Core Scientific reveals financial distress in SEC filing, says its end may be...

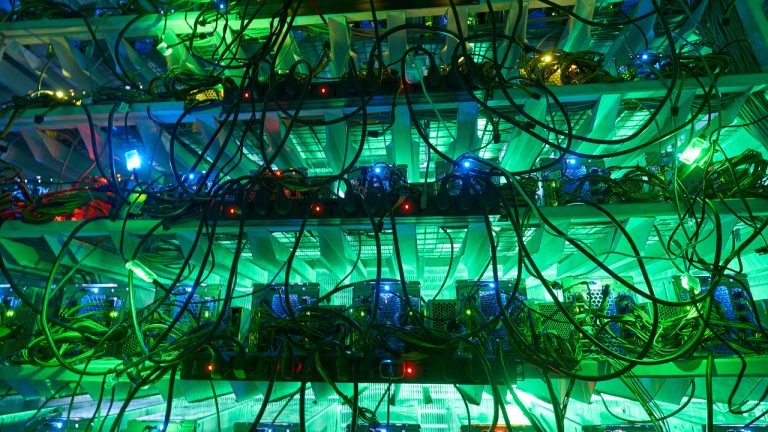

The Bitcoin miner says low BTC and high electricity rates and Celsius’ refusal to pay its bills could be its undoing; the company’s BTC holdings have dropped from 8,058 in May to 24 now. Bitcoin miner Core Scientific filed forms with the United States Securities and Exchange Commission (SEC) on Oct. 26 indicating that will not make payments due in late October and early November. The company blamed low Bitcoin prices, increased electricity costs, an increase in the global Bitcoin hash rate and litigation with the bankrupt crypto lender Celsius for the situation.The payments the company....

Related News

One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due for Oct. and early Nov. 2022. SEC Filing Shakes Core Scientific Investors, CORZ Slides 97% in 12 Months Bitcoin miners are having issues after the price of bitcoin (BTC) has slid roughly 70% against the U.S. dollar since Nov. 10, 2021. Moreover, the network’s mining....

The mining firm has cited the low price of Bitcoin, electricity costs, an increase in the BTC hash rate, and litigation with Celsius playing a role in its financial difficulties. Bitcoin mining firm Core Scientific is reportedly considering a potential bankruptcy amid a group of its convertible bondholders consulting restructuring lawyers.According to a Nov. 1 report from Bloomberg Law, the Core Scientific bondholders worked with legal firm Paul Hastings following a United States Securities and Exchange Commission filing suggesting financial distress. The Oct. 26 filing indicated that the....

On Nov. 7, 2022, the bitcoin mining firm Core Scientific released the company’s October update after the company’s Form 8-K U.S. Securities and Exchange Commission (SEC) filing on Oct. 26, 2022. The filing noted that the company was in the process of exploring “restructuring its existing capital structure.” The update published on Monday indicates that Core Scientific sold 2,285 bitcoins at an average price of $19,639 per bitcoin.

Core Scientific Releases October Update

On Oct. 29, Bitcoin.com News reported on the bitcoin mining firm Core Scientific....

Core Scientific claims to be losing approximately $53,000 per day to cover the increased electricity tariffs that Celsius refuses to pay. Crypto lender Celsius Network's legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the....

The crypto winter that began in early 2022 has resulted in several financial issues, including Bitcoin mining firms. Many crypto firms have struggled, while others had to close shop. The crypto community felt the impact, mainly through many crypto firms, including Celsius Network, Three Arrows Capital, Voyager Digital, etc. The blockchain and artificial intelligence company, Core Scientific, is among the affected companies. While for some other firms, there were needs to reduce staff count and suspend withdrawals, Core Scientific is presently considering bankruptcy. Related Reading:....