Bitcoin Bearish Signal: Exchanges Receiving Large Deposits

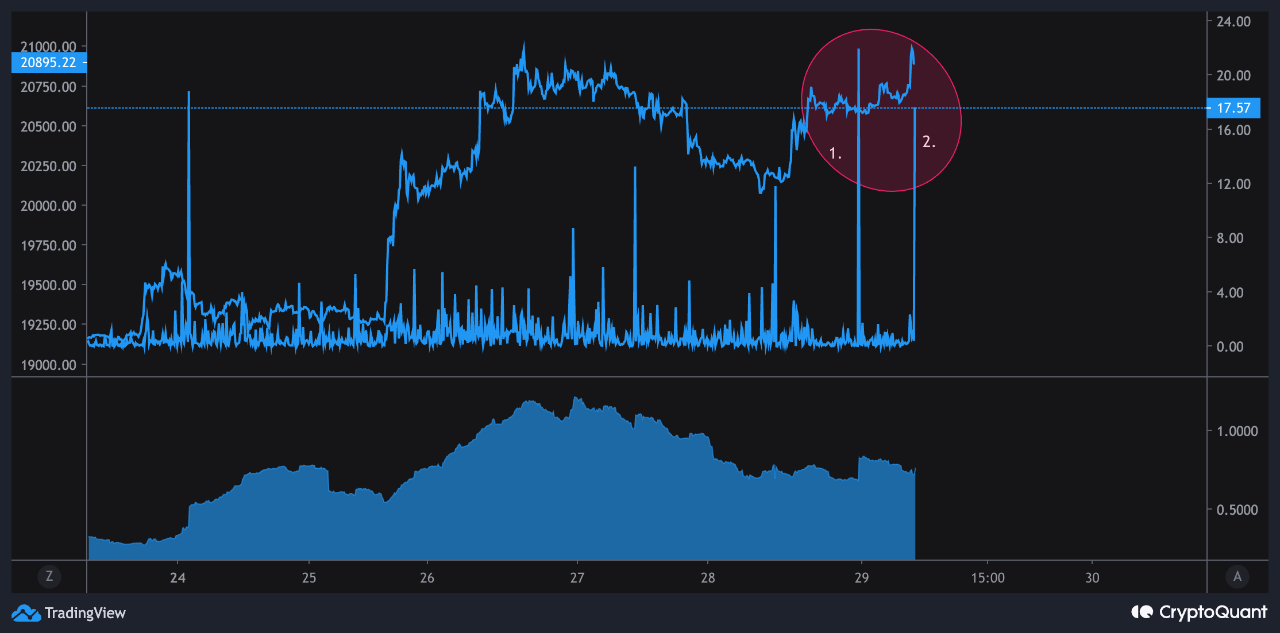

On-chain data shows the Bitcoin exchange inflows have spiked up over the last day, something that could prove to be bearish for the price of the crypto. Bitcoin Exchange Inflow Mean Has Observed Two Spikes In The Past 24 Hours As pointed out by an analyst in a CryptoQuant post, the two exchange inflow mean spikes amounted to around 21 BTC and 17 BTC respectively. The “exchange inflow mean” is an indicator that measures the mean amount of Bitcoin being transferred to the wallets of centralized exchanges per transaction. It’s different from the normal inflow metric in that....

Related News

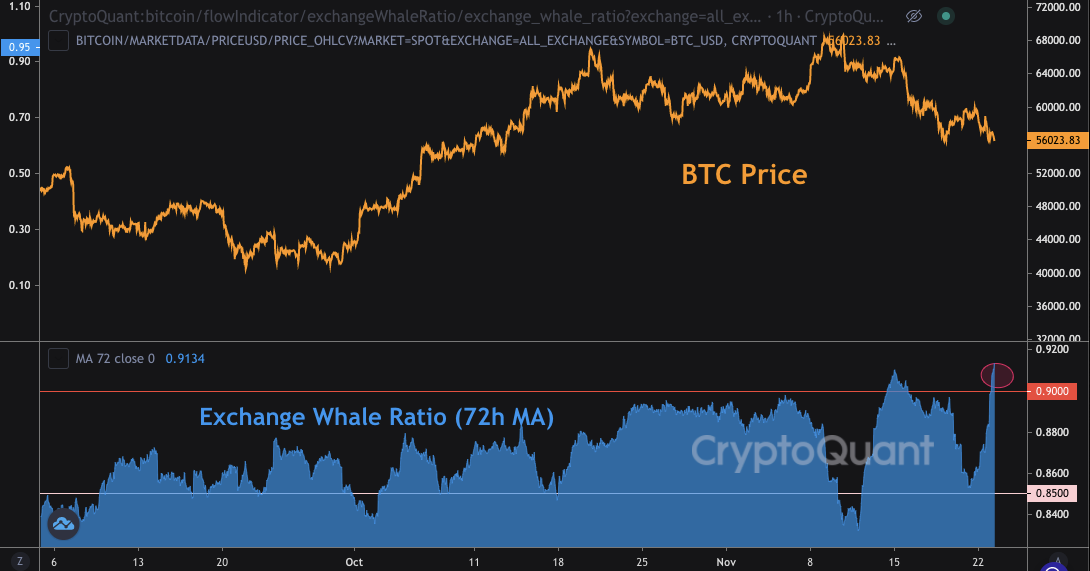

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]

It would appear that Bitcoin whales are shifting their BTC into exchanges at an alarming rate, which is a warning that they may be getting ready to liquidate their holdings. Recent on-chain data shows that Bitcoin whale exchange deposits reached $275 million in a single day as the cryptocurrency continues to struggle to cross over $30,000. Bitcoin Whales Moving Funds to Exchanges Tweets from the whale transaction tracker @whale_alert indicate that a total of 9,406 Bitcoins, with an approximate worth of $275 million, have been moved into exchanges through separate transactions. Related....

On-chain data shows miners have sent a large amount of Bitcoin to spot exchanges recently, something that can be bearish for the value of the crypto. Bitcoin Miners To Spot Exchanges Flow Has Surged Up Over The Past Day As pointed out by an analyst in a CryptoQuant post, the latest spike in the miner exchange deposits is larger than any other recent peaks. The relevant indicator here is the “miners to spot exchanges flow mean,” which measures the total amount of Bitcoin being transferred by miners to spot exchanges. When the value of this metric shoots up, it means miners have....

Bitcoin price spikes continue as data reveals exchange activity is anything but flat this week. Bitcoin (BTC) whales are moving large amounts of coins to exchanges in tandem with large outflows, curious new data shows. According to the exchange whale ratio indicator from on-chain analytics firm CryptoQuant, large transactions have accounted for over 90% of recent exchange deposits.Top 10 deposits make up 90% of exchange inflowsIn a marked change from previous behavior, over the past week, whales have become much more active prospective sellers on exchanges.The exchange whale ratio, which....

On-chain data shows that Bitcoin long-term holders are making deposits to exchanges currently, something that could be bearish for the price. Bitcoin Exchange Inflow CDD Has Spiked Recently As explained by an analyst in a CryptoQuant Quicktake post, investors have been making deposits to spot exchanges recently. There are two relevant indicators here: the “exchange inflow” and the “exchange reserve.” The former of these keeps track of the total amount of Bitcoin that the holders are transferring to centralized exchanges, while the latter one measures the total....