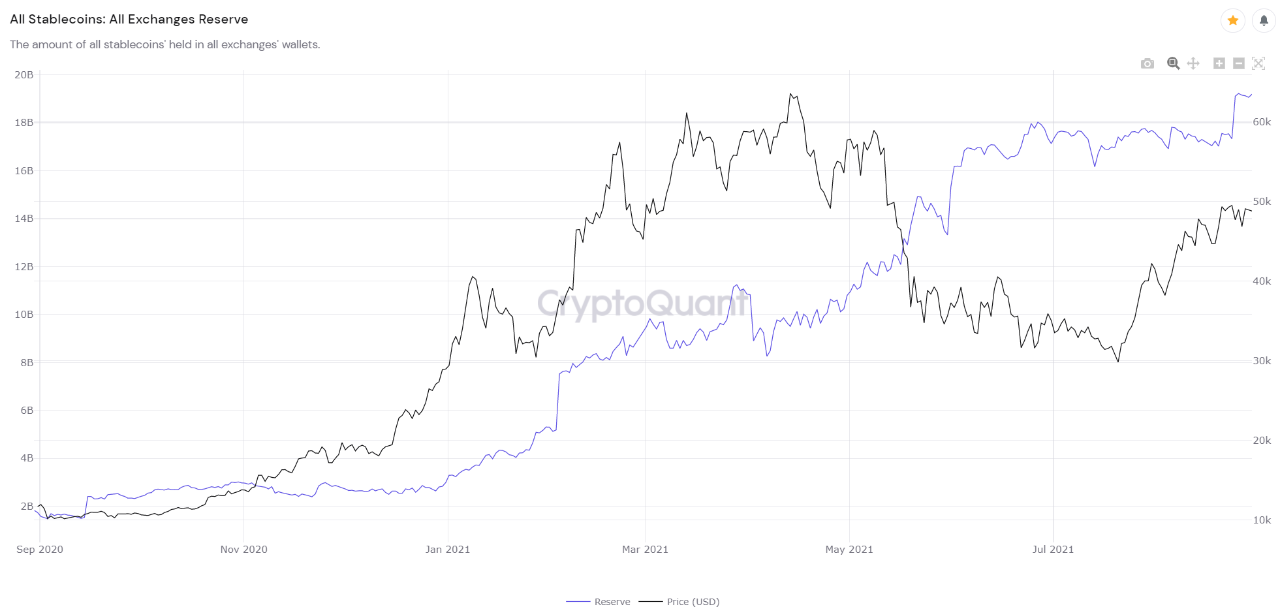

Bitcoin Dry Powder Accumulates On Exchanges As Stablecoins Exceed $19 Billion

On-chain data shows Bitcoin dry powder has been accumulating on exchanges as stablecoins reserve exceeds $19 billion. Stablecoins Reserve Crosses $19 Billion As pointed out by a CryptoQuant post, exchanges now hold stablecoins worth more than $19 billion. Such a large reserve might mean enough dry powder for Bitcoin to make a big move soon. […]

Related News

Data shows stablecoins volume has surged up once again. Past pattern may suggest that this accumulation could be dry powder for Bitcoin’s next big move. Bitcoin Stablecoins Reserve Rises Up Again As pointed out by an analyst in a CryptoQuant post, the stablecoins reserve seems to have risen again back to peak levels. The stablecoins reserve is an indicator that shows the total amount of stablecoins being held on wallets of all exchanges When the value of this indicator moves up, it means investors could be moving out of volatile crypto markets, and into the stable fiat tokens. High....

On-chain data shows the USDC exchange inflow has spiked up. Historically, stablecoins have provided dry powder for kicking off new Bitcoin rallies. USDC Exchange Inflow Sharply Rose To High Values Recently As explained by an analyst in a CryptoQuant post, almost one billion USDC has flowed into exchanges recently. Past pattern suggests this may lead to uptrend for Bitcoin. The “USD Coin exchange inflow” is an indicator that measures the total amount of the stablecoin entering wallets of all exchanges within a given period. When the value of this indicator moves up, it means....

Stablecoin inflows into exchanges spiked right as the price of Bitcoin recovered above $38,000, on-chain data shows. The price of Bitcoin (BTC) has extended its recovery on Jan. 14, reclaiming the $38,000 level. What's more, the weekly candle has now turned green for the fifth consecutive week despite the 28% crash earlier this week. BTC/USD Weekly candle chart (Bitstamp). Source: TradingviewMeanwhile, stablecoin deposits are flooding into cryptocurrency exchanges, according to data from CryptoQuant. This inflow may act as a short-term catalyst for Bitcoin as it suggests that sidelined....

Bitcoin analyst says new ATH in October is likely as on-chain data shows stablecoins may have started to pump into BTC. Stablecoins Reserve Starts Moving Down, Bitcoin To Reach New ATH In October? As explained by an analyst on CryptoQuant, after staying at highs, the stablecoins reserve has finally started a decline. Based on this and a couple other indicators, the quant believes there is a high probability we will see a new Bitcoin all time high (ATH) in October. The stablecoins exchange reserve is an indicator that shows the total amount of fiat-tied coins currently present on exchanges.....

An analytics firm has explained how the data related to the stablecoins could hint at whether the Bitcoin market top is in or not. Stablecoins Have Seen Their Market Cap Touch New Highs Recently In a new post on X, the market intelligence platform IntoTheBlock has discussed about the trend in the combined stablecoin market cap. “Stablecoins” refer to cryptocurrencies that are pegged to a fiat currency (with USD being the most popular choice). Generally, investors make use of these assets when they want to avoid the volatility associated with other coins like Bitcoin. Traders....