Not just Wall Street: Quant trader explains why Bitcoin price is going up

Alameda Research’s Sam Trabucco pinpoints four main factors that are pushing the price of Bitcoin toward its all-time high. Sam Trabucco, a quantitative trader at Alameda Research, believes four general factors are pushing up the price of Bitcoin (BTC). The catalysts are increasing adoption, whales, inflows from other products into Bitcoin, and influence from other markets. Alameda Research is a major cryptocurrency firm that trades a variety of cryptocurrencies and derivatives, with a volume between $600 million and $1.5 billion a day.The weekly price chart of Bitcoin. Source:....

Related News

Wall Street has been all over Bitcoin over the past few months due to the growth in the need for an inflation hedge and a relative stagnation in the price of gold relative to other asset classes. This much was confirmed just recently when a Wall Street veteran and former White House staffer launched a […]

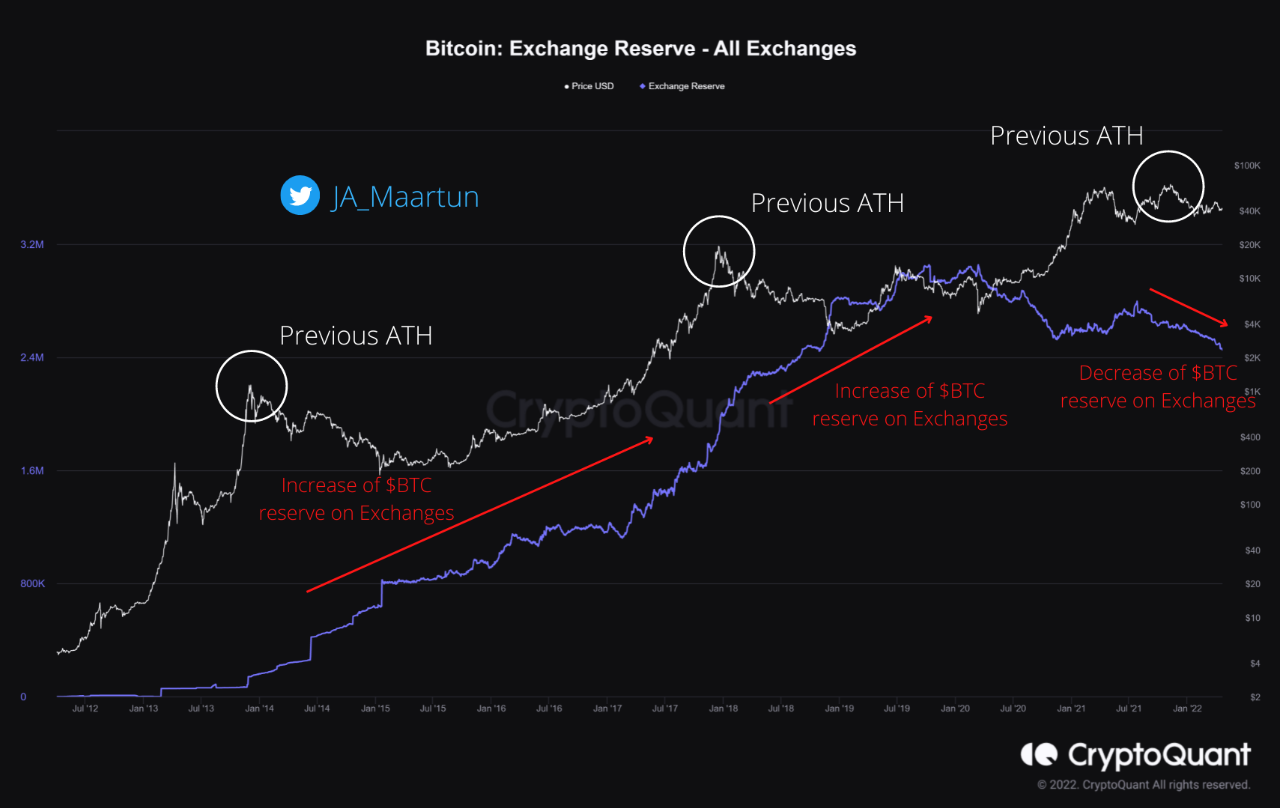

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

Wall Street has been embracing the latest wave of Silicon Valley financial tech at a fast rate. Over the past several months, many Wall Street Financial companies have embraced the new wave fintech enterprises with remarkable speed. The blockchain an online ledger that tracks the movement of digital currency, but it can also be used to manage, register and secure anything else that has value. Wall Street companies seem to have seen the true potential of the blockchain technology and many are now rushing to invest and develop new applications with this new technology. Jamie Dimon, JP Morgan....

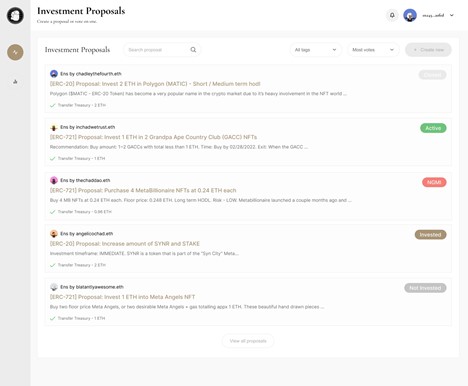

Wall Street Chads is the first NFT project to create a decentralized community-run investment platform. Inspired by WallStreetBets, the infamous subreddit community which is credited for the meme-investing craze and coordinating one of the largest short squeezes in history, Wall Street Chads leverages the power of the blockchain to bring the same community-driven investment strategies […]

Wall Street has previously not been at the forefront of bitcoin trading in the past. However, that looks poised to change. The approvals of three bitcoin ETFs in the past week have brought about more institutional interest in the digital asset and Wall Street brokers are starting to turn their attention to the cryptocurrency. The first Bitcoin ETF recorded trading volumes of over $1 billion on its first day. This success has not missed the radar of Wall Street. Analyst Christopher Brendler sat down with Coindesk to talk about the future of bitcoin in Wall Street. According to Brendler,....