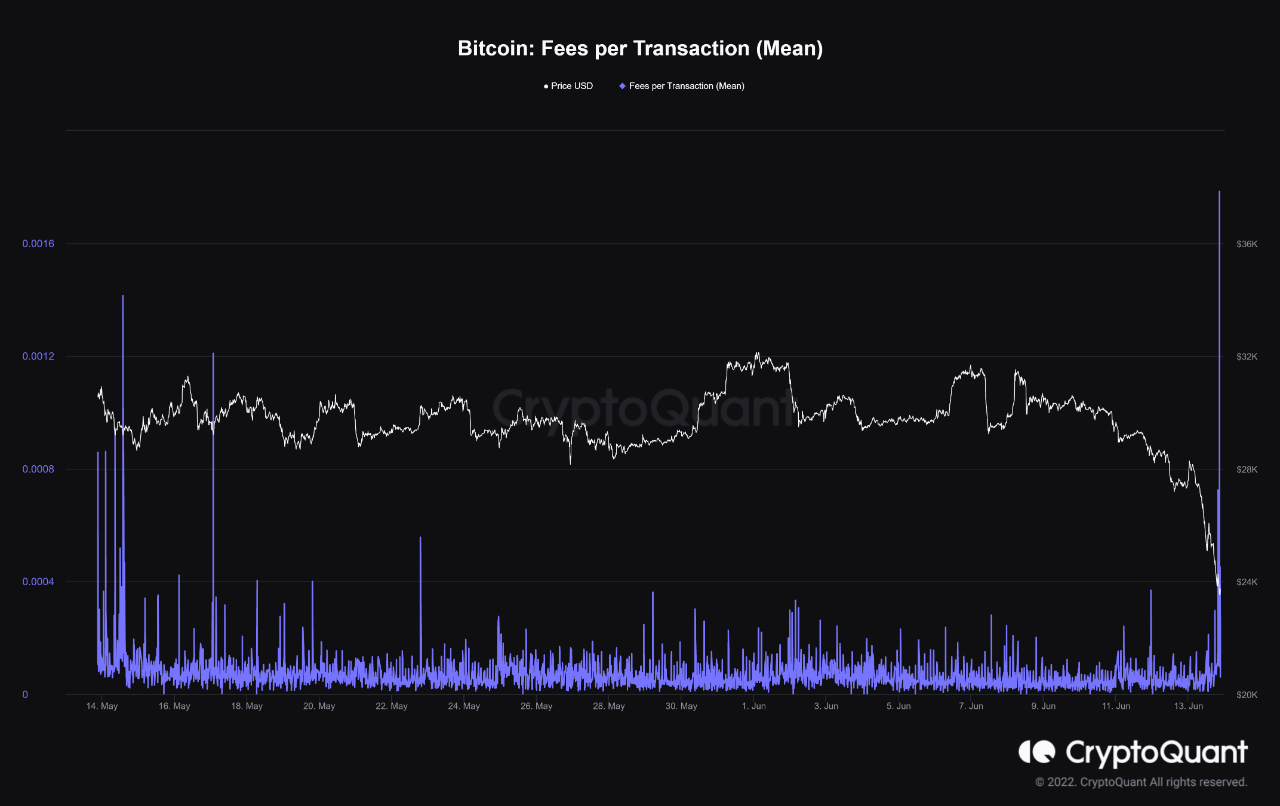

Bitcoin network transactions and fees surge amid investor de-risking

Investors are urgently sending Bitcoin into exchanges in order to either de-risk their portfolio or to protect margin positions with more collateral according to Glassnode’s latest report. The number of transactions on the Bitcoin network has spiked over the past week, which blockchain analysis firm Glassnode suggests are ‘urgent’ transactions due to investors de-risking.A sudden influx of 42,800 transactions hit the mempool on Bitcoin (BTC) last week. Glassnode’s chief analyst says these were likely "urgent" transactions due to the high amount of fees paid per transaction. The average fee....

Related News

Bitcoin advanced Tuesday after falling 8.5 percent in the previous session, displaying bullish continuation signs amid global re-risking sentiment.

Due to the continued spam attack on the blockchain network that Bitcoin Magazine has previously reported on, multiple bitcoin wallets have implemented either increased fees or the ability for individuals to increase the fees paid for a given transaction. Based on the nature of the software, miners prioritize which transaction to process first based on the fees associated with it, among other factors. The standard bitcoin fee is 0.0001 BTC per kilobyte. However, with so many spam transactions occurring, the standard transaction fee is not sufficient to ensure quick confirmations. BitGo....

Bitcoin mining is an important part of the bitcoin ecosystem. Miners who participate in mempools help to confirm transactions for which they receive a reward once a transaction is cleared. Usually, the mempool is ‘free’ and transactions go through easily with low fees but there are times when the mempool fills up causing transactions fees to surge. This was what took place at the start of March. Bitcoin Transaction Fees Surge At the beginning of the month, bitcoin had experienced higher transaction fees. These higher fees were as a result of transaction clustering in the mempool. Once the....

Ethereum's quarterly settlement value is on course to increase by 1,280% year-over-year. Ethereum usage is surging this year, with the value of transactions settled on the network skyrocketing during 2021.According to research from Messari, Ethereum has settled $926 trillion worth of transactions this quarter so far — 700% more than it processed during Q1 2020. The network is currently on-pace to settle $1.6 trillion in transactions for the first quarter of this year. In the last 12 months, Ethereum has already settled $2.1 trillion in transactions.If Messari’s $1.6 trillion forecast is....

Data shows both Bitcoin and Ethereum have observed a spike in the transaction fees over the past couple of days as holders have rushed to sell amid the crash. Bitcoin & Ethereum Transaction Fees Shoot Up The “transaction fees” is an amount that users making transactions on the network have to pay in order to […]