BitMEX OI is Trending Higher as Traders Flip Short on Bitcoin; Why This is Bu...

It has been a wild week for the crypto markets, with investors having to digest a plethora of news developments that largely favored Bitcoin bears. That being said, the market surprisingly didn’t react too negatively to any of these developments, which seems to be a sign of growing maturity. One of the main developments this […]

Related News

The crypto lending platform's Insolvency risks puts CEL price at risk of a 70% drop. The price of CEL, the native token of Celsius Network, has almost quadrupled since June 19 in what appears to be a frenzy stirred up by day traders.CEL price short squeezeCEL's price rose from $0.67 on June 19 to $1.59 on June 21, a 180% spike compared to the crypto market's 12.37% rise in the same period. Notably, the rally started after PlanC, an independent market analyst, announced a $20 million bounty for anyone who could prove that the Celsius Network suffered a coordinated attack at the hands of a....

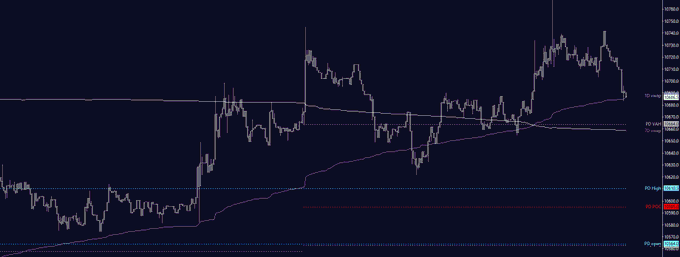

Bitcoin has pushed considerably higher since falling to $10,400 this week on news that BitMEX was being charged by the CFTC. The cryptocurrency wicked as high as $10,760 just a day ago as buyers re-enter the market. The cryptocurrency may be “losing some steam” on an extremely short-term basis, though. Bitcoin May Be Losing Some Steam Bitcoin has pushed considerably higher since falling to $10,400 this week on news that BitMEX was being charged by […]

Crypto derivative platform BitMEX’s struggle with the American authorities took a toll on Bitcoin and Ethereum markets. The US Commodity Futures Trading Commission on Thursday filed criminal charges against the owners of BitMEX, accusing them of facilitating money laundering and other illegal financial transactions. The news prompted derivative traders to withdraw more than $25 million […]

It’s official – the U.S. government has the Bitmex exchange in its headlights. With one Bitmex leader in custody and others on the lam, the exchange is practically toast. New York Times broke the story on October 1 showing how charges related to money laundering and reckless financial activity have left Bitmex backers in a […]

Bitcoin derivatives exchange BitMEX has announced that from 5th January they will publish a 30 day bitcoin volatility index, measuring the cryptocurrency's volatility against the United States dollar, and that they will create a tradable financial instrument based on the index. Often known colloquially as a 'fear index', a volatility index provides a measure of how much the value of a currency or asset is fluctuating up and down during a given period of time. A similar index called the VIX is often used by stock market traders to gauge and hedge against risk, as well as for other trading....