UST staking goes live on Binance as Anchor reserves fall

Yields from Terra's flagship savings protocol will be available to more than 30 million users on Binance. On Wednesday, centralized cryptocurrency exchange Binance launched its new TerraUSD (UST) staking program. Although Binance did not name the underlying decentralized finance protocol responsible for the staking rewards, Do Kwon — Terra Luna's (LUNA) co-founder — attributed the origins of the high yield to Terra's flagship Anchor protocol. Anchor rate is now available to 30M+ binance users The anchor yield of web3 is living up to its name. https://t.co/awubGdRJgP— Do Kwon (@stablekwon)....

Related News

With too many depositors chasing high yields and a lack of borrowers, Anchor interest rates appear to have become unsustainable. Anchor, the flagship savings protocol of the Terra Luna (LUNA) ecosystem, has seen its reserves decline by 35.7% in the past seven days, according to Terra.Engineer. Since the beginning of December, the amount of Terra USD Stablecoin (UST) held in the "terra1tmnqgvg567ypvsvk6rwsga3srp7e3lg6u0elp8" smart contract has declined by over 50%, with only $35.7 million remaining.As a savings protocol, users deposit their UST assets via their wallets and earn up to 20%....

FTX seems to fall deeper into its despair pit without any anchor. The crypto exchange is facing several issues threatening the stability of the firm. First, there appears to be an ongoing war between FTX and the Binance crypto exchange. This is presumed to involve their respective CEOs, Sam Bankman-Fried (SBF) and Changpeng Zhao (CZ). Binance announced its plans to liquidate FTT token holdings, which it has carried out. There’s still no explanation for Binance’s sudden lack of interest in the FTT tokens. However, some opine that Binance may consider holding FTT tokens as a....

Binance US is now offering crypto staking services and the firm details that seven digital currencies are currently available with annual percentage yields (APYs) up to 18%. Customers can earn yields on proof-of-stake (PoS) cryptocurrencies that include binance coin, solana, avalanche, livepeer, graph, cosmos, and audius. Binance US Adds Staking Services On Twitter, Binance US explained the company is now joining the ranks of the variety of crypto exchanges that offer staking services. “Binance US has officially launched staking, empowering customers to do more with their....

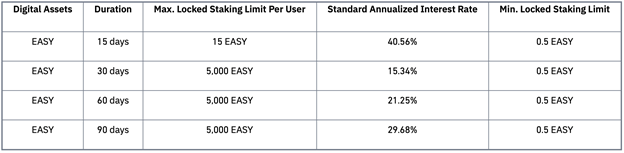

This week, Binance and EasyFi revealed that high-yield staking through the EASY token would be enabled, with full integration soon to follow within the Binance Smart Chain. Here’s everything you need to know about the attractive program that offers a staggering up to 40.56% APY and how Binance users can now gain access to this […]

Anchor Protocol, one of the most popular platforms in the Terra ecosystem, rolled out a change in its Earn Rate. The latter will begin to operate in a semi-dynamic fashion rather than the previously fixed 20% annual percentage yield (APY). Related Reading | Terra Price Continues Moving North; How Soon Will It Cross $100? With a massive shift in the protocol’s reward mechanism, the new models aim at making Anchor “more sustainable”. As a result, users started earning an 18% APY as of yesterday, May 1. The earn rate will be modified each month for the foreseeable future. The team....