GBTC Premium Drops To 2-Year High, Time For Spot Bitcoin ETF?

The largest Bitcoin trust in the world, the Grayscale Bitcoin Trust (GBTC) has been closing ranks around its premium over the last year. After hitting an all-time low of -48.89% in December 2022, the gap has been effectively closed to the point that it has reached a two-year high. GBTC Premium Sitting At -10.35% The […]

Related News

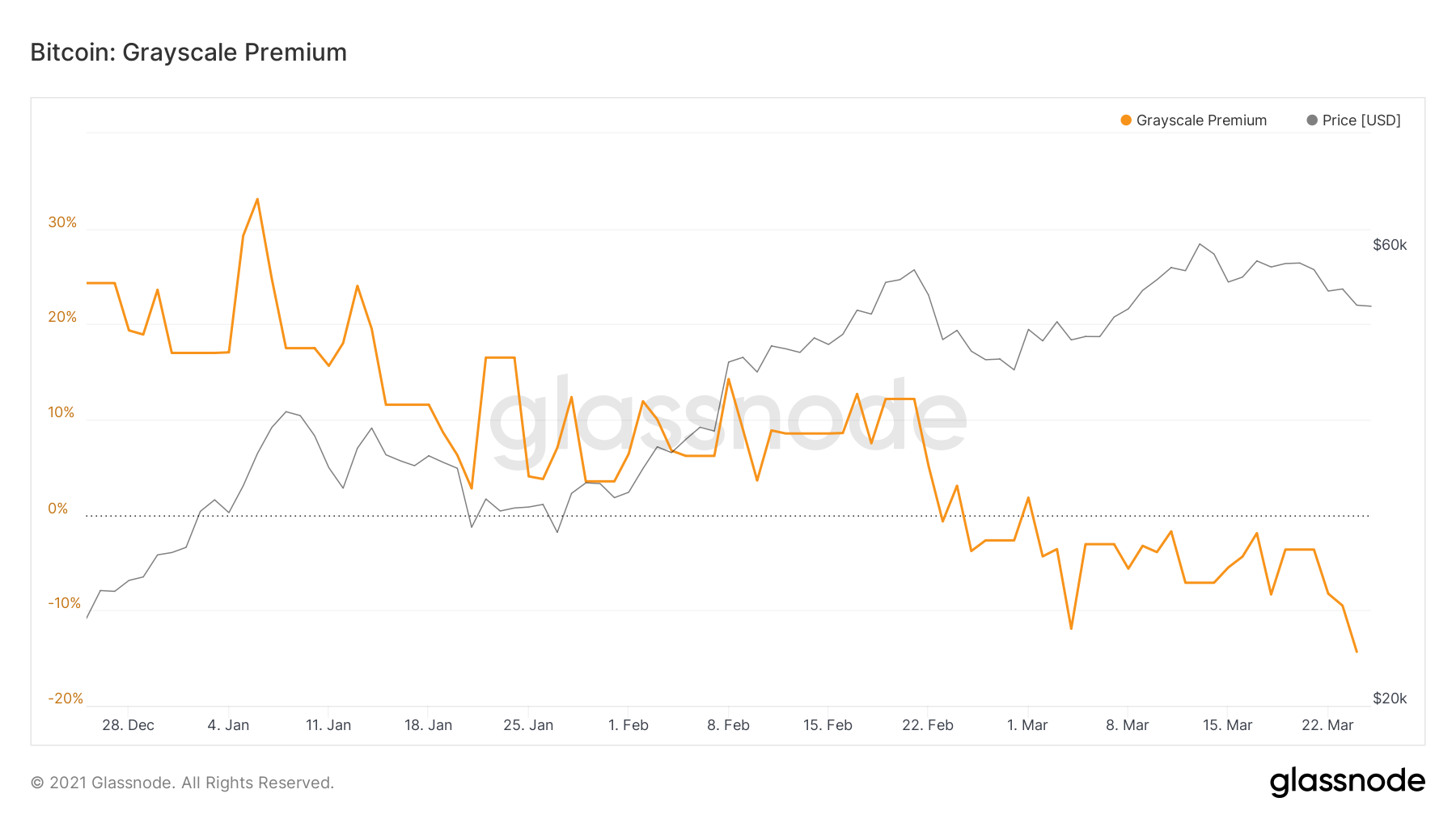

Following the recent bitcoin price pullback, the latest Skew data now indicates that the premium rate on Grayscale’s GBTC is under 10%. The lower rate comes just weeks after the premium peaked at 41% towards the end of December. The GBTC premium is a measure of the extent of differences in the value between the crypto asset on the open market and in the Grayscale fund. The same data also shows that between late October of 2020 and January 21 of the current year, this premium averaged 22%. However, in the seven days leading up to January 21, this rate dropped to 7.3%. According to....

For the past two months, Grayscale Bitcoin Trust (GBTC) has traded at a negative premium to the net asset value (NAV). GBTC historically traded at a high premium relative to the underlying, averaging a 15% premium since the fund’s inception. This was largely due to GBTC being the only investment vehicle easily accessible to institutional […]

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it. Analyzing Why Grayscale Bitcoin Trust Premium Continues to […]

Storm clouds are slowly fading for Grayscale and its embattled Bitcoin institutional investment product, while frustration with U.S. regulators continues to mount. Things are looking up for the United States’ largest institutional Bitcoin (BTC) product by asset holdings.Data from on-chain monitoring resource Coinglass confirms that as of April 21, the Grayscale Bitcoin Trust (GBTC) is rebounding toward 2022 highs.Grayscale CEO: “‘If’ not ‘when’” for U.S. Bitcoin spot ETFAfter a problematic year so far, GBTC has benefitted from steadying Bitcoin price action. Bitcoin’s descent from....

A recent market outlook published by Glassnode shows institutions are returning to the Bitcoin market after May 19 crash. Bitcoin (BTC) has crashed by around 44% from its all-time high of $64,899, signaling an end to its second-largest bull run that started in March 2020. Many analysts, including those from BiotechValley Insights, see "terrible technicals" in the Bitcoin market, noting that the flagship cryptocurrency could extend its ongoing decline until $20,000.Nevertheless, Glassnode Insights, a weekly newsletter issued by on-chain data analytics service Glassnode, anticipates a....