Analyst says Bitcoin could see ‘a smaller drawdown and a quicker bottom'

Bitcoin bulls fell short of flipping the $38,000 level to support, and one analyst said on-chain data signals that BTC could see “a smaller drawdown.” The cryptocurrency faithful got a reprieve from recent market struggles thanks to a rally in decentralized finance (DeFi) tokens and Dogecoin (DOGE) on June 2. A bit of a breakout in the price of Ether (ETH) and Bitcoin (BTC) may have also lifted sentiment, but at the moment, the top-ranked digital assets are still meeting pushback at key overhead resistance levels. Data from Cointelegraph Markets Pro and TradingView shows that the price of....

Related News

An analyst on social media platform X has highlighted a crucial support level for PEPE, as the meme coin faces a significant drawdown from its recent highs. Based on historical price trends, the analyst noted that PEPE has consistently experienced an average drawdown of approximately 64% following each local peak. The ongoing correction has placed […]

On-chain analytics platform Santiment has weighed in on whether the Bitcoin price has reached its bottom, following its drop to the $108,000 range. The platform alluded to the current social sentiment, suggesting that a further drawdown may be looming. Bitcoin Price Bottom Not Yet In Amid Spike In Social Dominance In a research report, Santiment indicated that the Bitcoin price bottom may not yet be in, considering the surge in the social dominance of ‘buy the dip’ mentions. The platform explained that a true bottom is often marked not by price but by a shift in social narrative from ‘buy....

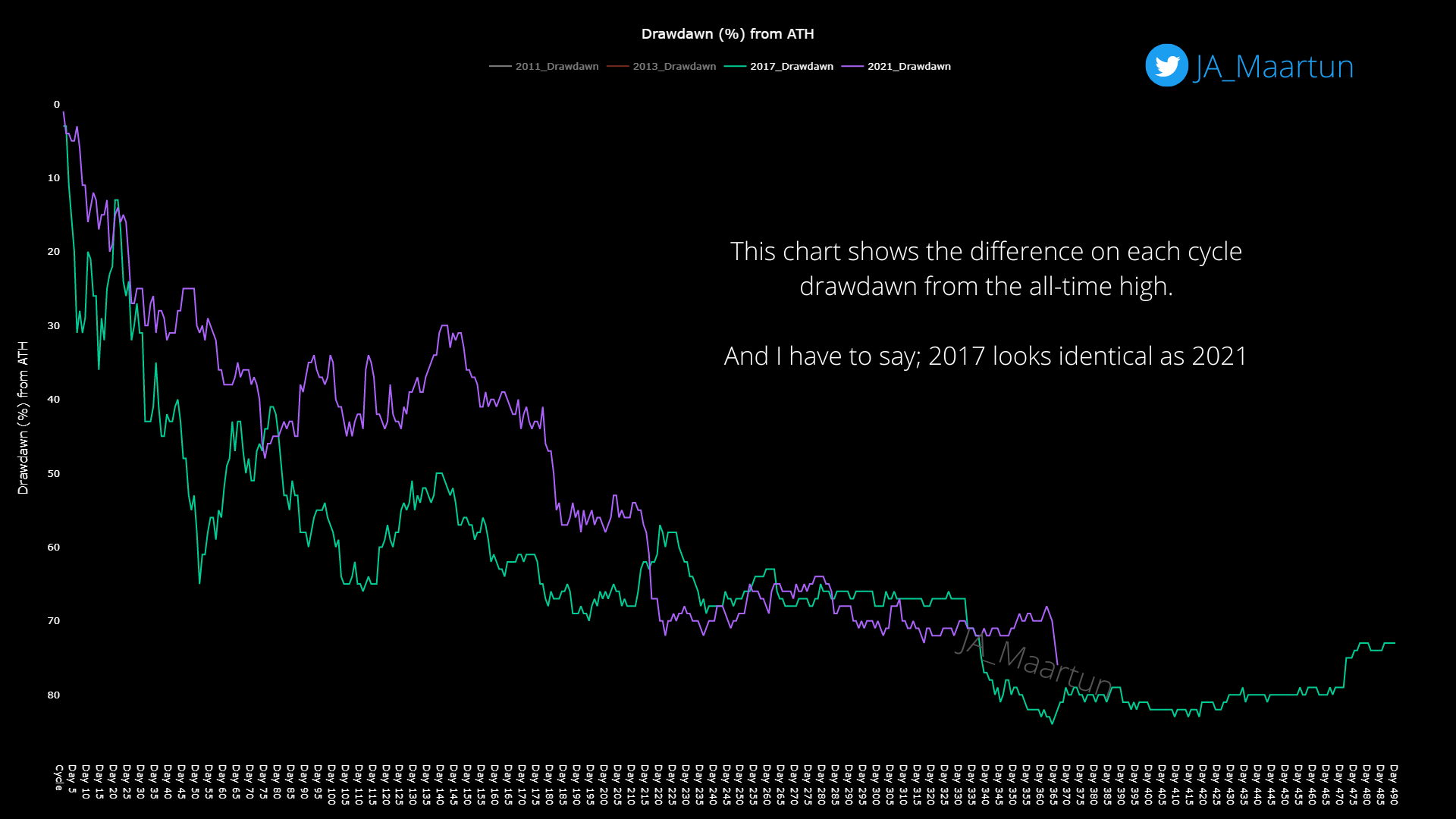

A quant has pointed out the similarities between the 2017 and 2021 Bitcoin cycles, something that could hint at how the rest of this bear market might play out. Both 2017 And 2021 Bitcoin Cycles Saw New Lows Around The 365-Day Mark Since The Top As explained by an analyst in a CryptoQuant post, the two cycles are more similar than one might expect them to be. The indicator of relevance here is the “drawdown from ATH,” which measures the percentage decrease in the price of Bitcoin following the all-time high during each cycle. Here is a chart that shows the trend in this metric....

The Bitcoin (BTC) price crash to $74,000 has left traders speculating whether the cryptocurrency has finally hit a bottom. However, a CMT-certified analyst suggests that Bitcoin’s price correction is far from over. He has predicted an even deeper pullback to $38,000 – $42,000, which he identifies as Bitcoin’s final price bottom. In a detailed Elliott Wave-based chart analysis, CMT-certified technical analyst Tony Severino outlines a classic 5-wave impulsive structure that appears to have completed its final leg near $85,000. Severino’s analysis highlights that Bitcoin’s latest....

Technical expert Tony Severino has revealed why he is no longer bullish on BTC and other crypto assets amid the recent Bitcoin price drawdown. The analyst had also earlier raised the possibility of the flagship crypto dropping to as low as $22,000. Expert Reveals Why He Is No Longer Bullish Amid Bitcoin Price Drawdown In […]