Inside the Estonian CBDC Experiment That Could Shape the Digital Euro

How the firm helping lead Estonia's central bank digital currency research is approaching a mass-market crypto coin.

Related News

A blockchain-based digital euro would be highly scalable allowing it to process an almost unlimited number of payments, the central bank of Estonia has concluded following a recent experiment. Central banks from several euro area countries and the ECB participated in the test, which also professed to show the digital currency’s carbon footprint would be smaller than that of card payments. 300,000 Payments a Second Processed During Digital Euro Trial An experiment carried out as part of the recently launched ‘Investigation Phase’ of the digital euro project has....

The central banks of France and Singapore are working on a digital currency interoperability system supporting multiple global CBDCs. Financial authorities in France and Singapore are actively exploring the cross-border applications of central bank digital currencies (CBDCs).In a joint announcement on Thursday, the Bank of France and the Monetary Authority of Singapore (MAS) said that they successfully completed a whole cross-border payment and settlement experiment using CBDCs and blockchain technology.The CBDC experiment was conducted with support and expertise from JPMorgan's digital....

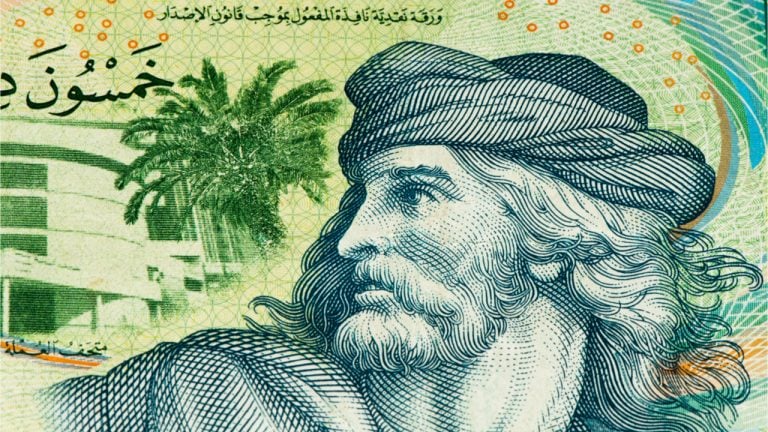

The French central bank, Banque de France (BOF), recently carried out its fifth experiment on the Central Bank of Tunisia (CBT)’s central bank digital currency (CBDC). According to a statement from BOF, the latest experiment is part of the banks’ joint effort to create conditions that are “conducive to a better inclusion of the Tunisian diaspora in Europe.” Platform Targets Tunisian Diaspora In his comments following the experiment, Mohamed Sadraoui, a director-general at CBT, suggested that the CBDC platform’s success will likely “reinforce....

European financial institutions are using pilots to make a case for the digital euro. It turns out the 100 million euro digital bond issued by the European Investment Bank earlier this week was actually a trial of a European central bank-issued digital currency, or CBDC.An April 28 announcement from France’s central bank, Banque de France, revealed the digital bond was settled using a CBDC on a blockchain.The two year-bond was issued on the Ethereum public blockchain on April 27 and settled the following day, with a maturity date of April 28, 2023. The sale was led by Goldman Sachs,....

The Bank of France’s deputy governor said there has been a “hands-on approach” with the bank’s experiment to launch a digital euro for the general public.