On-Chain Data Shows Bitcoin Daily Transaction Volumes Are Up 94%, Rally Might...

Bitcoin has recently lost momentum following the rally that occurred over the past week. The digital asset had seen gains of over 20% while the entire market followed suit and showed massive gains all across the board. Bitcoin had spent 9 consecutive days closing in the green for the first time in a decade. As the cryptocurrency sees slowing momentum, the price has experienced various dips that have driven the price down. After the asset had jumped over $42,000 for the first time in over a month. With this slowdown, it seems that the rally has come to its end. But on-chain data shows that....

Related News

On-chain data shows the Bitcoin trading volume has been increasing recently, which could help further the asset’s rally. Bitcoin Trading Volume Has Registered A Large Boost Recently According to data from the on-chain analytics firm Santiment, BTC continues to see high volumes. The “trading volume” here refers to measuring the daily total amount of a […]

The Bitcoin 20 DMA seems to have just crossed with the 50 DMA, here is how it might be bullish for the cryptocurrency. The Bitcoin Bullish Crossover As pointed out by a BTC technical analyst on Twitter, two important indicators of the cryptocurrency have just had a crossover. The two metrics are the 20 daily-moving average (DMA) and the 50 DMA. Before looking at the data, it’s best to first get a grasp of both these indicators. Moving averages (MA) help smooth out the price data for Bitcoin as they take averages of the price over a specific period and constantly update or....

Raw data from the Federal Revenue of Brazil (RFB) shows that crypto traded volumes in the country exceeded $6 billion between January and September this year. According to the data, bitcoin dominates as it accounts for over 80% of traded volumes. Still, other cryptos like bitcoin cash, dai, and dogecoin had significant volumes in the period under review. Since August 2019, Brazilian crypto companies and individual users have been complying with the new requirement to furnish the RFB with details of their digital currency transactions. The regulations specifically state that companies and....

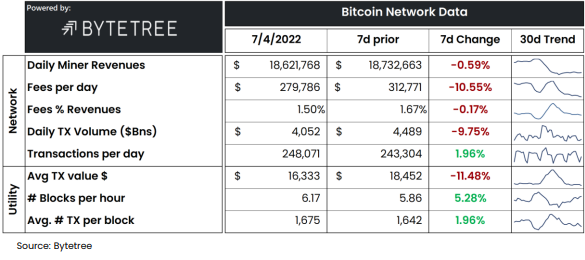

Data shows the Bitcoin bear environment has caused the market to become inactive as transaction fees continues to be extremely low. Bitcoin On-Chain Activity Remains Low As Price Action Stays Stale As per the latest weekly report from Arcane Research, the last week saw the lowest average daily transaction fees since April 2020. The “transaction […]

Onchain data indicates that bitcoin transactions per day have plummeted to lows not seen since October 2018. Further, bitcoin transaction fees have dropped 93% after touching a high of $62 per transaction in April 2021. Bitcoin Daily Transaction Rate Dips by 35%, Google Trends Data Shows Interest Has Dropped Since May While bitcoin (BTC) prices have dropped to lower bound ranges, after touching an all-time high over $64K per coin, the number of daily transactions has dive-bombed as well. In fact, daily BTC transactions have been plummeting since the first week of 2021, as statistics show a....