Stablecoins Supply Up By $20 Billion – The Key To Bitcoin’s Next Move?

Early in 2025, there was a significant surge in the stablecoin market, with a $20 billion increase in total supply. With a 10% increase from January, the total supply now stands at almost $205 billion. The spike, according to data from Glassnode, comes after a dip in late 2024, when the supply of stablecoins fell from $187 billion to $185 billion. Related Reading: Bitcoin And S&P Decline Together, But Data Predicts A Turnaround Stablecoins See A Strong Rebound For trading cryptocurrencies, stablecoins—like USDT and USDC—often act as a reserve for investors expecting the right time to buy....

Related News

The three largest stablecoins represent a combined capitalization of $60 billion. Research from on-chain analytics provider Glassnode has revealed that the top three stablecoins represent more than 90% of the sector’s entire market cap.Glassnode’s April 13 “Week On-chain” report found that the top three stablecoins — Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) — have seen significant growth over the past six months to represent a combined capitalization of more than $60 billion, equal to 92.75% of the stablecoin market.By contrast, six months ago the combined stablecoin....

Bitcoin has dropped below the $30k mark, while stablecoins go strong as they surpass over $100 billion in total supply. Total Stablecoin Supply Is Now More Than $100 Billion According to a report by Arcane Research, the total stablecoin supply has now surpassed the $100 billion mark, while Tether’s dominance is declining. Here is a chart that shows the trend in the total supply and dominance of some popular coins: The stablecoins total supply as reached a new height There are a few interesting features in the graph. The total supply of these coins used to be only $11 billion in July....

Tether, USD Coin, Binance USD, and DAI are now worth more than $78 billion combined. The circulating supply of the four-largest stablecoins has spiked to new all-time highs, suggesting buyers could soon spark another leg up for the Bitcoin and crypto markets.The combined capitalization of Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and Dai (DAI) has surged almost 190% from $27 billion to almost $78 billion since the beginning of this year.In its May 3 Week on Chain report, on-chain analytics provider, Glassnode, noted that Tether is firmly positioned as the stable token sector’s....

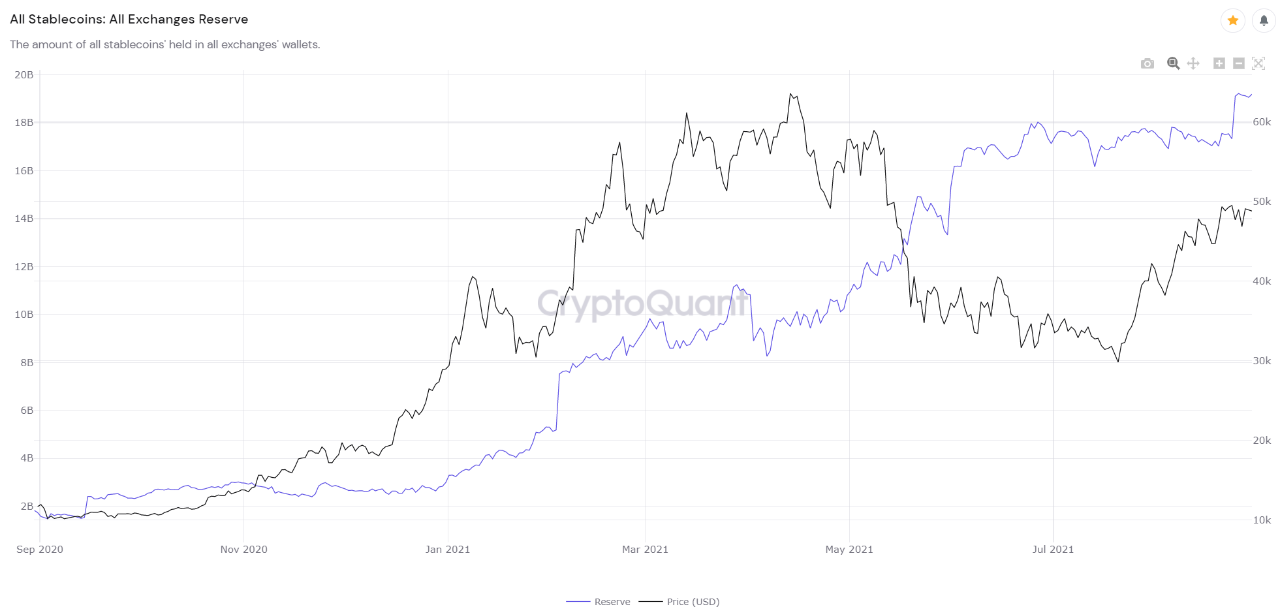

On-chain data shows Bitcoin dry powder has been accumulating on exchanges as stablecoins reserve exceeds $19 billion. Stablecoins Reserve Crosses $19 Billion As pointed out by a CryptoQuant post, exchanges now hold stablecoins worth more than $19 billion. Such a large reserve might mean enough dry powder for Bitcoin to make a big move soon. […]

On Monday, the total market capitalization of all stablecoins topped $150 billion. The largest stablecoin is remains Tether’s USDT. However, according to a new analysis, stablecoin whales control 80% of the tether supply. Stablecoins Whales Control USDT Supply With a current market capitalization of $77.9 billion, data from onchain researchers at Santiment shows that tether […]