$EASY As ABC: High-Yield Staking Program Launches on Binance Exchange

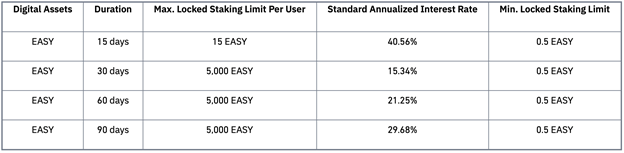

This week, Binance and EasyFi revealed that high-yield staking through the EASY token would be enabled, with full integration soon to follow within the Binance Smart Chain. Here’s everything you need to know about the attractive program that offers a staggering up to 40.56% APY and how Binance users can now gain access to this […]

Related News

EasyFi Network, the universal layer 2 DeFi lending protocol known for scalability, composability and adoption has announced the launch of its high yield farming program. Launched in association with QuickSwap, this one-of-a-kind LP farming and staking program went live on August 4, 2021. The collaboration between EasyFi Network and QuickSwap has enabled the introduction of two programs where EZ token holders can create liquidity pools with USDC and QUICK tokens on Polygon Network’s QuickSwap Exchange. They can then use the LP tokens to farm QUICK tokens. Meanwhile, the partnership also....

Coinbase, the largest exchange in terms of crypto reserves held, has announced the introduction of a savings program tied to usd coin. The company’s high yield USDC savings program allows customers to gain 4% APY interest on stablecoin accounts. Coinbase Reveals USDC Savings Program With Interest Rates Eight-Times Higher the national average The cryptocurrency exchange Coinbase announced pre-enrollment for its usd coin (USDC) savings program that allows clients to earn a 4% APY interest rate on USDC held on the platform. Coinbase joins firms like Blockfi and Crypto.com that already....

IOST rallied to a multiyear high after Binance announced a new staking program and the project airdropped tokens to Citadel One mobile wallet users. While the past year has been marked by the rise of decentralized finance (DeFi), centralized entities like Coinbase and Binance continue to be some of the most important players in the industry as a whole, as they are essential in attracting attention to promising projects and pave the way for wider adoption. One protocol that has taken advantage of the "Binance bump" over the past week is IOST, a fully-fledged decentralized blockchain....

DeFi Yield Protocol (DYP) continues to attain popularity within the decentralized finance sector. Since the launch of the staking dAPP three months ago, DYP Protocol has experienced massive growth in its community. DeFi Yield Protocol The yield farming platform has over $39 million locked in its ETH staking contract and has paid 7,064 ETH worth over $14 million to liquidity providers. DYP has also experienced a 20x increase in liquidity on popular decentralized exchange Uniswap. At the moment, more than $21,000,000 in liquidity on Uniswap on the DYP/ETH. DYP has also expanded its ecosystem....

Once reserved for the pros in the crypto space, staking has become a common practice across all participants in the space. Today, anyone has an opportunity to earn passive income on their crypto assets in just a few clicks, whether on a centralized exchange or DEX. Over the past two years, centralized exchanges such as Binance and Coinbase have introduced staking to their users, compelling decentralized exchanges, or DEXs, to follow suit. At the height of the DeFi boom in 2021, over $110 billion in value was locked on decentralized platforms as staking became one of the most lucrative ways....