcoin ETF?The fund was launched in 2013 and the Grayscale Bitcoin Trust became the preferred institutional vehicle in the U.S. for BTC....

The largest Bitcoin trust in the world, the Grayscale Bitcoin Trust (GBTC) has been closing ranks around its premium over the last year. After hitting an all-time low of -48.89% in December 2022, the gap has been effectively closed to the point that it has reached a two-year high. GBTC Premium Sitting At -10.35% The […]

Since February, Grayscale’s premier crypto fund Grayscale Bitcoin Trust (GBTC) has traded at a negative premium to its net asset value (NAV). GBTC, which has been the largest publicly-traded crypto fund available on the market, saw its historically high premium plummet as new competition weighed in. In the past, institutional investors had to accept GBTC’s […]