Nearly 20% of Bitcoin Supply Hasn’t Budged In 7 Years

Bitcoin price is appreciating at full steam because the market consists of nothing but buyers at the moment. Those who already own the abundance of the currently circulating supply are holding strong and refusing to sell. However, data shows that nearly 20% of the entire circulating supply hasn’t moved in seven years. Are those coins held by the strongest holders yet, or are there other reasons the large share of BTC supply hasn’t moved in […]

Related News

On-chain data shows more than 50% of the Bitcoin supply in circulation has remained dormant since at least five years ago. Bitcoin Supply Aged More Than 5 Years Is Only Continuing To Grow In a new post on X, analyst James V. Straten shared a chart that reveals the supply distribution of coins aged more […]

Bitcoin is the entire reason that the term “HODL” was coined, no pun intended. The phrase “hold on for dear life” may have been taken too much too heart, with more than half of the total BTC supply locked away dormant in a wallet for a year or more. Are these committed long-term holders, hoarders, or is something else going on? We’re looking at all the possible scenarios related to the ever-increasing sleeping supply of […]

On-chain data shows a majority of the Bitcoin supply hasn’t moved in more than two years, despite the fact that BTC has seen a significant uplift during this period. Bitcoin Inactive Supply Trend Suggests HODLing Behavior Remains Strong In a new post on X, Glassnode co-founder Rafael has discussed about the trend in the various bands of the Bitcoin Active Supply. The “Active Supply” includes that part of the BTC circulating supply that has been involved in at least one transaction over a given timeframe. Related Reading: Bitcoin Officially In Overheated MVRV Zone, Rally....

On-chain data shows the Bitcoin diamond hands holding since more than five years ago have continued to be stalwart despite the latest crash. Over 30% Of The Entire Bitcoin Supply Hasn’t Moved In 5 Years Or More In a new post on X, the market intelligence platform IntoTheBlock talked about what the percentage of the […]

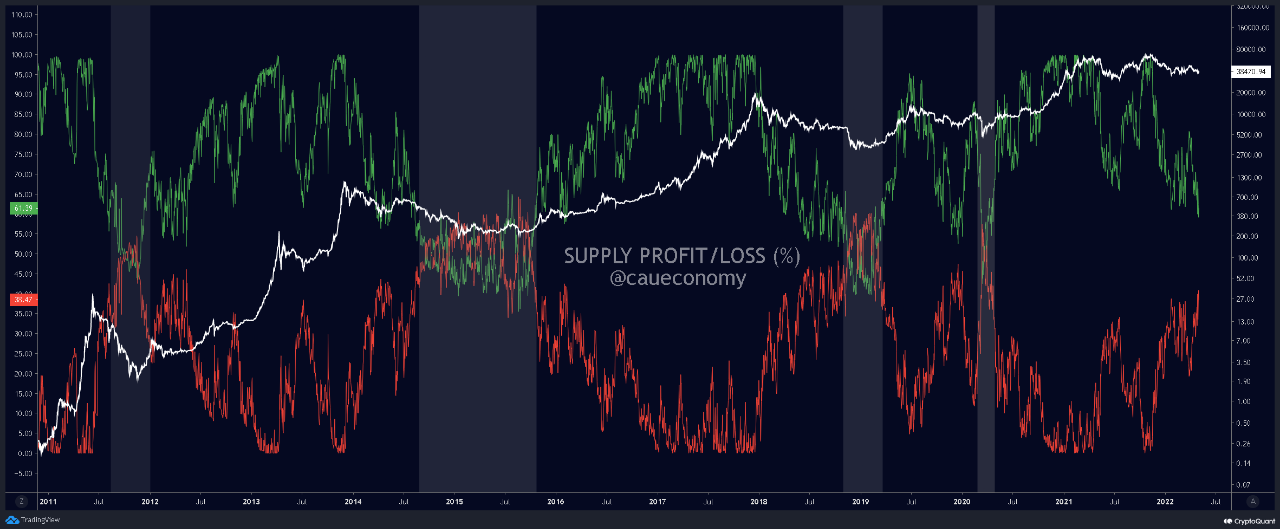

On-chain data shows Bitcoin hasn’t yet hit a bear market bottom as the supply in profit is still more than that in loss. Bitcoin Supply In Profit/Loss Says A Majority Of Network Is Still In Profit As explained by an analyst in a CryptoQuant post, past trend may suggest that the current BTC market still […]