Ethereum Funding Rates Drop To 14-Month Low, Short Squeeze In The Making?

On-chain data shows the Ethereum funding rates have now declined to the lowest value in 14 months, something that could pave way for a short squeeze in the market. Ethereum Funding Rates Reach Highly Negative Value As pointed out by an analyst in a CryptoQuant post, the ETH funding rates are currently at their least value since July 2021. The “funding rate” is an indicator that measures the periodic fee that traders in the Ethereum futures market are exchanging between each other right now. When the value of the metric is negative, it means short traders are paying a premium to....

Related News

Ethereum traders are betting on a "sell-the-news" event on the day of the Merge as ETH exchange balance jumps. Ethereum successfully completed its long-awaited transition to proof-of-stake via "the Merge" on Sep. 15, while traders have been increasingly shorting Ether (ETH) in anticipation of a sell-the-news event. Ethereum funding rate plummeEther's futures funding rates across leading derivatives platforms dropped below zero—to their worst levels to date—before the Merge. The rate dropped to as low as -0.6% on BitMex. ETH funding rates history. Source: CoinglassFunding rates are a....

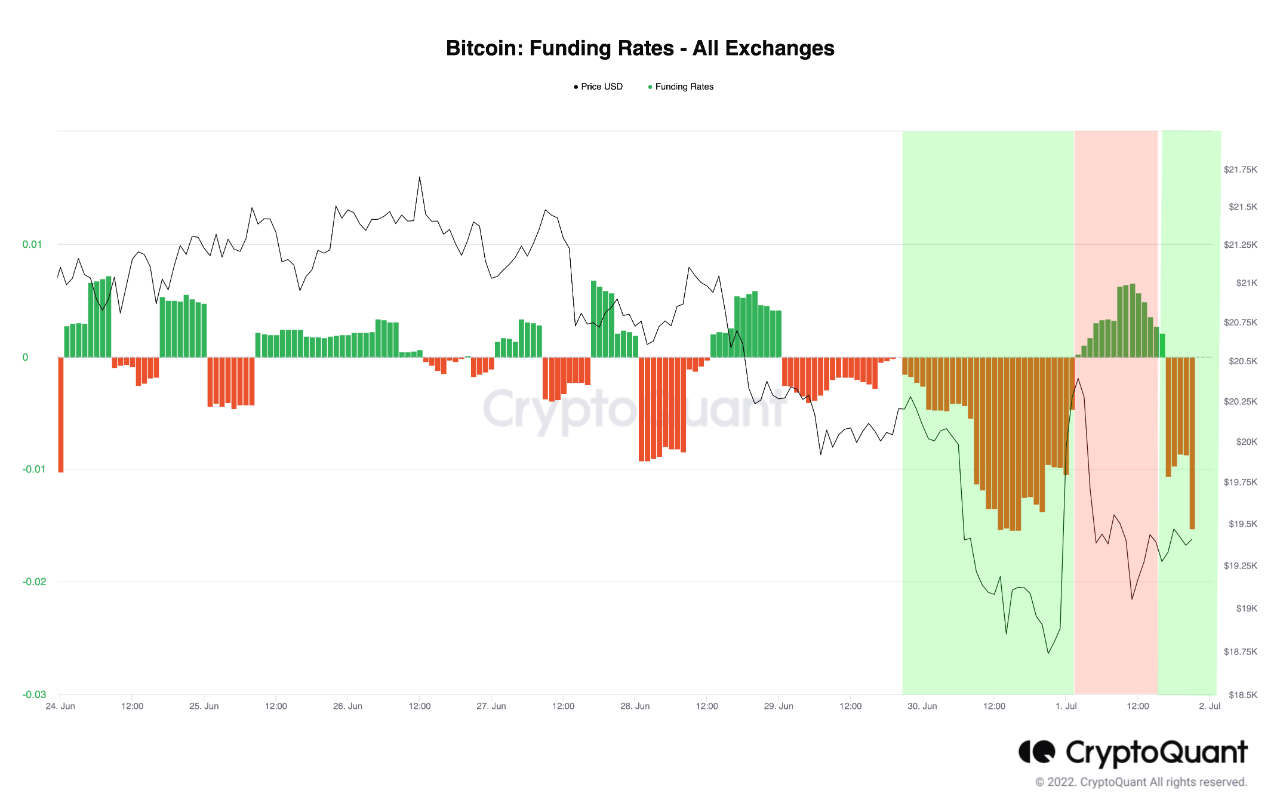

On-chain data shows Bitcoin funding rates have sunk into deep negative values, something that could pave way for a short squeeze in the market. Bitcoin All Exchanges Funding Rate Has A Red Value Right Now As pointed out by an analyst in a CryptoQuant post, BTC may see a slight uplift in the short term […]

Bitcoin has begun to consolidate above $13,000. Despite this bullish trend, most Bitcoin funding rates on leading futures exchanges currently are negative. The current Bitcoin futures funding rates are bearish on Binance, BitMEX, and OKEx. Bitcoin Funding Rates Still Negative Bitcoin has begun to consolidate above $13,000. $13,000 has long been an important level for Bitcoin, making this consolidation important for the bull case. The cryptocurrency currently trades for $13,500, above the aforementioned support level. […]

On-chain data shows the Bitcoin funding rates have observed a rise again, suggesting that another long squeeze may be in store for the crypto. Bitcoin Funding Rates Show Relatively High Positive Value As explained by an analyst in a CryptoQaunt post, the current positive funding rates may mean the price could observe a decline soon. The “funding rate” is an indicator that measures the periodic fee that Bitcoin futures traders are paying each other. When the value of this metric is greater than zero, it means long traders are paying a premium to short investors to hold on to....

On-chain data shows the Bitcoin funding rates have now hit a 6-month high, something that could lead to a long squeeze in the market. Bitcoin Funding Rates Currently Have A Highly Positive Value As pointed out by an analyst in a CryptoQuant post, BTC funding rates have surged up to the highest for the last six months. The “funding rate” is an indicator that measures the periodic fee that traders in the Bitcoin futures market have to pay each other. When the value of this metric is greater than zero, it means long traders are paying shorts to hold onto their positions right now.....