DeFi “Blue Chips” Aave and Synthetix Surge 15% as Buying Floods In

Earlier this week, the decentralized finance (DeFi) market was in a state of capitulation. Top coins pertaining to this space were plunging by dozens of percent over the span of a day or two, including “blue chip” names like Yearn.finance’s YFI, Synthetix Network Token (SNX), and many others. From their highs set in the summer […]

Related News

The DeFi sector has been on the up and up throughout the past few weeks, with the post-Summer downtrend first reversing earlier in early-November when Yearn.finance’s YFI token bottomed out at $7,500 and saw a massive overnight surge up towards $18,000. From this point forward, the cryptocurrency has been climbing higher every week, showing signs […]

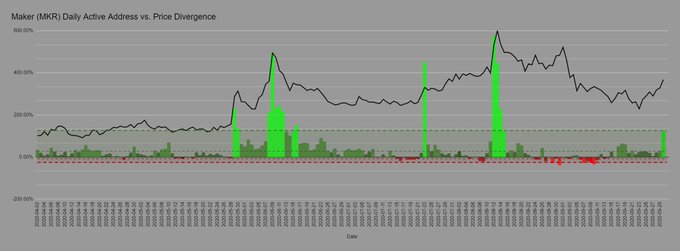

While decentralized finance (DeFi) has seen a strong surge in 2020, Maker (MKR), a token strongly tied to DeFi, has underperformed. The cryptocurrency, relative to its competitors, is underperforming; where Aave’s LEND and Synthetix’s Synthetix Network Token surged hundreds of percent in this year alone, MKR only saw a 20-30% move higher. The market may […]

There are several factors why SNX is seeing some impressive gains over the past month. SNX, the native token of Synthetix, a DeFi derivatives protocol, has been surging throughout the past week and is now worth over $7.87 as of Dec. 23.The primary catalyst behind SNX has been a listing on Coinbase. On Dec. 16, Coinbase officially announced the listing of Aave (AAVE), Bancor (BNT) and Synthetix (SNX). Other factors include the rapid increase in the total value locked and user interface improvements via its latest software upgrade on Dec. 22.SNX/USDT daily chart (Binance). Source:....

Comparisons with 2017 seem to be ill-advised for now. This week definitely feels calmer, more positive than the last. And there’s good reason to be optimistic for DeFi bulls too, as the market posted a decent recovery since my last newsletter.People are calling it a “blue chip” rally, which means that it’s household names that are leading the charts (at least that’s the standard definition, it may also refer to their blue logos). AAVE and YFI rallied the most, followed by decent recoveries for Curve and Synthetix. These are big names, but at the same time I would give the “blue chip”....

The transformation of Aave’s native asset LEND into a new symbol, titled “AAVE,” has begun with a 25 percent price surge. In retrospect, the team behind Aave announced two weeks ago that it would transfer its ownership of the lending protocol to a “genesis governance” built following a community vote. The ayes came in favor […]