Coins Are Moving: Bitcoin Sent To Exchanges Spikes To 2021 High

Bitcoin is back below $50,000 and fear is in the air. The historic bull market is now in jeopardy, even though holders thus far haven’t been willing to part with their coins. They might be faced with the difficult decision of doing so as prices dip lower and have to consider selling. The selloff has […]

Related News

On-chain data shows Bitcoin whales are transferring large amounts to derivatives exchanges right now, a signal that more volatility could be ahead for the crypto. Bitcoin All Exchanges To Derivatives Flow Continues To Show High Value As explained by an analyst in a CryptoQuant post, BTC whale activity on derivatives exchanges still seems to be high. The relevant indicator here is the “all exchanges to derivatives exchanges flow,” which measures the total amount of Bitcoin moving from spot exchange wallets to derivatives. When the value of this metric spikes up, it means whales....

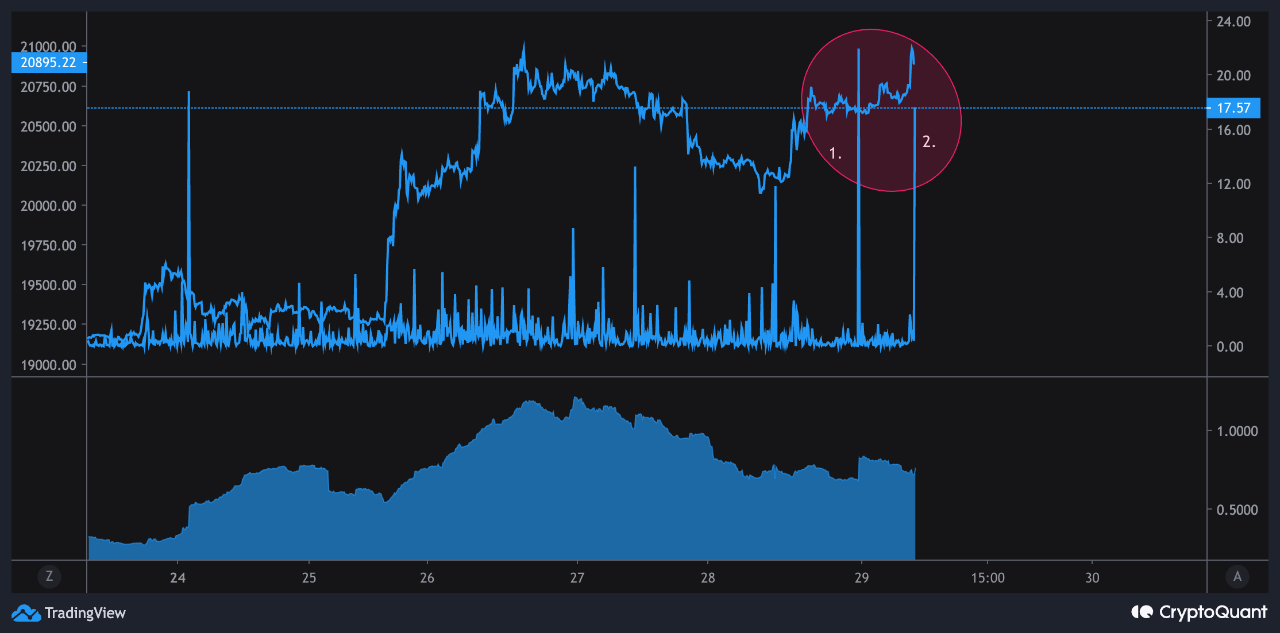

On-chain data shows the Bitcoin exchange inflows have spiked up over the last day, something that could prove to be bearish for the price of the crypto. Bitcoin Exchange Inflow Mean Has Observed Two Spikes In The Past 24 Hours As pointed out by an analyst in a CryptoQuant post, the two exchange inflow mean spikes amounted to around 21 BTC and 17 BTC respectively. The “exchange inflow mean” is an indicator that measures the mean amount of Bitcoin being transferred to the wallets of centralized exchanges per transaction. It’s different from the normal inflow metric in that....

Bitcoin (BTC) showed resilience over the last weekend as it defended the crucial $108,000 support level amid heightened whale selling on leading crypto exchanges around the world, including Binance. Bitcoin Survives September Whale Selling Pressure According to a CryptoQuant Quicktake post by contributor Arab Chain, September was marked by clear fluctuations between Bitcoin’s attempts to rally and exposure to selling pressure by whales and long-term holders. Binance trading volume data confirms this. Related Reading: Bitcoin Faces Bearish Pressure As Exchange Inflows Stay Elevated – Will....

Bitcoin spot to derivatives exchange flow has surged up recently, something that has preceded local bottoms for the crypto in the past. Bitcoin All Exchanges To Derivative Exchange Flow Observes Uplift As pointed out by an analyst in a CryptoQuant post, whales have been moving their coins into derivative exchanges recently. The relevant indicator here […]

Bitcoin price spikes continue as data reveals exchange activity is anything but flat this week. Bitcoin (BTC) whales are moving large amounts of coins to exchanges in tandem with large outflows, curious new data shows. According to the exchange whale ratio indicator from on-chain analytics firm CryptoQuant, large transactions have accounted for over 90% of recent exchange deposits.Top 10 deposits make up 90% of exchange inflowsIn a marked change from previous behavior, over the past week, whales have become much more active prospective sellers on exchanges.The exchange whale ratio, which....