Bitcoin Indicator Hits Historical Low Not Seen Since 2015

Bitcoin bulls continue to be demoralized, as the price per coin grinds continuously at lows for what feels like an infinite amount of time. However, a bottom could be forming, according to an indicator that has reached historical lows not seen since the 2015 bear market bottom. What followed the last signal, was 10,000% returns and Bitcoin became forever became a household name. While such returns aren’t likely a second time, such oversold conditions could yield some significant, unexpected upside. Here is a closer look at the 3-day Stochastic on BTCUSD price charts. The Stochastic....

Related News

Bitcoin’s short-term supply has started to reach historical lows, data shows. The cryptocurrency hasn’t seen such values since August 2015. Short-Term Bitcoin Supply Hits A Low Of Just 16.16% According to the latest Arcane Research report, BTC’s short-term supply is now the lowest it has been since August 2015. The “short-term” Bitcoin supply here refers […]

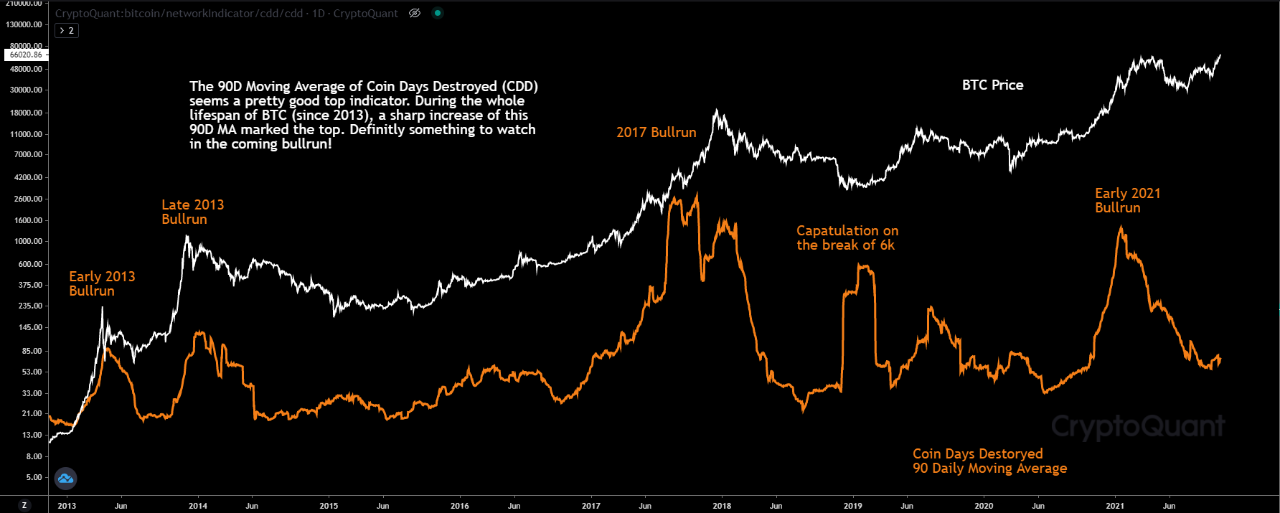

Historical data of the “coin days destroyed” indicator versus the Bitcoin price may suggest the metric can help predict tops. The Bitcoin Coin Days Destroyed (CDD) Indicator As explained by an analyst in a CryptoQuant post, the coin days destroyed metric might be a reliable indicator for BTC tops. A “coin day” is defined as […]

This week, Bitcoin's 150-day EMA is set to close below its 471-day EMA for only the third time in history. Bitcoin (BTC) could undergo a massive price recovery in the coming months, based on an indicator that marked the 2015 and 2018 bear market bottoms.What's the Bitcoin Pi Cycle bottom indicator? Dubbed "Pi Cycle bottom," the indicator comprises a 471-day simple moving average (SMA) and a 150-period exponential moving average (EMA). Furthermore, the 471-day SMA is multiplied by 0.745; the outcome is pitted against the 150-day EMA to predict the underlying market's bottom.Notably, each....

Data shows the Bitcoin supply in profit has continued its decline, but the metric has still not reached levels as low as the previous bear market bottoms. Around 50% Of The Bitcoin Supply Is In Profit At The Moment According to the latest weekly report from Glassnode, the current profitability levels in the BTC market are still above the 40%-42% values that were observed during historical bottoms. The “percent supply in profit” is an indicator that measures the total percentage of the Bitcoin supply that’s currently holding some unrealized profit. The metric works by....

Bitcoin price this week reached a high of $19,500, following a six-week, 60% rally. From the moment the first-ever cryptocurrency made it above $12,000, on 3-day timeframes, there were twelve consecutive green candle closes without any red. The extreme bullish impulse caused one specific technical indicator to reach the highest reading in history – reached […]