Stablecoins Reserve Surges Up Again, Dry Powder For Bitcoin’s Next Big Move?

Data shows stablecoins volume has surged up once again. Past pattern may suggest that this accumulation could be dry powder for Bitcoin’s next big move. Bitcoin Stablecoins Reserve Rises Up Again As pointed out by an analyst in a CryptoQuant post, the stablecoins reserve seems to have risen again back to peak levels. The stablecoins reserve is an indicator that shows the total amount of stablecoins being held on wallets of all exchanges When the value of this indicator moves up, it means investors could be moving out of volatile crypto markets, and into the stable fiat tokens. High....

Related News

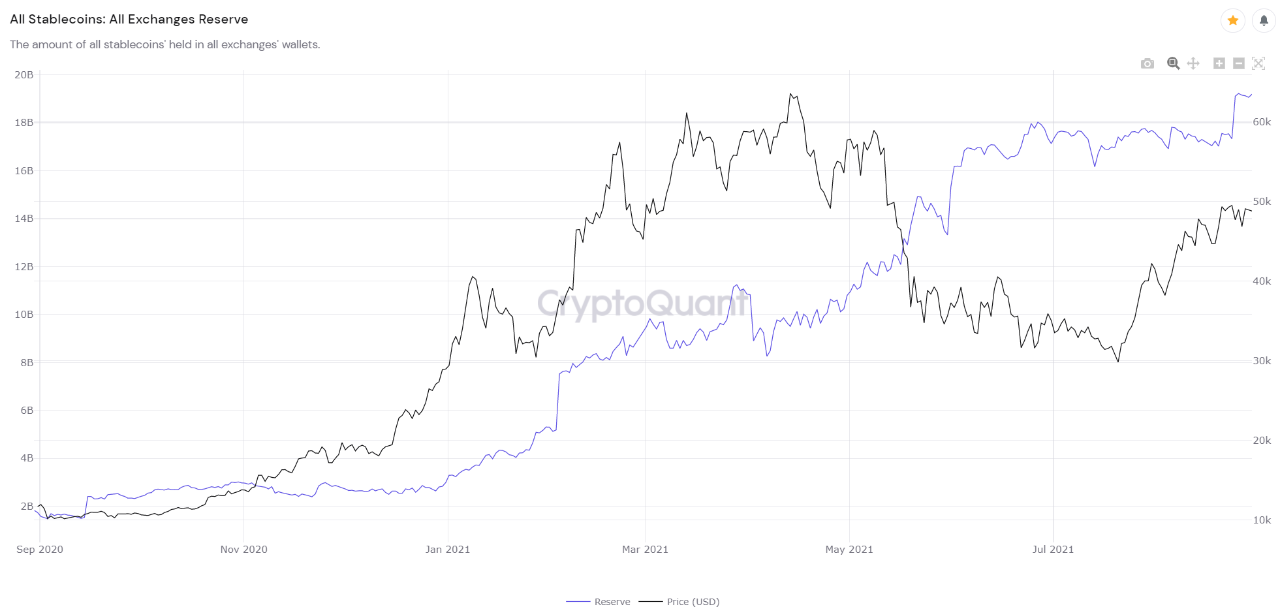

On-chain data shows Bitcoin dry powder has been accumulating on exchanges as stablecoins reserve exceeds $19 billion. Stablecoins Reserve Crosses $19 Billion As pointed out by a CryptoQuant post, exchanges now hold stablecoins worth more than $19 billion. Such a large reserve might mean enough dry powder for Bitcoin to make a big move soon. […]

On-chain data shows stablecoins reserve has hit a new all-time-high (ATH), here’s what it could mean for Bitcoin’s price based on past patterns. Stablecoins All Exchanges Reserve Achieves New ATH As pointed out by a CryptoQuant post, the all exchanges stablecoins reserve has spiked up and reached a new ATH. Past pattern of the indicator might help predict how Bitcoin’s price will move next. The all exchanges stablecoins reserve is a metric that measures the amount of stablecoins present on all centralized exchanges. When the value of this indicator goes up, it means more....

Bitcoin analyst says new ATH in October is likely as on-chain data shows stablecoins may have started to pump into BTC. Stablecoins Reserve Starts Moving Down, Bitcoin To Reach New ATH In October? As explained by an analyst on CryptoQuant, after staying at highs, the stablecoins reserve has finally started a decline. Based on this and a couple other indicators, the quant believes there is a high probability we will see a new Bitcoin all time high (ATH) in October. The stablecoins exchange reserve is an indicator that shows the total amount of fiat-tied coins currently present on exchanges.....

A quant has explained how the data of the stablecoin supply ratio (SSR) may be used to find Bitcoin buy or sell signals. Stablecoin Supply Ratio May Be Able To Predict Bitcoin Buy And Sell Signals As explained by an analyst in a CryptoQuant post, the stablecoin supply ratio may help us find BTC buy or sell signals. The “stablecoin supply ratio” (or SSR in short) is an indicator that measures the ratio between the market cap of Bitcoin and that of all stablecoins. In simpler terms, what this metric tells us is how the supply of the stablecoins compare with that of BTC. Investors....

Federal Reserve Board Governor Christopher Waller says that stablecoins do not need to be regulated with all the same rules as banks. He disagrees with some of the recommendations on stablecoin regulation by the President’s Working Group on Financial Markets. He explained that while banks should be able to issue stablecoins, not all stablecoin issuers need to be banks. Fed’s Waller Disagrees That Stablecoins Need to Be Regulated With Full Banking Regulation Federal Reserve Board Governor Christopher Waller talked about stablecoin regulation Wednesday during a virtual....