How Jointer Is Evolving DeFi Through World’s First Cross-Chain Shared Pool Swap

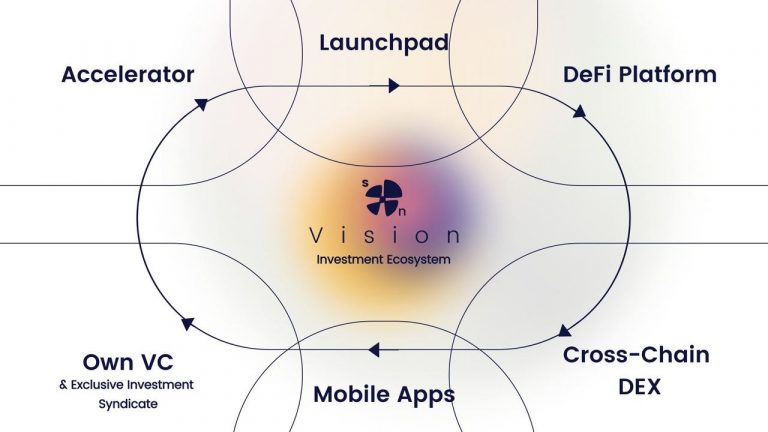

27th October 2020, San Francisco, United States – While some blockchain projects focus on one specific technological improvement, others are creating entire ecosystems. These ambitious projects find a market fit and then scour the world for the most appropriate solutions. Jointer is a prominent DAO in the DeFi space pursuing this goal, flying under most crypto influencers’ radar despite winning multiple awards and over $1 million in international competitions.

Originally founded as the world’s first commercial real estate DeFi project, Jointer is implementing DeFi solutions across the entire syndication economy, utilizing blockchain to remove barriers while providing investors with uncorrelated returns and instant diversification.

Investors have been participating in Jointer’s commercial real estate syndication platform through a daily auction of the JNTR token–a liquidity bridge that transfers value between commercial real estate equity and digital currencies. The JNTR token is interoperable across blockchains through Jointer’s patent-pending SmartSwap technology. In taking this approach, Jointer solves many of the issues plaguing the DeFi ecosystem, including siloed blockchains, limited liquidity and extreme price volatility.

Blockchain BridgesLiquidity on the blockchain is undeniably an important issue. Projects want to have their tokens accessible on as many blockchains as possible. For example, the stablecoin Tether is available on the following blockchains: Ethereum, OMG, Tron, and Algo. This availability ensures that users on those blockchains have a place to convert to a dollar-equivalent stablecoin. However, these blockchains do not talk to each other, meaning Tether on OMG cannot be transferred to an Ethereum wallet. Different blockchain; different token. This siloed or “walled garden” ecosystem creates a scenario wherein the liquidity of Tether, or any token, is restricted to its respective blockchain.

As the industry continues to trend toward decentralized exchanges, this issue becomes readily apparent. Limited liquidity quickly leads to price swings of double and triple digits. This may be fun for a quick trade over 30 seconds, but it is also a barrier to entry for those new to cryptocurrencies. These newcomers from traditional financial markets may be more concerned about retaining their value and not fast trades.

Solving the cross-chain problem is a fundamental issue. There are currently several projects actively working on this with varying levels of success. Jointer is deploying its version of a bridge, connecting Ethereum to Binance Smart Chain (BSC) and Liquidity System which is 52 smart contracts built on top of the basic pool technology.

Slippage-Free, Cross-Chain OperationJointer has already achieved a working version of this with its JNTR bridge tokens. Jointer Smartswap is currently operational and allows for swapping an ERC20 token from Ethereum to BSC through JNTR/e to JNTR, or JNTR/b, respectively. This 1-to-1 swap is done instantly with one click and without the need for a centralized exchange and with zero fees. There is also zero chance of price slippage, a significant advantage over DEXs like Uniswap, where a 10% slippage is not uncommon. Even on centralized exchanges, price movement is commonplace. Further, all the JNTR bridge tokens maintain a 1:1 value, meaning that 1 JNTR/b will always equal 1 JTNR/e, thus creating a natural arbitrage opportunity across pools and blockchains.

This cross-chain functionality also allows Jointer to tap into liquidity on other BSC blockchains, taking full advantage of the local Automated Market Makers on Uniswap and Pancake, two of the largest liquidity providers. This means users on Binance Smart Chain will instantly benefit from liquidity on the Ethereum blockchain in Uniswap. And since the Binance Smart Chain gas fees are so low, users may find incentive trading on BSC through PancakeSwap rather than Ethereum.

These incremental and foundational improvements are necessary, as the Jointer project explores a world beyond the tokenization of commercial real estate, implementing the first DeFi approach to the space with live auctions, gamified markets, instant syndication and more.

The daily auction charts JNTR’s consistent growth from $0.01 to $0.44. That means a $500 investment on day one of the Jointer DeFi auction has turned into $22,500 in just one month.

For more information, visit the Jointer website: https://jointer.io

Media Contact Details

Contact Name: Bitcoin PR Buzz Media Team

Contact Email: [email protected]

Jointer is the source of this content. This Press Release is for informational purposes only. The information does not constitute investment advice or an offer to invest. Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. Cryptocurrencies and tokens are extremely volatile. There is no guarantee of a stable value, or of any value at all.

About Bitcoin PR Buzz: Bitcoin PR Buzz has been proudly serving the crypto press release distribution needs of blockchain start-ups for over 8 years. Get your Bitcoin Press Release Distribution today.

Source

Related News